Memorex 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

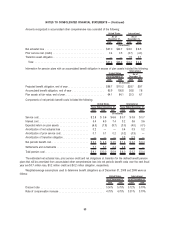

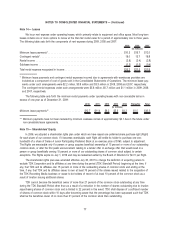

Total related stock-based compensation expense recognized in the Consolidated Statements of Operations for the

years ended December 31, 2009, 2008 and 2007 was $4.9 million, $6.4 million and $7.0 million before income taxes,

respectively. The related tax benefit was $1.6 million, $2.0 million and $2.2 million for the years ended December 31,

2009, 2008 and 2007, respectively. No related stock-based compensation was capitalized as part of an asset for the years

ended December 31, 2009, 2008 or 2007. As of December 31, 2009, there was $8.1 million of total unrecognized

compensation expense related to non-vested stock options granted under our Stock Plans. That expense is expected to be

recognized over a weighted average period of 2.47 years.

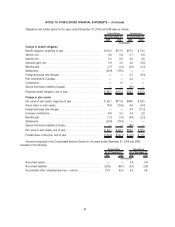

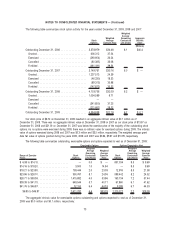

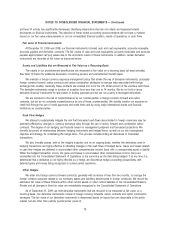

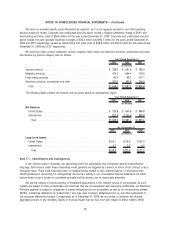

Restricted Stock

The following table summarizes our restricted stock activity for the years ended December 31, 2009, 2008 and 2007:

Restricted

Stock

Weighted

Average

Grant Date

Fair Value

Per Share

Nonvested as of December 31, 2006. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214,163 $38.71

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118,143 38.08

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (69,834) 38.57

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (55,243) 38.33

Nonvested as of December 31, 2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 207,229 $38.52

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 206,261 24.05

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (80,219) 37.85

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (28,760) 37.61

Nonvested as of December 31, 2008. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 304,511 $28.98

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 327,654 9.38

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (119,074) 29.44

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (51,389) 30.04

Nonvested as of December 31, 2009. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 461,702 $14.84

The total fair value of shares vested during the years 2009, 2008 and 2007 was $3.5 million, $3.0 million and

$2.7 million, respectively.

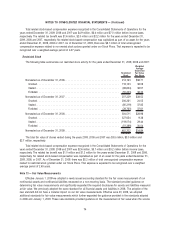

Total related stock-based compensation expense recognized in the Consolidated Statements of Operations for the

years ended December 31, 2009, 2008 and 2007 was $2.6 million, $3.1 million and $3.2 million before income taxes,

respectively. The related tax benefit was $1.0 million and $1.2 million for the years ended December 31, 2009 and 2008,

respectively. No related stock-based compensation was capitalized as part of an asset for the years ended December 31,

2009, 2008, or 2007. As of December 31, 2009, there was $5.2 million of total unrecognized compensation expense

related to restricted stock granted under our Stock Plans. That expense is expected to be recognized over a weighted

average period of 2.63 years.

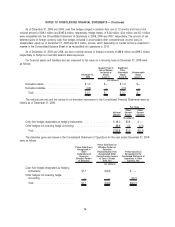

Note 13 — Fair Value Measurements

Effective January 1, 2009 we adopted a newly issued accounting standard for the fair value measurement of our

nonfinancial assets and nonfinancial liabilities measured on a non-recurring basis. The standard provided guidance on

determining fair value measurements and significantly expanded the required disclosures for assets and liabilities measured

at fair value. We previously adopted the same standard for all financial assets and liabilities in 2008. The adoption of the

new standard did not have a material impact on our fair value measurements. Effective June 30, 2009, we adopted

additional standards for fair value measurements which further expanded the guidance provided in the standards adopted

in 2008 and January 1, 2009. These new standards provided guidance on the measurement of fair value when the volume

74

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)