Johnson Controls 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.101

an impairment charge is measured as the amount by which the carrying amount of the asset group exceeds its fair value based on

discounted cash flow analysis or appraisals.

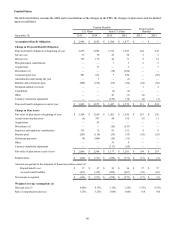

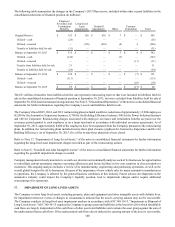

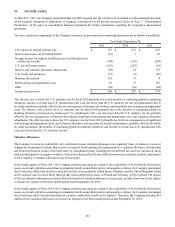

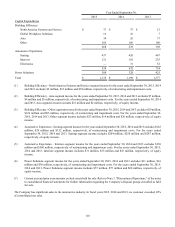

In the fourth quarter of fiscal 2015, the Company concluded it had triggering events requiring assessment of impairment for certain

of its long-lived assets in conjunction with its announced restructuring actions and the intention to spin-off the Automotive

Experience business. As a result, the Company reviewed the long-lived assets for impairment and recorded a $183 million

impairment charge within restructuring and impairment costs on the consolidated statements of income. Of the total impairment

charge, $139 million related to corporate assets, $27 million related to the Automotive Experience Seating segment, $16 million

related to the Building Efficiency Other segment and $1 million related to the Building Efficiency North America Systems and

Service segment. Refer to Note 16, "Significant Restructuring and Impairment Costs," of the notes to consolidated financial

statements for additional information. The impairment was measured, depending on the asset, either under an income approach

utilizing forecasted discounted cash flows or a market approach utilizing an appraisal to determine fair values of the impairment

assets. These methods are consistent with the methods the Company employed in prior periods to value other long-lived assets.

The inputs utilized in the analyses are classified as Level 3 inputs within the fair value hierarchy as defined in ASC 820, "Fair

Value Measurement."

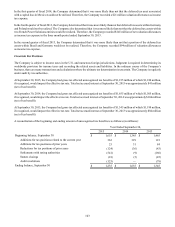

In the third and fourth quarters of fiscal 2014, the Company concluded it had triggering events requiring assessment of impairment

for certain of its long-lived assets in conjunction with its restructuring actions announced in fiscal 2014. In addition, in the fourth

quarter of fiscal 2014, the Company concluded that it had a triggering event requiring assessment of impairment of long-lived

assets held by the Building Efficiency Other - Latin America reporting unit due to the impairment of goodwill in the quarter. As

a result, the Company reviewed the long-lived assets for impairment and recorded a $91 million impairment charge within

restructuring and impairment costs on the consolidated statements of income, of which $45 million was recorded in the third quarter

and $46 million in the fourth quarter of fiscal 2014. Of the total impairment charge, $45 million related to the Automotive Experience

Interiors segment, $34 million related to the Building Efficiency Other segment, $7 million related to the Automotive Experience

Seating segment and $5 million related to corporate assets. In addition, the Company recorded $43 million of asset and investment

impairments within discontinued operations in the third quarter of fiscal 2014 related to the divestiture of the Automotive Experience

Electronics business. Refer to Note 3, "Discontinued Operations," and Note 16, "Significant Restructuring and Impairment Costs,"

of the notes to consolidated financial statements for additional information. The impairment was measured, depending on the asset,

either under an income approach utilizing forecasted discounted cash flows or a market approach utilizing an appraisal to determine

fair values of the impairment assets. These methods are consistent with the methods the Company employed in prior periods to

value other long-lived assets. The inputs utilized in the analyses are classified as Level 3 inputs within the fair value hierarchy as

defined in ASC 820, "Fair Value Measurement."

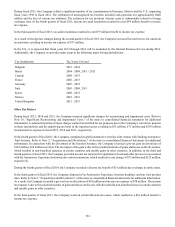

In the second, third and fourth quarters of fiscal 2013, the Company concluded it had a triggering event requiring assessment of

impairment for certain of its long-lived assets in conjunction with its restructuring actions announced in fiscal 2013. In addition,

in the fourth quarter of fiscal 2013, the Company concluded that it had a triggering event requiring assessment of impairment for

the long-lived assets held by the Automotive Experience Interiors segment due to the impairment of goodwill in the quarter. As a

result, the Company reviewed the long-lived assets for impairment and recorded a $156 million impairment charge within

restructuring and impairment costs on the consolidated statements of income, of which $13 million was recorded in the second

quarter, $36 million in the third quarter and $107 million in the fourth quarter of fiscal 2013. Of the total impairment charge, $57

million related to the Automotive Experience Interiors segment, $40 million related to the Building Efficiency Other segment, $22

million related to the Automotive Experience Seating segment, $18 million related to the Power Solutions segment, $12 million

related to corporate assets and $7 million related to various segments within the Building Efficiency business. Refer to Note 16,

"Significant Restructuring and Impairment Costs," of the notes to consolidated financial statements for additional information.

The impairment was measured, depending on the asset, either under an income approach utilizing forecasted discounted cash flows

or a market approach utilizing an appraisal to determine fair values of the impairment assets. These methods are consistent with

the methods the Company employed in prior periods to value other long-lived assets. The inputs utilized in the analyses are

classified as Level 3 inputs within the fair value hierarchy as defined in ASC 820, "Fair Value Measurement."

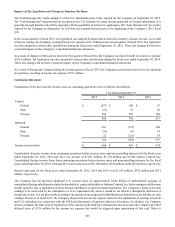

At September 30, 2015, 2014 and 2013, the Company concluded it did not have any other triggering events requiring assessment

of impairment of its long-lived assets. Refer to Note 1, "Summary of Significant Accounting Policies," of the notes to consolidated

financial statements for discussion of the Company’s goodwill impairment testing. Refer to Note 6, "Goodwill and Other Intangible

Assets," of the notes to consolidated financial statements for further information regarding the goodwill impairment charges

recorded in the fourth quarter of fiscal 2014 and 2013.