Memorex 2009 Annual Report Download - page 26

Download and view the complete annual report

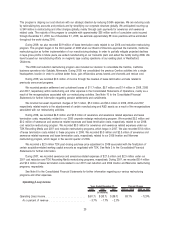

Please find page 26 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.brands, as described above. The strength of our brands has allowed us to gain market share in world wide optical

media markets. In addition, with over half of our revenue coming from outside the United States, we seek to

leverage our global marketing and distribution capability by bringing products to market across multiple

geographies.

• Extend certain brands selectively across multiple product categories. We sell accessories and certain

consumer electronic products, selectively, under multiple brands in various regions of the world. With the acquisition

of Memcorp we entered into the consumer electronics market to sell certain products which we did not offer

previously. Our product portfolio includes CD and DVD players, alarm clocks, portable boom boxes, MP3 players,

iPod and iPhone accessories, flat panel televisions, headphones, speakers, karaoke machines and gaming

accessories sold under the Memorex, TDK Life on Record and XtremeMac brands. The portfolio continues to

evolve with consumer demand and with development of our brands.

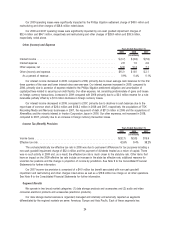

We have taken several actions which we believe have increased our industry presence and relevance in both

commercial and consumer retail channels and markets globally. These steps have broadened the scope of our business

and have allowed us to better address the large and growing consumer market for data storage media and audio/video

consumer electronics and accessories. The most significant actions driving this change over the past five years include the

following:

•In April 2006, we acquired substantially all of the assets of Memorex International Inc. (Memorex), including the

Memorex brand name and the capital stock of its operating subsidiaries engaged in design, development, sourcing,

marketing, distribution and sale of hardware, media and accessories used for the storage of electronic data under

the Memorex brand name. This action strengthened our position in optical products and accessories, especially in

the United States retail channel. See Note 3 to the Consolidated Financial Statements for further information.

•In February 2007, we entered into agreements that established us as the exclusive global distributor for HP

branded recordable optical media products and as a master distributor for Sun StorageTek branded tape media

products, whether manufactured by Imation or others.

•In July 2007, we acquired Memcorp. This action established our foundation in the consumer electronic products

in the mass merchant channel and enabled us to better manage the Memorex brand name across all retail

channels in the United States. See Note 3 to the Consolidated Financial Statements for further information.

•In July 2007, we acquired TDK Recording Media. This action further strengthened our optical market position,

especially in the important consumer markets of Europe and Japan. See Note 3 to the Consolidated Financial

Statements for further information.

•In June 2008, we acquired substantially all of the assets of XtremeMac, a Florida-based product development and

design firm focused on consumer electronic products and accessories for the iPod», iPhone»and Apple TV»

markets. This action was taken to expand our product portfolio, enhance our distribution reach and strengthen

product design capabilities, with particular focus on Apple users.

•Other agreements have given us exclusive and non-exclusive distribution rights for certain brands of recordable

media in various regions or product categories. Examples of other distribution agreements include those with

ProStor Systems Inc. and Tandberg Data ASA (Tandberg).

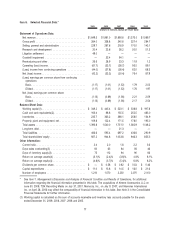

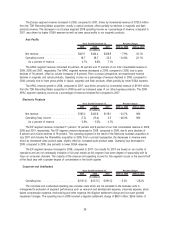

Factors Affecting Comparability of our Financial Results

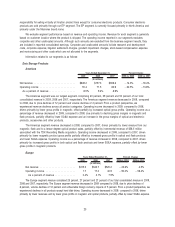

Discontinued Operations

As a result of the wind down of our GDM business joint venture during the three months ended September 30, 2009,

these operations are presented in our Consolidated Financial Statements as discontinued operations for all periods

presented. GDM has been a joint venture created to market optical media products with MBI. Since the inception of the

joint venture in 2003, we held a 51 percent ownership in the business. As the controlling shareholder, we have historically

consolidated the results of the joint venture in our financial statements. GDM was included partially in the Americas and

Europe segments. Operating results of the GDM business joint venture are included as discontinued operations for the

current period and all prior periods presented in the consolidated results of operations. See Note 4 to the Consolidated

Financial Statements for further information.

19