Memorex 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Evaluating goodwill for impairment involves the determination of the fair value of our reporting units in which we have

recorded goodwill. A reporting unit is a component of an operating segment for which discrete financial information is

available and reviewed by management on a regular basis. We have determined that our reporting units are our segments

with the exception of the Americas data storage media segment which is further divided between the Americas-Consumer

and Americas-Commercial reporting units. Inherent in the determination of fair value of our reporting units are certain

estimates and judgments, including the interpretation of current economic indicators and market valuations as well as our

strategic plans with regard to our operations. To the extent additional information arises or our strategies change, it is

possible that our conclusion regarding goodwill impairment could change, which could have a material effect on our

financial position and results of operations.

In the fourth quarter of 2009, in connection with the annual test of goodwill impairment, no impairments were identified.

In evaluating whether goodwill was impaired, we compared the fair value of the reporting units to which goodwill is

assigned to their carrying value (Step 1 of the impairment test). In calculating fair value, we used a weighting of the

valuations calculated using a market approach and the income approach. The income approach is a valuation technique

under which we estimate future cash flows using the reporting units’ financial forecasts. Future estimated cash flows are

discounted to their present value to calculate fair value. The market approach establishes fair value by comparing our

company to other publicly traded guideline companies or by analysis of actual transactions of similar businesses or assets

sold. In determining the fair value of reporting units, we weighted values under the income approach 75 percent and

values determined from market comparables 25 percent. The basis of this weighting is due to the fact that the income

approach is tailored to the circumstances of the business, and the market approach is completed as a secondary test to

ensure that the results of the income approach are reasonable and in line with comparable companies in the industry. The

summation of our reporting units’ fair values is compared and reconciled to our market capitalization as of the date of our

impairment test. In the situation where a reporting unit’s carrying amount exceeds its fair value, the amount of the

impairment loss must be measured. The measurement of the impairment (Step 2 of the impairment test) is calculated by

determining the implied fair value of a reporting unit’s goodwill. In calculating the implied fair value of goodwill, the fair

value of the reporting unit is allocated to all other assets and liabilities of that unit based on their fair values. The excess

of the fair value of a reporting unit over the amount assigned to its other assets and liabilities is the implied fair value of

goodwill. The goodwill impairment is measured as the excess of the carrying amount of goodwill over its implied fair value.

In determining the fair value of our Electronic Products reporting unit under the income approach, our expected cash

flows are affected by various assumptions. Fair value on a discounted cash flow basis uses forecasts over a 10 year period

with an estimation of residual growth rates thereafter. We use our business plans and projections as the basis for expected

future cash flows. The most significant assumptions incorporated in these forecasts for the most recent goodwill impairment

tests included annual revenue changes with an average annual growth rate of 13 percent and significant growth of greater

than 25 percent in 2010 and 2011, and with a terminal growth rate of 4 percent. A discount rate of 18 percent was used in

the 2009 analysis to reflect the relevant risks of the higher growth assumed for this reporting unit. An increase in the discount

rate of one percent would have decreased the reporting unit’s fair value by $5.0 million while a decrease in the discount rate

by one percent would have increased the reporting unit’s fair value by $7.0 million. The revenue growth in 2010 and 2011 are

significant assumptions within the projections. If revenue growth were adjusted down to approximately 10 percent for each of

those years, reducing the average annual growth rate to 6 percent and the discount rate to 15 percent, the indicated fair

value of the reporting unit would be reduced by approximately $3.0 million and would not result in an impairment.

There are also various assumptions used under the market approach that affect the valuation of our reporting units.

The most significant assumptions are market multiples and control premium. In estimating the fair value of our Company

under the market approach, we considered the relative merits of commonly applied market capitalization multiples based

on the availability of data. Based on our analysis, we determined the market value of invested capital to earnings before

interest, taxes, depreciation and amortization multiple to be the most appropriate valuation multiple to be applied in the

application of the market approach.

As a result of our analysis of fair value from the combination of our discounted cash flow modeling and market

comparisons, we utilized a stock price of $8.77 per share on the November 30, 2009 testing date in determining and allocating

fair value to our reporting units as compared to a stock price of $12.36 per share on the November 30, 2008 testing date for

57

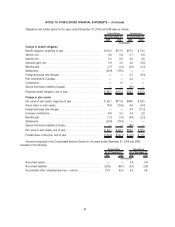

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)