Johnson Controls 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

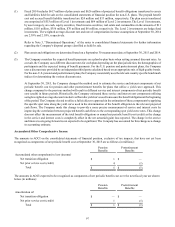

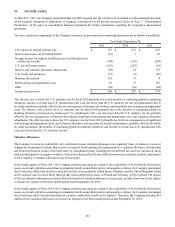

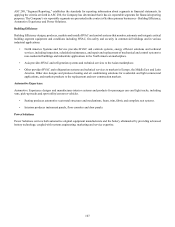

In the first quarter of fiscal 2014, the Company determined that it was more likely than not that the deferred tax asset associated

with a capital loss in Mexico would not be utilized. Therefore, the Company recorded a $21 million valuation allowance as income

tax expense.

In the fourth quarter of fiscal 2013, the Company determined that it was more likely than not that deferred tax assets within Germany

and Poland would not be realized. The Company also determined that it was more likely than not that the deferred tax assets within

two French Power Solutions entities would be realized. Therefore, the Company recorded $145 million of net valuation allowances

as income tax expense in the three month period ended September 30, 2013.

In the second quarter of fiscal 2013, the Company determined that it was more likely than not that a portion of the deferred tax

assets within Brazil and Germany would not be realized. Therefore, the Company recorded $94 million of valuation allowances

as income tax expense.

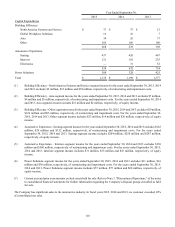

Uncertain Tax Positions

The Company is subject to income taxes in the U.S. and numerous foreign jurisdictions. Judgment is required in determining its

worldwide provision for income taxes and recording the related assets and liabilities. In the ordinary course of the Company’s

business, there are many transactions and calculations where the ultimate tax determination is uncertain. The Company is regularly

under audit by tax authorities.

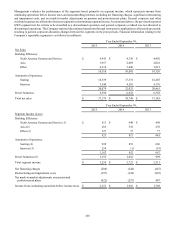

At September 30, 2015, the Company had gross tax effected unrecognized tax benefits of $1,235 million of which $1,180 million,

if recognized, would impact the effective tax rate. Total net accrued interest at September 30, 2015 was approximately $41 million

(net of tax benefit).

At September 30, 2014, the Company had gross tax effected unrecognized tax benefits of $1,655 million of which $1,505 million,

if recognized, would impact the effective tax rate. Total net accrued interest at September 30, 2014 was approximately $106 million

(net of tax benefit).

At September 30, 2013, the Company had gross tax effected unrecognized tax benefits of $1,345 million of which $1,198 million,

if recognized, would impact the effective tax rate. Total net accrued interest at September 30, 2013 was approximately $84 million

(net of tax benefit).

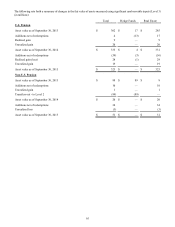

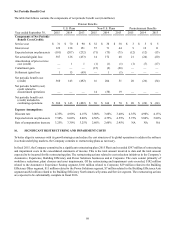

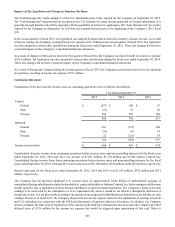

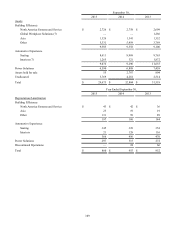

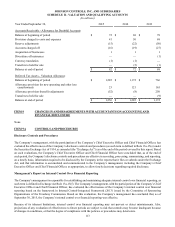

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in millions):

Year Ended September 30,

2015 2014 2013

Beginning balance, September 30 $ 1,655 $ 1,345 $ 1,465

Additions for tax positions related to the current year 363 329 123

Additions for tax positions of prior years 23 31 84

Reductions for tax positions of prior years (124)(36)(43)

Settlements with taxing authorities (541)(9)(160)

Statute closings (18)(5)(45)

Audit resolutions (123) — (79)

Ending balance, September 30 $ 1,235 $ 1,655 $ 1,345