Memorex 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

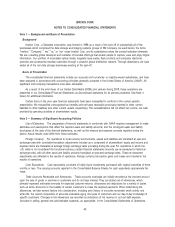

As a result of the transaction, TDK became our largest shareholder and has the right to nominate a representative to

serve on the Imation Board of Directors. Raymond Leung, TDK’s nominee, was elected to serve as a Class III member of

the Board of Directors on November 7, 2007 and was reelected by shareholders in May 2008. Pursuant to an Investor

Rights Agreement, dated July 31, 2007, TDK’s ownership stake will be permitted to increase up to 21 percent of Imation

common stock on a fully diluted basis through open market purchases. TDK received certain preemptive rights and

registration rights and TDK agreed to a standstill on further acquisitions of Imation common stock above the 21 percent

threshold (except as a result of stock repurchases initiated by Imation, in which event TDK’s ownership will not be

permitted to exceed 22 percent of the then outstanding shares). TDK also agreed to a voting agreement with respect to

certain matters presented to Imation shareholders and a three-year lock-up on sales of the Imation shares acquired in the

transaction.

TDK and Imation also entered into two long-term Trademark License Agreements, dated July 31, 2007, with respect

to the TDK Life on Record brand, which will continue, unless terminated by TDK at the earliest in 2032, (2017 in the case

of headphones, speakers or wholly new products) or earlier in the event of a material breach of the Trademark License

Agreement, specific change of control events or default by Imation. One of the agreements licenses the trademark to

Imation for the U.S. territory, while the other licenses the trademark to an Imation affiliate outside the United States. The

trademark licenses provide us exclusive use of the TDK Life on Record logo for marketing and sales of current and

successor magnetic tape, optical media and flash memory products, certain accessories, headphones and speakers and

certain future removable recording media products. We anticipate that TDK will continue its research and development

(R&D) and manufacturing operations for recording media products including audio, video and data storage tape and

Blu-ray optical discs, which TDK will supply us as well as its other OEM customers.

We also entered into a Supply Agreement, dated July 31, 2007, with TDK to purchase Imation’s requirements of

removable recording media products and accessory products for resale under the TDK Life on Record brand to the extent

TDK can supply such products on competitive terms and TDK agreed not to sell any such products to third parties for

resale under the TDK Life on Record brand during the term of the Trademark License Agreement. The Supply Agreement

will continue until 2012 or for so long as TDK manufactures any of the products.

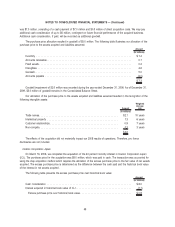

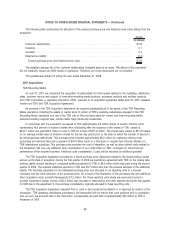

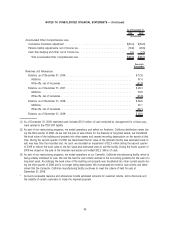

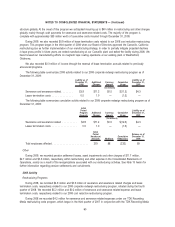

The following table summarizes our original purchase price as of December 31, 2007:

Amount

(In millions)

Cash consideration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 54.9

Cash consideration to minority interest holders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.9

Common stock issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216.7

Direct acquisition costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.2

Restructuring and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.2

Total purchase price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $314.9

The purchase price allocation resulted in goodwill of $55.9 million. The portion of goodwill deductible for tax purposes

was $11.7 million.

50

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)