Johnson Controls 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

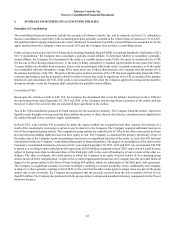

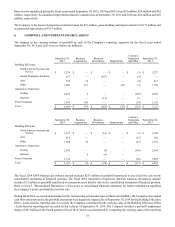

In the third quarter of fiscal 2014, the Company completed its purchase of ADT for approximately $1.6 billion, net of cash acquired,

all of which was paid as of June 30, 2014. ADT is one of the largest independent providers of air distribution and ventilation

products in North America. In the third quarter of fiscal 2014, the Company completed a public offering of $1.7 billion aggregate

principal amount of fixed rate senior notes to finance the purchase of ADT. In fiscal 2014, the Company recorded goodwill of

$837 million in the Building Efficiency Other segment as a result of the ADT acquisition. The Company also recorded approximately

$477 million of intangible assets that are subject to amortization, of which approximately $475 million was assigned to customer

relationships with useful lives between 18 and 20 years. In addition, the Company recorded approximately $230 million of trade

names that are not subject to amortization.

Also during fiscal 2014, the Company completed four additional acquisitions for a combined purchase price, net of cash acquired,

of $144 million, all of which was paid as of September 30, 2014. The acquisitions in the aggregate were not material to the

Company's consolidated financial statements. In connection with the acquisitions, the Company recorded goodwill of $140 million.

Three of the acquisitions increased the Company's ownership from a noncontrolling to controlling interest. As a result, the Company

recorded a combined non-cash gain of $38 million in equity income to adjust the Company's existing equity investments in the

partially-owned affiliates to fair value. The $38 million gain includes $19 million for the Power Solutions business and $19 million

for the Building Efficiency Asia business.

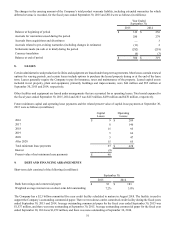

In the third quarter of fiscal 2014, the Company completed the divestiture of the Automotive Experience Interiors headliner and

sun visor product lines. As part of this divestiture, the Company made a cash payment of $54 million to the buyer to fund future

operational improvement initiatives. The Company recorded a pre-tax loss on divestiture, including transaction costs, of $95 million

within selling, general and administrative expenses on the consolidated statements of income. The tax impact of the divestiture

was income tax expense of $38 million due to the jurisdictional mix of gains and losses on the sale, which resulted in non-benefited

losses in certain countries and taxable gains in other countries. There was no change in goodwill as a result of this transaction.

In the third quarter of fiscal 2014, the Company recorded a $25 million charge within income (loss) from discontinued operations,

net of tax, on the consolidated statements of income related to the indemnification of certain costs associated with a divested GWS

business in 2004.

In the second quarter of fiscal 2014, the Company announced that it had reached an agreement to sell the remainder of its Automotive

Experience Electronics business to Visteon Corporation, subject to regulatory and other approvals. The sale closed on July 1, 2014.

The cash proceeds from the sale were $266 million, all of which was received as of September 30, 2014. At March 31, 2014, the

Company determined that the Automotive Experience Electronics segment met the criteria to be classified as a discontinued

operation. Refer to Note 3, "Discontinued Operations," of the notes to consolidated financial statements for further disclosure

related to the Company's discontinued operations.

In the first quarter of fiscal 2014, the Company completed one additional divestiture for a sales price of $13 million, all of which

was received as of September 30, 2014. The divestiture was not material to the Company’s consolidated financial statements. In

connection with the divestiture, the Company recorded a gain, net of transaction costs, of $9 million in the Automotive Experience

Interiors segment within selling, general and administrative expenses on the consolidated statements of income. There was no

change in goodwill as a result of this transaction.

During fiscal 2014, the Company adjusted the purchase price allocation of certain fiscal 2013 acquisitions and recorded additional

goodwill of $2 million.

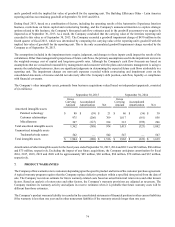

During fiscal 2013, the Company completed three acquisitions for a combined purchase price, net of cash acquired, of $123 million,

all of which was paid as of September 30, 2013. The acquisitions in the aggregate were not material to the Company's consolidated

financial statements. In connection with the acquisitions, the Company recorded goodwill of $266 million. Two of the acquisitions

increased the Company's ownership from a noncontrolling to controlling interest. As a result, the Company recorded a combined

non-cash gain of $106 million in Automotive Experience Seating equity income to adjust the Company's existing equity investments

in the partially-owned affiliates to fair value.

During the fourth quarter of fiscal 2013, the Company completed its divestiture of its Automotive Experience Electronics'

HomeLink® product line to Gentex Corporation. The selling price was $701 million, all of which was received as of September

30, 2013. In connection with the HomeLink® product line divestiture, the Company recorded a gain, net of transaction costs, of

$476 million and reduced goodwill by $177 million in the Automotive Experience Electronics business.

Also during fiscal 2013, the Company completed two additional divestitures for a combined sales price, net of cash transferred,

of $60 million, all of which was received as of September 30, 2013. The divestitures were not material to the Company's consolidated

financial statements. In connection with the divestitures, the Company recorded a gain of $29 million within selling, general and