Memorex 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

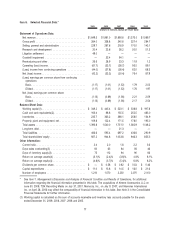

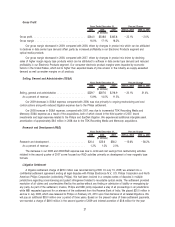

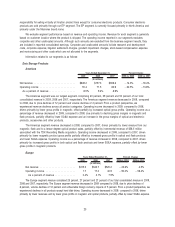

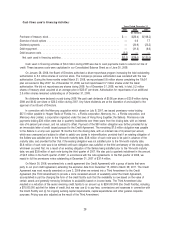

Gross Profit

2009 2008 2007 2009 vs. 2008 2008 vs. 2007

Years Ended December 31, Percent Change

(In millions)

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $264.0 $338.8 $345.8 ⫺22.1% ⫺2.0%

Gross margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.0% 17.1% 18.2%

Our gross margin decreased in 2009, compared with 2008, driven by changes in product mix which can be attributed

to declines in data center tape demand offset partly by increased profitability in our Electronic Products segment and

optical media products.

Our gross margin decreased in 2008, compared with 2007, driven by changes in product mix driven by declining

sales of higher margin legacy tape products which can be attributed to softness in data center tape demand and reduced

profitability in our Electronic Products segment. Our consumer electronic product margins were impacted by economic

factors in the United States, which led to higher than expected levels of price erosion in the industry as supply exceeded

demand as well as weaker margins on all products.

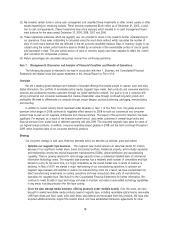

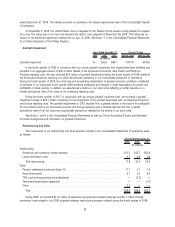

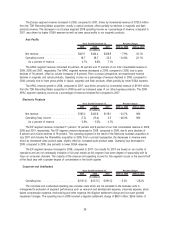

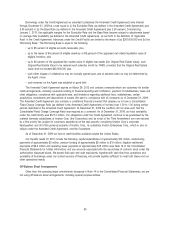

Selling, General and Administrative (SG&A)

2009 2008 2007 2009 vs. 2008 2008 vs. 2007

Years Ended December 31, Percent Change

(In millions)

Selling, general and administrative . . . . . . . . . . . . . . . . . . . $229.7 $287.6 $218.9 ⫺20.1% 31.4%

As a percent of revenue . . . . . . . . . . . . . . . . . . . . . . . . 13.9% 14.5% 11.5%

Our 2009 decrease in SG&A expense, compared with 2008, was due primarily to ongoing restructuring and cost

control actions along with reduced litigation expense due to the Philips settlement.

Our 2008 increase in SG&A expense, compared with 2007, was due to incremental TDK Recording Media and

Memcorp SG&A expense as a result of the acquisitions, both of which closed in the third quarter of 2007, brand

investments and legal expenses related to the Philips and SanDisk litigation. We experienced additional intangible asset

amortization of approximately $6.0 million in 2008 due to the TDK Recording Media and Memcorp acquisitions.

Research and Development (R&D)

2009 2008 2007 2009 vs. 2008 2008 vs. 2007

Years Ended December 31, Percent Change

(In millions)

Research and development . . . . . . . . . . . . . . . . . . . . . . . . $20.4 $23.6 $38.2 ⫺13.6% ⫺38.2%

As a percent of revenue . . . . . . . . . . . . . . . . . . . . . . . . 1.2% 1.2% 2.0%

The decrease in our 2009 and 2008 R&D expense was due to continued cost savings from restructuring activities

initiated in the second quarter of 2007 as we focused our R&D activities primarily on development of new magnetic tape

formats.

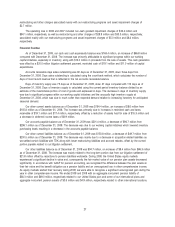

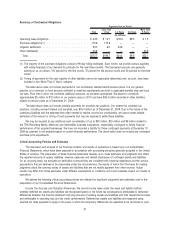

Litigation Settlement

A litigation settlement charge of $49.0 million was recorded during 2009. On July 13, 2009, we entered into a

confidential settlement agreement ending all legal disputes with Philips Electronics N.V., U.S. Philips Corporation and North

American Philips Corporation (collectively, Philips). We had been involved in a complex series of disputes in multiple

jurisdictions regarding cross-licensing and patent infringement related to recordable optical media. The settlement provided

resolution of all claims and counterclaims filed by the parties without any finding or admission of liability or wrongdoing by

any party. As part of the settlement, Imation, Philips and MBI jointly requested a stay of all proceedings in all jurisdictions

while MBI requested approval for an element of the settlement from the Reserve Bank of India. We placed $20.0 million in

escrow in July 2009, which was released to Philips on February 23, 2010 upon final dismissal of all related litigations. We

will pay an additional $33.0 million over a period of three years. Based on the present value of these settlement payments,

we recorded a charge of $49.0 million in the second quarter of 2009 and interest accretion of $0.8 million for the year

21