Memorex 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

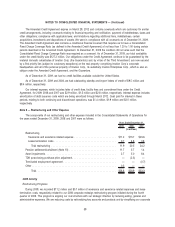

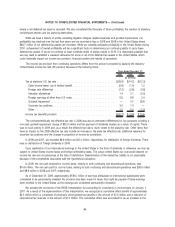

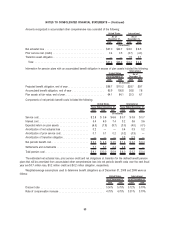

Deferred taxes arise because of the different treatment of transactions for financial statement accounting and income

tax accounting, known as temporary differences. We record the tax effect of these temporary differences as deferred tax

assets and deferred tax liabilities in our Consolidated Balance Sheets. Deferred tax assets generally represent items that

can be used as a tax deduction or credit in a tax return in future years for which we have already recorded the tax benefit

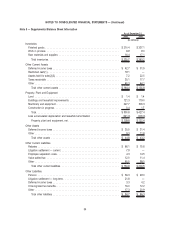

in the Consolidated Statements of Operations. The components of net deferred tax assets and liabilities were as follows:

2009 2008

As of December 31,

(In millions)

Accounts receivable allowances. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9.3 $ 12.6

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.1 14.7

Payroll, pension and severance (short-term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.5 10.9

State tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.9 5.6

Operating loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.7 23.4

Accrued liabilities and other reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.7 21.7

Pension (long-term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.9 15.9

Research and development credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.3 6.0

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.5 —

Gross deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107.9 110.8

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22.9) (18.6)

Deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85.0 92.2

Property, plant and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.5) (8.4)

Intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.6) (5.1)

Deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10.1) (13.5)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 74.9 $ 78.7

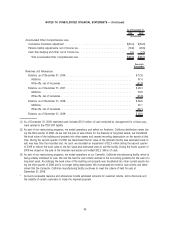

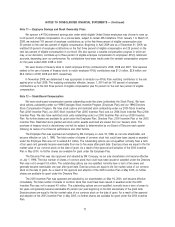

The valuation allowance was provided to account for uncertainties regarding the recoverability of certain foreign

operating loss carryforwards and state tax credit carryforwards. The current and noncurrent components of our deferred

tax balances are generally based on the balance sheet classification of the asset or liability creating the temporary

difference. The valuation allowance was $22.9 million, $18.6 million and $16.5 million as of December 31, 2009, 2008 and

2007, respectively. The increase in 2009 as compared to 2008 is due to the establishment of valuation allowances related

to anticipated expiration of certain foreign net operating losses of $4.4 million, offset by a release of valuation allowances

of $0.1 million. The increase in 2008 compared with 2007 was due to the establishment of additional valuation allowances

related to anticipated expirations of certain foreign net operating loss carryforwards of $4.6 million, offset by $2.5 million

for lapsing of statutes and other items. There was an increase in 2007 of $7.1 million due primarily to the acquisition of a

foreign subsidiary. Of the aggregate net international operating loss carryforwards totaling $86.7 million, $37.3 million will

expire at various dates up to 2023 and $49.4 million may be carried forward indefinitely. State tax credit carryforwards of

$4.2 million will expire between 2010 and 2023. Additionally, we have available for state income tax purposes net operating

losses of $28.2 million, which expire, if unused, in 2013 through 2028.

Significant judgment is required in determining the realizability of our deferred tax assets. The assessment of whether

valuation allowances are required considers, among other matters, the nature, frequency and severity of current and

cumulative losses, forecasts of future profitability, the duration of statutory carryforward periods, our experience with loss

carryforwards expiring unused and tax planning alternatives.

Our analysis of the need for valuation allowances considered that, after excluding the impact of those goodwill

impairments and certain litigation settlement charges and related expenses, which are one time charges, we have a

consolidated cumulative profit over the most recent three year period and cumulative three year profit in all tax jurisdictions

63

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)