Memorex 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

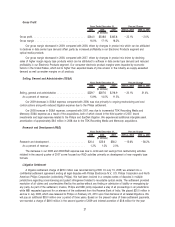

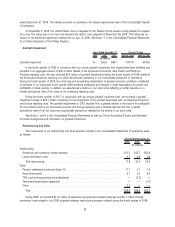

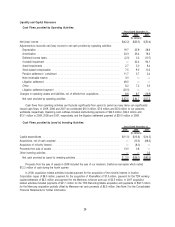

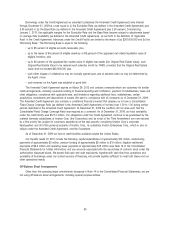

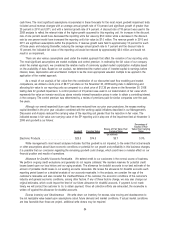

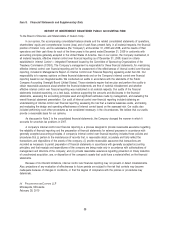

Liquidity and Capital Resources

Cash Flows provided by Operating Activities:

2009 2008 2007

Years Ended December 31,

(In millions)

Net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(42.2) $(33.3) $(50.4)

Adjustments to reconcile net (loss) income to net cash provided by operating activities:

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.7 25.9 28.6

Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.3 23.4 18.3

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.0) 0.2 (10.7)

Goodwill impairment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 32.4 94.1

Asset impairments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.7 5.0 8.4

Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.5 9.5 10.2

Pension settlement / curtailment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.7 5.7 2.4

Note receivable reserve . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.0 — —

Litigation settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49.0 — —

Other............................................................ 6.2 7.2 3.5

Litigation settlement payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20.0) — —

Changes in operating assets and liabilities, net of effects from acquisitions. . . . . . . . . . . . . . 8.6 8.7 (16.9)

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 67.5 $ 84.7 $ 87.5

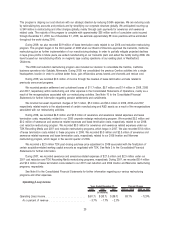

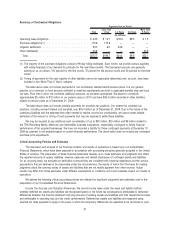

Cash flows from operating activities can fluctuate significantly from period to period as many items can significantly

impact cash flows. In 2009, 2008 and 2007 we contributed $10.3 million, $7.6 million and $5.6 million to our pensions

worldwide, respectively. Operating cash outflows included restructuring payments of $22.3 million, $32.0 million and

$13.1 million in 2009, 2008 and 2007, respectively, and the litigation settlement payment of $20.0 million in 2009.

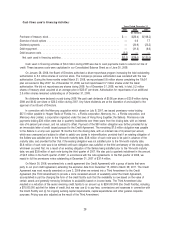

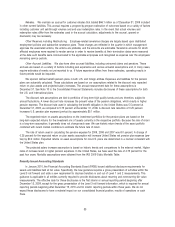

Cash Flows provided by (used in) Investing Activities:

2009 2008 2007

Years Ended December 31,

(In millions)

Capital expenditures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(11.0) $(13.6) $(14.5)

Acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (15.3) (68.3)

Acquisition of minority interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (8.0) —

Proceeds from sale of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.0 0.8 —

Other investing activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 0.3

Net cash provided by (used in) investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.0 $(36.1) $(82.5)

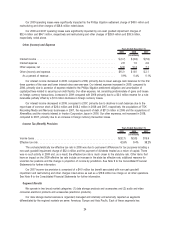

Proceeds from the sale of assets in 2009 included the sale of our Anaheim, California real estate which netted

$12.2 million of cash during the fourth quarter.

In 2008, acquisition related activities included payment for the acquisition of the minority interest in Imation

Corporation Japan of $8.0 million, payment for the acquisition of XtremeMac of $7.3 million, payment for the TDK working

capital settlement of $6.5 million and payment for the Memorex minimum earn-out of $2.5 million. In 2007 acquisition

related activities included payments of $41.1 million for the TDK Recording Media acquisition and payments of $32.7 million

for the Memcorp acquisition partially offset by Memorex net cash proceeds of $5.5 million. See Note 3 to the Consolidated

Financial Statements for further information.

28