Johnson Controls 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

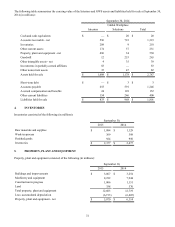

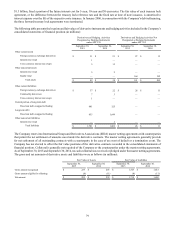

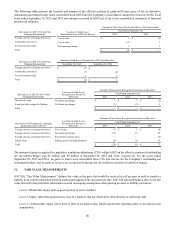

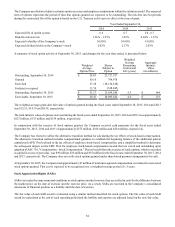

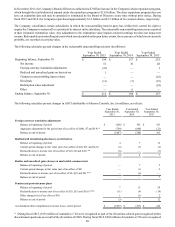

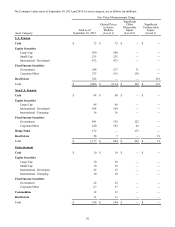

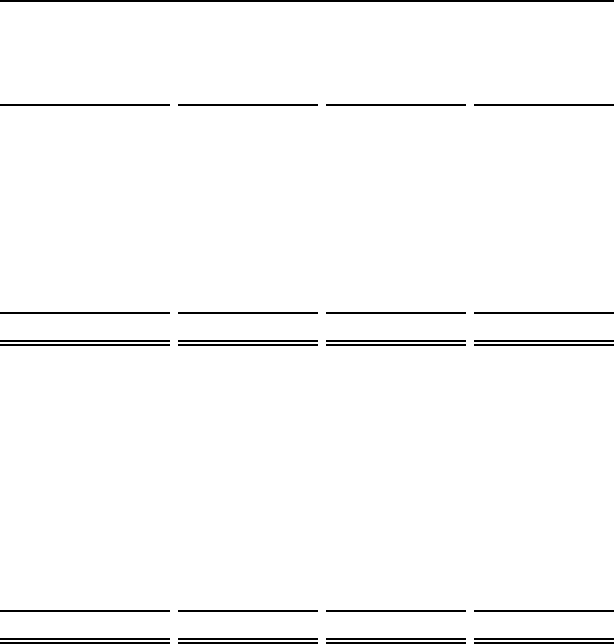

Fair Value Measurements Using:

Total as of

September 30, 2014

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Other current assets

Foreign currency exchange derivatives $ 34 $ — $ 34 $ —

Cross-currency interest rate swaps 15 — 15 —

Other noncurrent assets

Interest rate swaps 2 — 2 —

Investments in marketable common stock 4 4 — —

Equity swap 192 192 — —

Total assets $ 247 $ 196 $ 51 $ —

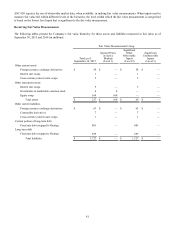

Other current liabilities

Foreign currency exchange derivatives $ 33 $ — $ 33 $ —

Commodity derivatives 3 — 3 —

Current portion of long-term debt

Fixed rate debt swapped to floating 125 — 125 —

Long-term debt

Fixed rate debt swapped to floating 1,649 — 1,649 —

Other noncurrent liabilities

Interest rate swaps 3 — 3 —

Total liabilities $ 1,813 $ — $ 1,813 $ —

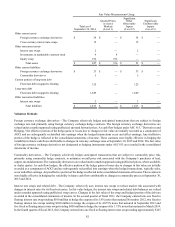

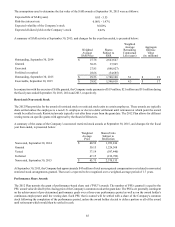

Valuation Methods

Foreign currency exchange derivatives - The Company selectively hedges anticipated transactions that are subject to foreign

exchange rate risk primarily using foreign currency exchange hedge contracts. The foreign currency exchange derivatives are

valued under a market approach using publicized spot and forward prices. As cash flow hedges under ASC 815, "Derivatives and

Hedging," the effective portion of the hedge gains or losses due to changes in fair value are initially recorded as a component of

AOCI and are subsequently reclassified into earnings when the hedged transactions occur and affect earnings. Any ineffective

portion of the hedge is reflected in the consolidated statements of income. These contracts were highly effective in hedging the

variability in future cash flows attributable to changes in currency exchange rates at September 30, 2015 and 2014. The fair value

of foreign currency exchange derivatives not designated as hedging instruments under ASC 815 are recorded in the consolidated

statements of income.

Commodity derivatives - The Company selectively hedges anticipated transactions that are subject to commodity price risk,

primarily using commodity hedge contracts, to minimize overall price risk associated with the Company’s purchases of lead,

copper, tin and aluminum. The commodity derivatives are valued under a market approach using publicized prices, where available,

or dealer quotes. As cash flow hedges, the effective portion of the hedge gains or losses due to changes in fair value are initially

recorded as a component of AOCI and are subsequently reclassified into earnings when the hedged transactions, typically sales,

occur and affect earnings. Any ineffective portion of the hedge is reflected in the consolidated statements of income. These contracts

were highly effective in hedging the variability in future cash flows attributable to changes in commodity prices at September 30,

2015 and 2014.

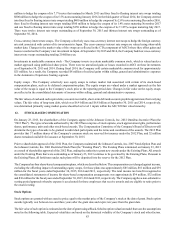

Interest rate swaps and related debt - The Company selectively uses interest rate swaps to reduce market risk associated with

changes in interest rates for its fixed-rate notes. As fair value hedges, the interest rate swaps and related debt balances are valued

under a market approach using publicized swap curves. Changes in the fair value of the swap and hedged portion of the debt are

recorded in the consolidated statements of income. In the second quarter of fiscal 2011, the Company entered into one fixed to

floating interest rate swap totaling $100 million to hedge the coupon of its 5.8% notes that matured November 2012, two fixed to

floating interest rate swaps totaling $300 million to hedge the coupon of its 4.875% notes that matured in September 2013 and

five fixed to floating interest rate swaps totaling $450 million to hedge the coupon of its 1.75% notes that matured in March 2014.

In the fourth quarter of fiscal 2013, the Company entered into one fixed to floating interest rate swap totaling approximately $125