Memorex 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

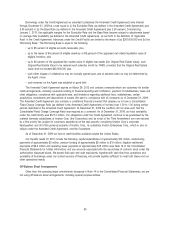

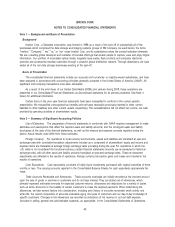

cash flows. The most significant assumptions incorporated in these forecasts for the most recent goodwill impairment tests

included annual revenue changes with an average annual growth rate of 13 percent and significant growth of greater than

25 percent in 2010 and 2011, and with a terminal growth rate of 4 percent. A discount rate of 18 percent was used in the

2009 analysis to reflect the relevant risks of the higher growth assumed for this reporting unit. An increase in the discount

rate of one percent would have decreased the reporting unit’s fair value by $5.0 million while a decrease in the discount

rate by one percent would have increased the reporting unit’s fair value by $7.0 million. The revenue growth in 2010 and

2011 are significant assumptions within the projections. If revenue growth were held to approximately 10 percent for each

of those years and reducing thereafter, reducing the average annual growth rate to 7 percent and the discount rate to

15 percent, the indicated fair value of the reporting unit would be reduced by approximately $3.0 million and would not

result in an impairment.

There are also various assumptions used under the market approach that affect the valuation of our reporting units.

The most significant assumptions are market multiples and control premium. In estimating the fair value of our company

under the market approach, we considered the relative merits of commonly applied market capitalization multiples based

on the availability of data. Based on our analysis, we determined the market value of invested capital to earnings before

interest, taxes, depreciation and amortization multiple to be the most appropriate valuation multiple to be applied in the

application of the market approach.

As a result of our analysis of fair value from the combination of our discounted cash flow modeling and market

comparisons, we utilized a stock price of $8.77 per share on the November 30, 2009 testing date in determining and

allocating fair value to our reporting units as compared to a stock price of $12.36 per share on the November 30, 2008

testing date for goodwill impairment. A control premium of 25 percent was used in our determination of fair value which

represents the value an investor would pay above minority interest transaction prices in order to obtain a controlling interest

in the company. The control premium was determined by a review of premiums paid for similar companies over the past

five years.

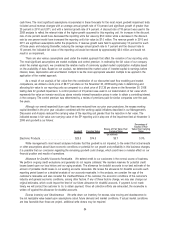

Although our overall expected future cash flows were reduced from our prior year projections, the excess working

capital identified in the prior year valuation combined with the working capital initiatives described in our Management’s

Discussion and Analysis reduced the carrying value of the reporting unit greater than the reduction in fair value. The

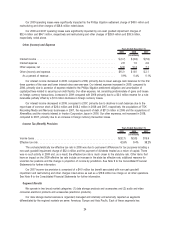

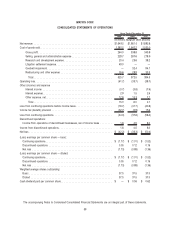

indicated excess in fair value over carrying value of the EP reporting unit in step one of the impairment test at November 3,

2009 and goodwill is as follows:

Goodwill Carrying Value

Excess of Fair Value Over

Carrying Value

Percentage of

Excess of Fair

Value Over Carrying

Value

(In millions)

Electronic Products. . . . . . . . . . . . . . . . . . . . . $23.5 $74.3 $3.7 5.0%

While management’s most recent analyses indicates that this goodwill is not impaired, to the extent that actual results

or other assumptions about future economic conditions or potential for our growth and profitability in this business changes,

it is possible that our conclusion regarding the remaining goodwill could change, which could have a material effect on our

financial position and results of operations.

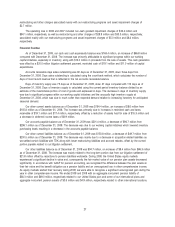

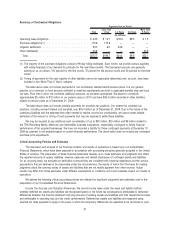

Allowance for Doubtful Accounts Receivable. We extend credit to our customers in the normal course of business.

We perform ongoing credit evaluations and generally do not require collateral. We maintain reserves for potential credit

losses based upon our loss history and our aging analysis. The allowance for doubtful accounts is our best estimate of the

amount of probable credit losses in our existing accounts receivable. We review the allowance for doubtful accounts each

reporting period based on a detailed analysis of our accounts receivable. In the analysis, we consider the age of the

customer’s receivable and also consider the creditworthiness of the customer, the economic conditions of the customer’s

industry and general economic conditions, among other factors. If any of these factors change, we may also change our

original estimates, which could impact the level of our future allowance for doubtful accounts. If payment is not made

timely, we will contact the customer to try to obtain payment. Once all collection efforts are exhausted, the receivable is

written off against the allowance for doubtful accounts.

Excess Inventory and Obsolescence. We write down our inventory for excess, slow moving and obsolescence to

the net realizable value based upon assumptions about future demand and market conditions. If actual market conditions

are less favorable than those we project, additional write downs may be required.

34