Johnson Controls 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

JOHNSON CONTROLS, INC. AND SUBSIDIARIES

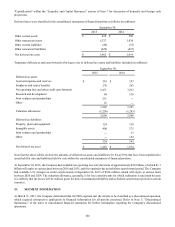

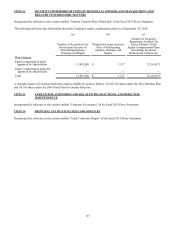

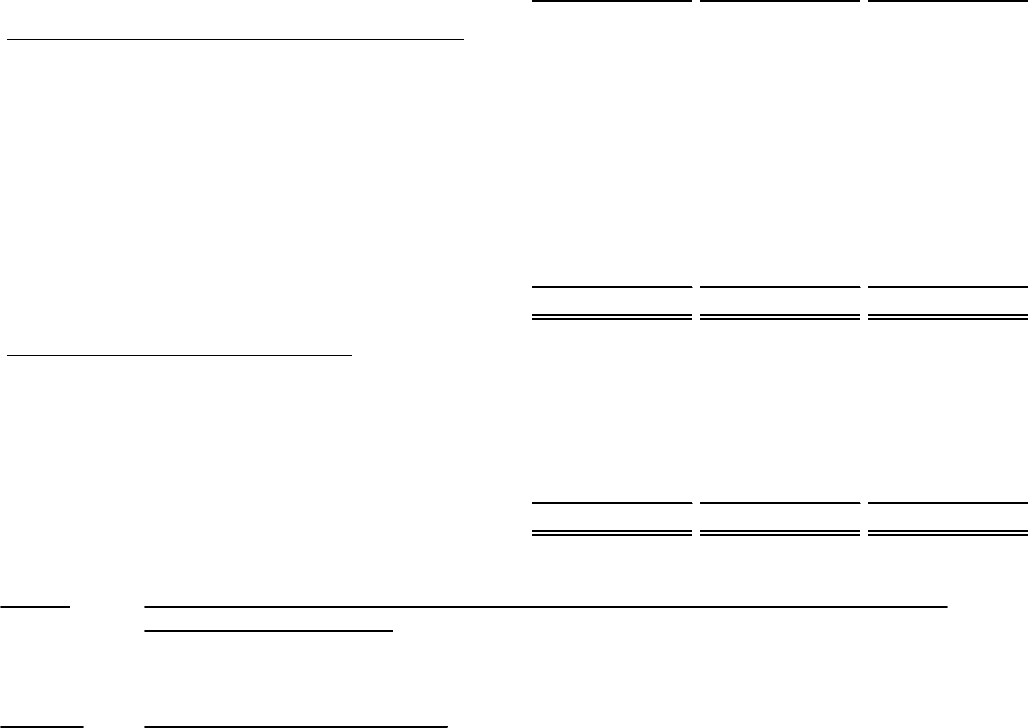

SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS

(In millions)

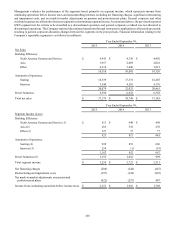

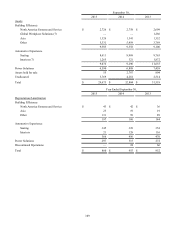

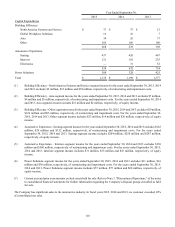

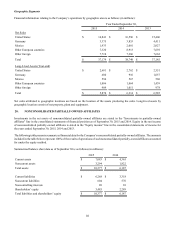

Year Ended September 30, 2015 2014 2013

Accounts Receivable - Allowance for Doubtful Accounts

Balance at beginning of period $ 72 $ 68 $ 78

Provision charged to costs and expenses 41 50 68

Reserve adjustments (15)(22)(50)

Accounts charged off (16)(19)(27)

Acquisition of businesses 1 1 1

Divestiture of businesses — — (1)

Currency translation (1)(1) —

Transfers to held for sale — (5)(1)

Balance at end of period $ 82 $ 72 $ 68

Deferred Tax Assets - Valuation Allowance

Balance at beginning of period $ 1,285 $ 1,172 $ 766

Allowance provision for new operating and other loss

carryforwards 23 121 165

Allowance provision (benefit) adjustments (52)(8) 250

Transfers to held for sale — — (9)

Balance at end of period $ 1,256 $ 1,285 $ 1,172

ITEM 9 CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

The Company’s management, with the participation of the Company’s Chief Executive Officer and Chief Financial Officer, has

evaluated the effectiveness of the Company’s disclosure controls and procedures (as such term is defined in Rule 13a-15(e) under

the Securities Exchange Act of 1934, as amended (the "Exchange Act")) as of the end of the period covered by this report. Based

on such evaluations, the Company’s Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of

such period, the Company’s disclosure controls and procedures are effective in recording, processing, summarizing, and reporting,

on a timely basis, information required to be disclosed by the Company in the reports that it files or submits under the Exchange

Act, and that information is accumulated and communicated to the Company’s management, including the Company’s Chief

Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

Management’s Report on Internal Control Over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as

such term is defined in Exchange Act Rule 13a-15(f). The Company’s management, with the participation of the Company’s Chief

Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the Company’s internal control over financial

reporting based on the framework in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring

Organizations of the Treadway Commission. Based on this evaluation, the Company’s management has concluded that, as of

September 30, 2015, the Company’s internal control over financial reporting was effective.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to risk that controls may become inadequate because

of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.