Memorex 2009 Annual Report Download - page 42

Download and view the complete annual report

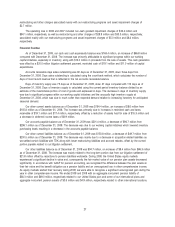

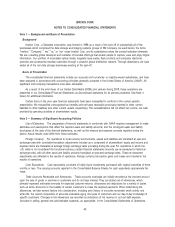

Please find page 42 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Rebates. We maintain an accrual for customer rebates that totaled $66.1 million as of December 31, 2009 included

in other current liabilities. This accrual requires a program-by-program estimation of outcomes based on a variety of factors

including customer unit sell-through volumes and end user redemption rates. In the event that actual volumes and

redemption rates differ from the estimates used in the accrual calculation, adjustments to the accrual, upward or

downward, may be necessary.

Other Reserves including Restructuring. Employee-related severance charges are largely based upon distributed

employment policies and substantive severance plans. These charges are reflected in the quarter in which management

approves the associated actions, the actions are probable, and the amounts are estimable. Severance amounts for which

affected employees were required to render service in order to receive benefits at their termination dates were measured

at the date such benefits were communicated to the applicable employees and recognized as expense over the employees’

remaining service periods.

Other Accrued Liabilities. We also have other accrued liabilities, including uninsured claims and pensions. These

accruals are based on a variety of factors including past experience and various actuarial assumptions and, in many cases,

require estimates of events not yet reported to us. If future experience differs from these estimates, operating results in

future periods would be impacted.

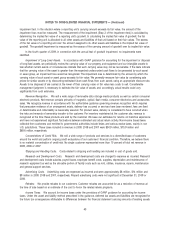

We sponsor defined benefit pension plans in both U.S. and foreign entities. Expenses and liabilities for the pension

plans are actuarially calculated. These calculations are based on our assumptions related to the discount rate, expected

return on plan assets and projected salary increases. The annual measurement date for these assumptions is

December 31. See Note 10 to the Consolidated Financial Statements includes disclosures of these assumptions for both

the U.S. and international plans.

The discount rate assumptions are tied to portfolios of long-term high quality bonds and are, therefore, subject to

annual fluctuations. A lower discount rate increases the present value of the pension obligations, which results in higher

pension expense. The discount rate used in calculating the benefit obligation in the United States was 5.5 percent at

December 31, 2009, as compared to 5.75 percent at December 31, 2008. A discount rate reduction of 0.25 percent

increases U.S. pension plan expense (pre-tax) by approximately $0.1 million.

The expected return on assets assumptions on the investment portfolios for the pension plans are based on the

long-term expected returns for the investment mix of assets currently in the respective portfolio. Because the rate of return

is a long-term assumption, it generally does not change each year. We use historic return trends of the asset portfolio

combined with recent market conditions to estimate the future rate of return.

The rate of return used in calculating the pension expense for 2009, 2008 and 2007 was 8.0 percent. A change of

0.25 percent for the expected return on plan assets assumption will increase United States net pension plan expense (pre-

tax) by $0.2 million. Expected returns on asset assumptions for non-U.S. plans are determined in a manner consistent with

the United States plan.

The projected salary increase assumption is based on historic trends and comparisons to the external market. Higher

rates of increase result in higher pension expenses. In the United States, we have used the rate of 4.75 percent for the

past four years. Mortality assumptions were obtained from the IRS 2009 Static Mortality Table.

Recently Issued Accounting Standards

In January 2010, the Financial Accounting Standards Board (FASB) issued additional disclosure requirements for

assets and liabilities held at fair value. Specifically, the new guidance requires a gross presentation of activities within the

Level 3 roll forward and adds a new requirement to disclose transfers in and out of Level 1 and 2 measurements. This

guidance is applicable to all entities currently required to provide disclosures about recurring and nonrecurring fair value

measurements. The effective date for these disclosures is the first interim or annual reporting period beginning after

December 15, 2009, except for the gross presentation of the Level 3 roll forward information, which is required for annual

reporting periods beginning after December 15, 2010 and for interim reporting periods within those years. We do not

expect these disclosures to have a material impact on our consolidated financial position, results of operations or cash

flows.

35