Memorex 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

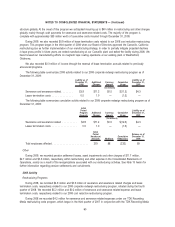

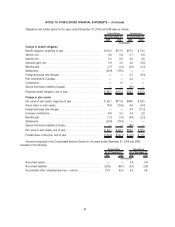

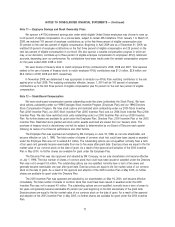

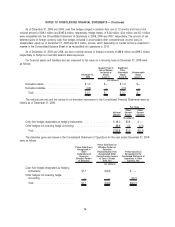

The fair value of the plan assets as of December 31, 2009 by asset category were as follows:

December 31,

2009

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments:

Money markets. . . . . . . . . . . . . . . . . . $ 3.5 $ 3.5 $ — $ —

Commingled trust funds . . . . . . . . . . . . 1.9 1.9 — —

Mutual funds . . . . . . . . . . . . . . . . . . . 0.2 — 0.2 —

Other short-term investments . . . . . . . . 0.3 0.3 — —

Fixed income securities:

Mutual funds . . . . . . . . . . . . . . . . . . . 28.7 13.2 15.5 —

Equity securities:

Blended mutual funds . . . . . . . . . . . . . 23.4 6.6 16.8 —

Large-cap growth funds . . . . . . . . . . . . 18.3 — — 18.3

Small-cap growth funds . . . . . . . . . . . . 7.9 7.9 — —

Small-cap value funds . . . . . . . . . . . . . 7.2 7.2 — —

Commingled trust funds . . . . . . . . . . . . 6.2 — — 6.2

Growth mutual funds . . . . . . . . . . . . . . 1.2 1.2 — —

Other investments:

Insurance contracts . . . . . . . . . . . . . . . 19.9 — 19.9 —

Absolute return strategy funds . . . . . . . 4.4 — 4.4 —

Total . . . . . . . . . . . . . . . . . . . . . . . . . $123.1 $41.8 $56.8 $24.5

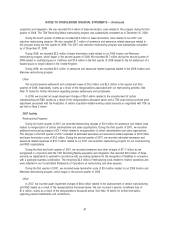

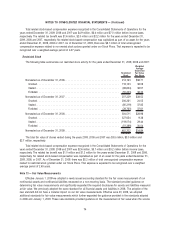

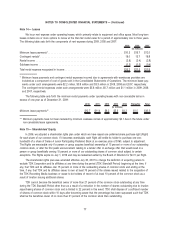

Level 3 assets are valued using net asset values of shares held in Level 3 investments, which are based on the fair

value of the underlying investments. Our methods used to value investments may produce a fair value which may not be

indicative of the actual net realizable value or reflective of future fair values. Furthermore, while the valuation methods are

appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine

the fair value of certain financial instruments could result in different measurement values.

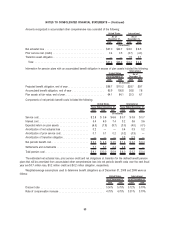

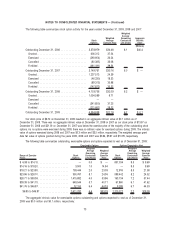

Changes in the fair value of the Plan’s Level 3 assets for the year ended December 31, 2009, were as follows:

Fixed

Income -

Corporate

Bond

Funds

Equity -

Large-cap

Growth

Funds

Equity -

Small-cap

Value

Funds

Equity -

Comingled

Trust

Funds Total

(In millions)

Balance, beginning of year . . . . . . . . . . . . . . . . . . . $ 0.1 $ — $ 0.2 $ 7.2 $ 7.5

Realized gains (losses) . . . . . . . . . . . . . . . . . . . . . — — — 1.1 1.1

Unrealized gains (losses) relating to instruments still

held at the reporting date . . . . . . . . . . . . . . . . . . — — 0.1 — 0.1

Purchases/ issuances . . . . . . . . . . . . . . . . . . . . . . — — 0.2 — 0.2

Sales/ settlements . . . . . . . . . . . . . . . . . . . . . . . . . (0.1) — (0.1) (2.1) (2.3)

Transfer into level 3 . . . . . . . . . . . . . . . . . . . . . . . . — 18.3 — — 18.3

Transfer (out) of level 3 . . . . . . . . . . . . . . . . . . . . . — — (0.4) — (0.4)

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . $ — $18.3 $ — $ 6.2 $24.5

70

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)