Memorex 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

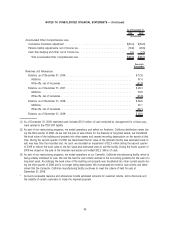

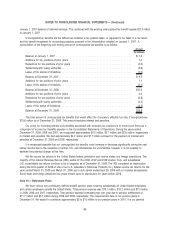

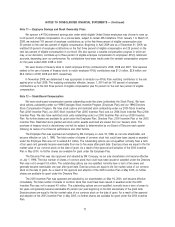

January 1, 2007 balance of retained earnings. This combined with the existing unrecognized tax benefit equaled $7.3 million

at January 1, 2007.

Unrecognized tax benefits are the differences between a tax position taken, or expected to be taken in a tax return

and the benefit recognized for accounting purposes pursuant to the interpretation adopted on January 1, 2007. A

reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Amount

(In millions)

Balance at January 1, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $7.3

Additions for tax positions of prior years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.0

Reductions for tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2)

Settlements with taxing authorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.6)

Lapse of the statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.0)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9.5

Additions for tax positions of prior years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1

Lapse of the statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.1)

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10.5

Additions for tax positions of prior years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.4

Reductions for tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.6)

Settlements with taxing authorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2)

Lapse of the statue of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.3)

Balance at December 31, 2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13.8

The total amount of unrecognized tax benefits that would affect the Company’s effective tax rate, if recognized was

$13.8 million as of December 31, 2009. This amount excludes interest and penalties.

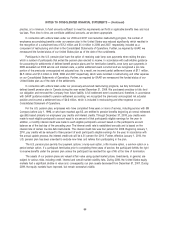

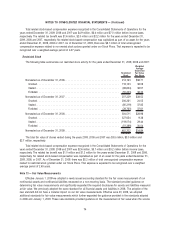

Our policy for recording interest and penalties associated with uncertain tax positions is to record such items as a

component of income tax (benefit) expense in the Consolidated Statements of Operations. During the years ended

December 31, 2009, 2008 and 2007, we recognized approximately $0.5 million, $0.7 million and $0.6 million, respectively,

in interest and penalties. We had approximately $2.2 million and $1.7 million accrued for the payment of interest and

penalties at December 31, 2009 and 2008, respectively.

It is reasonably possible that our unrecognized tax benefits could increase or decrease significantly during the next

twelve months due to the resolution of certain U.S. and international tax uncertainties; however it is not possible to

estimate the potential change at this time.

We file income tax returns in the United States federal jurisdiction and various states and foreign jurisdictions. The

majority of the Internal Revenue Service (IRS) audits for the 2006, 2007 and 2008 Imation Corp. and subsidiaries’

U.S. consolidated tax returns continue to be in progress as of December 31, 2009. The IRS completed an examination

during the third quarter of 2009 of one of our U.S. subsidiary’s (Memorex Products Inc.) federal income tax returns for the

years ended March 31, 2005 and March 31, 2006 and a stub period ended April 28, 2006 with no material assessments.

Some state and foreign jurisdiction tax years remain open to examination for years before 2006.

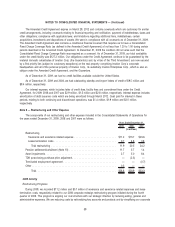

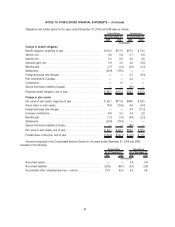

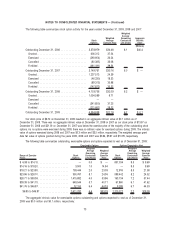

Note 10 — Retirement Plans

We have various non-contributory defined benefit pension plans covering substantially all United States employees

and certain employees outside the United States. Total pension expense was $15.1 million, $10.2 million and $7.3 million

in 2009, 2008 and 2007, respectively. Total pension expense increased year over year due to pension settlements of

$11.7 million and $5.7 million during 2009 and 2008, respectively. The measurement date of our pension plans is

December 31. We expect to contribute approximately $5 to $10 million to our pension plans in 2010. It is our general

65

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)