Johnson Controls 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

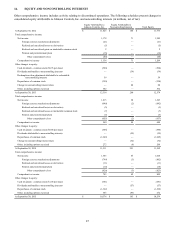

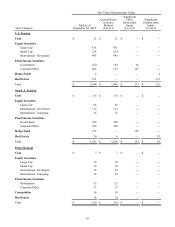

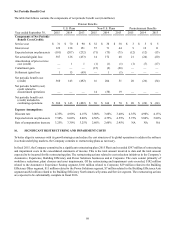

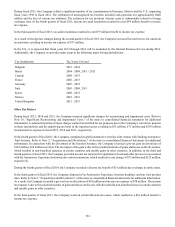

(1) Fiscal 2014 includes $617 million of plan assets and $626 million of projected benefit obligations transferred to assets

and liabilities held for sale on the consolidated statements of financial position for non-U.S. plans. The prepaid benefit

cost and accrued benefit liability transferred are $24 million and $33 million, respectively. The plan assets transferred

are comprised of $553 million of Level 1 investments and $64 million of Level 2 investments. The Level 1 investments,

by asset category, are cash, equity securities, fixed income securities, real estate and commodities in the amounts of $11

million, $110 million, $356 million, $70 million and $6 million, respectively. The Level 2 investments are hedge fund

investments. The weighted average discount rate and rate of compensation increase assumptions at September 30, 2014

are 2.30% and 2.10%, respectively.

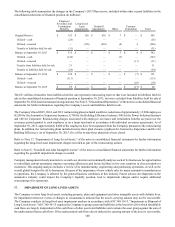

Refer to Note 3, "Discontinued Operations," of the notes to consolidated financial statements for further information

regarding the Company's disposal groups classified as held for sale.

(2) Plan assets and obligations are determined based on a September 30 measurement date at September 30, 2015 and 2014.

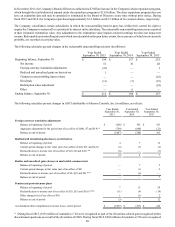

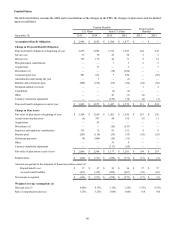

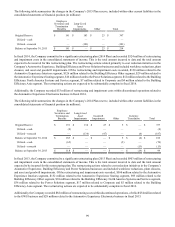

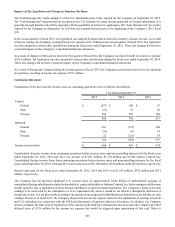

(3) The Company considers the expected benefit payments on a plan-by-plan basis when setting assumed discount rates. As

a result, the Company uses different discount rates for each plan depending on the plan jurisdiction, the demographics of

participants and the expected timing of benefit payments. For the U.S. pension and postretirement plans, the Company

uses a discount rate provided by an independent third party calculated based on an appropriate mix of high quality bonds.

For the non-U.S. pension and postretirement plans, the Company consistently uses the relevant country specific benchmark

indices for determining the various discount rates.

At September 30, 2015, the Company changed the method used to estimate the service and interest components of net

periodic benefit cost for pension and other postretirement benefits for plans that utilize a yield curve approach. This

change compared to the previous method will result in different service and interest components of net periodic benefit

cost (credit) in future periods. Historically, the Company estimated these service and interest cost components utilizing

a single weighted-average discount rate derived from the yield curve used to measure the benefit obligation at the beginning

of the period. The Company elected to utilize a full yield curve approach in the estimation of these components by applying

the specific spot rates along the yield curve used in the determination of the benefit obligation to the relevant projected

cash flows. The Company made this change to provide a more precise measurement of service and interest costs by

improving the correlation between projected benefit cash flows to the corresponding spot yield curve rates. This change

does not affect the measurement of the total benefit obligations or annual net periodic benefit cost (credit) as the change

in the service and interest costs is completely offset in the net actuarial (gain) loss reported. The change in the service

and interest costs going forward is not expected to be significant. The Company has accounted for this change as a change

in accounting estimate.

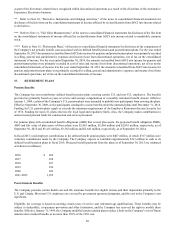

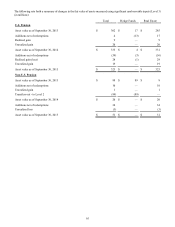

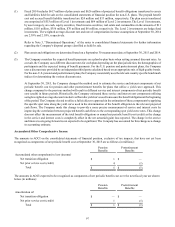

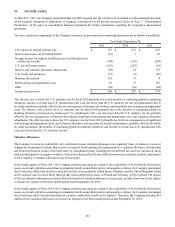

Accumulated Other Comprehensive Income

The amounts in AOCI on the consolidated statements of financial position, exclusive of tax impacts, that have not yet been

recognized as components of net periodic benefit cost at September 30, 2015 are as follows (in millions):

Pension

Benefits Postretirement

Benefits

Accumulated other comprehensive loss (income)

Net transition obligation $ 1 $ —

Net prior service cost (credit) 4(1)

Total $ 5 $ (1)

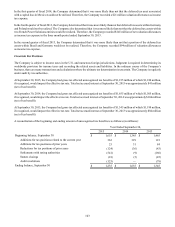

The amounts in AOCI expected to be recognized as components of net periodic benefit cost over the next fiscal year are shown

below (in millions):

Pension

Benefits Postretirement

Benefits

Amortization of:

Net transition obligation $ — $ —

Net prior service cost (credit) 1(1)

Total $ 1 $ (1)