Johnson Controls 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to

measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized

is based on the lowest level input that is significant to the fair value measurement.

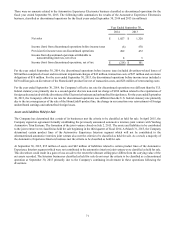

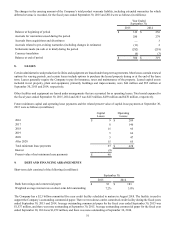

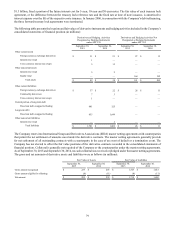

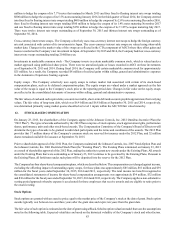

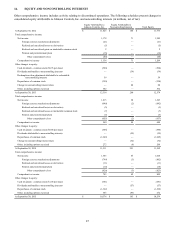

Recurring Fair Value Measurements

The following tables present the Company’s fair value hierarchy for those assets and liabilities measured at fair value as of

September 30, 2015 and 2014 (in millions):

Fair Value Measurements Using:

Total as of

September 30, 2015

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Other current assets

Foreign currency exchange derivatives $ 58 $ — $ 58 $ —

Interest rate swaps 1 — 1 —

Cross-currency interest rate swaps 5 — 5 —

Other noncurrent assets

Interest rate swaps 5 — 5 —

Investments in marketable common stock 4 4 — —

Equity swap 164 164 — —

Total assets $ 237 $ 168 $ 69 $ —

Other current liabilities

Foreign currency exchange derivatives $ 63 $ — $ 63 $ —

Commodity derivatives 7 — 7 —

Cross-currency interest rate swaps 1 — 1—

Current portion of long-term debt

Fixed rate debt swapped to floating 801 — 801 —

Long-term debt

Fixed rate debt swapped to floating 855 — 855 —

Total liabilities $ 1,727 $ — $ 1,727 $ —