Johnson Controls 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

"Capitalization" within the "Liquidity and Capital Resources" section of Item 7 for discussion of domestic and foreign cash

projections.

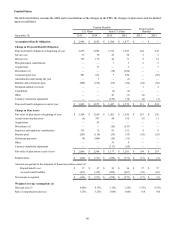

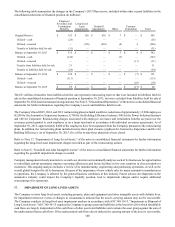

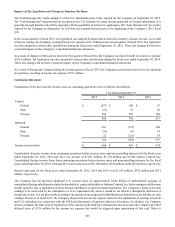

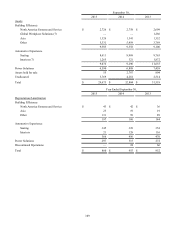

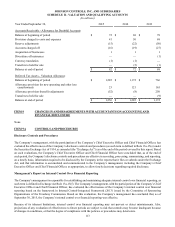

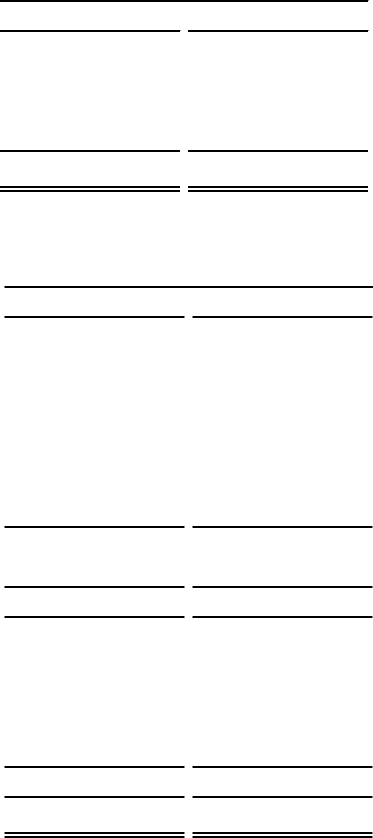

Deferred taxes were classified in the consolidated statements of financial position as follows (in millions):

September 30,

2015 2014

Other current assets $ 624 $ 558

Other noncurrent assets 1,327 1,834

Other current liabilities (49)(51)

Other noncurrent liabilities (420)(427)

Net deferred tax asset $ 1,482 $ 1,914

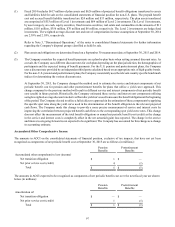

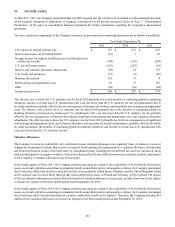

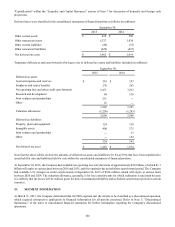

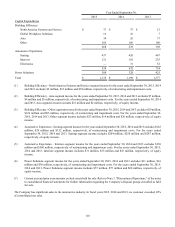

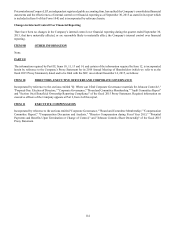

Temporary differences and carryforwards which gave rise to deferred tax assets and liabilities included (in millions):

September 30,

2015 2014

Deferred tax assets

Accrued expenses and reserves $ 210 $ 197

Employee and retiree benefits 270 243

Net operating loss and other credit carryforwards 2,471 3,233

Research and development 64 118

Joint ventures and partnerships 231 —

Other 16 —

3,262 3,791

Valuation allowances (1,256)(1,285)

2,006 2,506

Deferred tax liabilities

Property, plant and equipment 124 128

Intangible assets 400 275

Joint ventures and partnerships — 37

Other — 152

524 592

Net deferred tax asset $ 1,482 $ 1,914

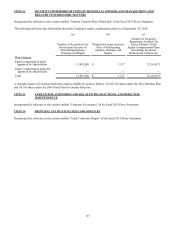

Note that the above tables exclude the amounts of deferred tax assets and liabilities for fiscal 2014 that have been transferred to

assets held for sale and liabilities held for sale within the consolidated statements of financial position.

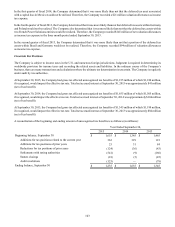

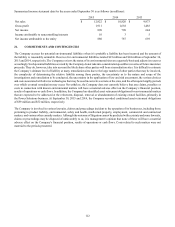

At September 30, 2015, the Company had available net operating loss carryforwards of approximately $4.8 billion, of which $1.7

billion will expire at various dates between 2016 and 2035, and the remainder has an indefinite carryforward period. The Company

had available U.S. foreign tax credit carryforwards at September 30, 2015 of $934 million, which will expire at various dates

between 2020 and 2024. The valuation allowance, generally, is for loss carryforwards for which realization is uncertain because

it is unlikely that the losses will be realized given the lack of sustained profitability and/or limited carryforward periods in certain

countries.

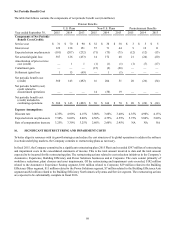

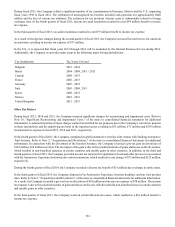

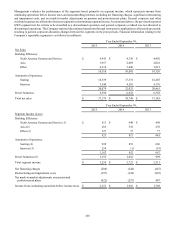

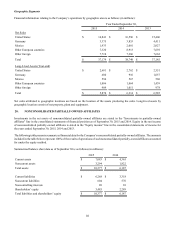

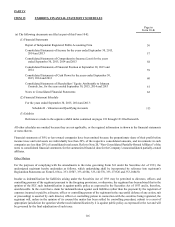

19. SEGMENT INFORMATION

At March 31, 2015, the Company determined that its GWS segment met the criteria to be classified as a discontinued operation,

which required retrospective application to financial information for all periods presented. Refer to Note 3, "Discontinued

Operations," of the notes to consolidated financial statements for further information regarding the Company's discontinued

operations.