Memorex 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This program is aligning our cost structure with our strategic direction by reducing SG&A expenses. We are reducing costs

by rationalizing key accounts and products and by simplifying our corporate structure globally. We anticipated incurring up

to $40 million in restructuring and other charges globally, mainly through cash payments for severance and severance

related costs. The majority of the program is complete with approximately $35 million worth of cumulative costs incurred

through December 31, 2009. As of December 31, 2009, we estimate approximately 59 more positions will be eliminated

throughout the world during 2010.

During 2009, we also recorded $0.9 million of lease termination costs related to our 2008 cost reduction restructuring

program. This program began in the third quarter of 2008 when our Board of Directors approved the Camarillo, California

restructuring plan as further implementation of our manufacturing strategy. In order to partially mitigate projected declines

in tape gross profits in future years, we ended manufacturing at our Camarillo plant and exited the facility during 2008. We

have focused our manufacturing efforts on magnetic tape coating operations at our existing plant in Weatherford,

Oklahoma.

The 2008 cost reduction restructuring program also included our decision to consolidate the Cerritos, California

business operations into Oakdale, Minnesota. During 2009, we consolidated the previous Cerritos activities into a single

headquarters location in order to achieve better focus, gain efficiencies across brands and channels and reduce cost.

During 2009, we recorded $0.3 million of income through the reversal of lease termination accruals related to

previously announced programs.

We recorded pension settlement and curtailment losses of $11.7 million, $5.7 million and $1.4 million in 2009, 2008

and 2007, respectively, within restructuring and other expense in the Consolidated Statements of Operations, mainly as a

result of the reorganizations associated with our restructuring activities. See Note 10 to the Consolidated Financial

Statements for further information regarding pension settlements and curtailments.

We incurred net asset impairment charges of $2.7 million, $5.0 million and $8.4 million in 2009, 2008 and 2007,

respectively, related mainly to the abandonment of certain manufacturing and R&D assets as a result of the reorganizations

associated with our restructuring activities.

During 2008, we recorded $4.9 million and $0.5 million of severance and severance related expenses and lease

termination costs, respectively, related to our 2008 corporate redesign restructuring program. We recorded $5.2 million and

$0.2 million of severance and severance related expenses and lease termination costs, respectively, related to our 2008

cost reduction restructuring program. We recorded $5.3 million for severance and severance related expenses under our

TDK Recording Media and 2007 cost reduction restructuring programs, which began in 2007. We also recorded $1.8 million

of lease termination costs related to these programs in 2008. We recorded $0.3 million and $2.3 million of severance and

severance related expenses and lease termination costs, respectively, related to our 2006 Imation and Memorex

restructuring program, which began in the second quarter of 2006.

We recorded a $2.3 million TDK post-closing purchase price adjustment in 2008 associated with the finalization of

certain acquisition-related working capital amounts as negotiated with TDK. See Note 3 to the Consolidated Financial

Statements for further information.

During 2007, we recorded severance and severance related expenses of $21.5 million and $2.3 million under our

2007 cost reduction and TDK Recording Media restructuring programs, respectively. During 2007, we recorded $0.4 million

and $0.2 million of lease termination costs related to our 2007 cost reduction and 2006 Imation and Memorex restructuring

programs, respectively.

See Note 8 to the Consolidated Financial Statements for further information regarding our various restructuring

programs and other expenses.

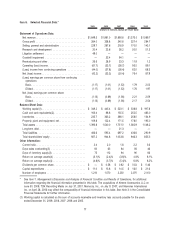

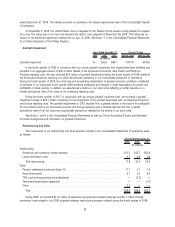

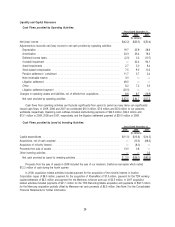

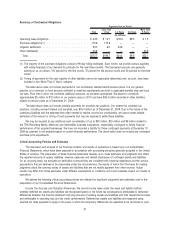

Operating (Loss) Income

2009 2008 2007 2009 vs. 2008 2008 vs. 2007

Years Ended December 31, Percent Change

(In millions)

Operating (loss) income. . . . . . . . . . . . . . . . . . . . . . . . . . . $ (61.7) $ (33.7) $(38.7) 83.1% ⫺12.9%

As a percent of revenue . . . . . . . . . . . . . . . . . . . . . . . . ⫺3.7% ⫺1.7% ⫺2.0%

23