Johnson Controls 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

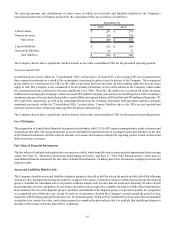

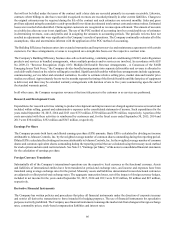

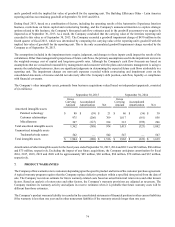

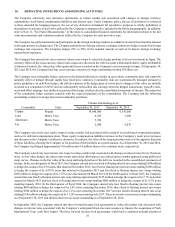

There were no amounts related to the Automotive Experience Electronics business classified as discontinued operations for the

fiscal year ended September 30, 2015. The following table summarizes the results of the Automotive Experience Electronics

business, classified as discontinued operations for the fiscal years ended September 30, 2014 and 2013 (in millions):

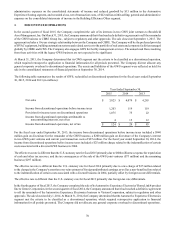

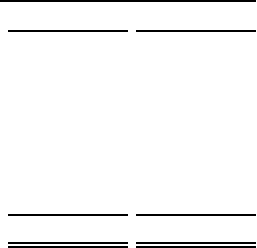

Year Ended September 30,

2014 2013

Net sales $ 1,027 $ 1,320

Income (loss) from discontinued operations before income taxes (8) 578

Provision for income taxes on discontinued operations 202 472

Income from discontinued operations attributable to

noncontrolling interests, net of tax 8 5

Income (loss) from discontinued operations, net of tax $(218) $ 101

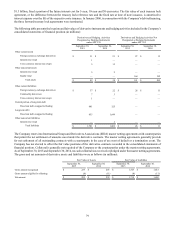

For the year ended September 30, 2014, the discontinued operations before income taxes included divestiture-related losses of

$80 million comprised of asset and investment impairment charges of $43 million, transaction costs of $27 million and severance

obligations of $10 million. For the year ended September 30, 2013, the discontinued operations before income taxes included a

$476 million gain on divestiture of the HomeLink® product line net of transaction costs, and $28 million of restructuring costs.

For the year ended September 30, 2014, the Company's effective tax rate for discontinued operations was different than the U.S.

federal statutory rate primarily due to a second quarter discrete non-cash tax charge of $180 million related to the repatriation of

foreign cash associated with the divestiture of the Electronics business and unbenefited foreign losses. For the year ended September

30, 2013, the Company's effective tax rate for discontinued operations was different than the U.S. federal statutory rate primarily

due to the tax consequences of the sale of the HomeLink® product line, the change in our assertion over reinvestment of foreign

undistributed earnings and unbenefited foreign losses.

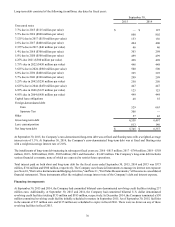

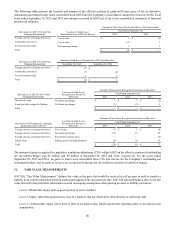

Assets and Liabilities Held for Sale

The Company has determined that certain of its businesses met the criteria to be classified as held for sale. In April 2015, the

Company signed an agreement formally establishing the previously announced automotive interiors joint venture with Yanfeng

Automotive Trim Systems. The formation of the joint venture closed on July 2, 2015. The assets and liabilities to be contributed

to the joint venture were classified as held for sale beginning in the third quarter of fiscal 2014. At March 31, 2015, the Company

determined certain product lines of the Automotive Experience Interiors segment which will not be contributed to the

aforementioned automotive interiors joint venture also met the criteria to be classified as held for sale. As a result, a majority of

the Automotive Experience Interiors business met the criteria to be classified as held for sale.

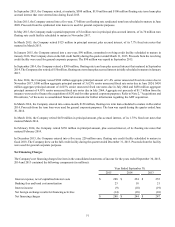

At September 30, 2015, $55 million of assets and $42 million of liabilities related to certain product lines of the Automotive

Experience Interiors segment which were not contributed to the automotive interiors joint venture were classified as held for sale.

This divestiture could result in a gain or loss on sale to the extent the ultimate selling price differs from the carrying value of the

net assets recorded. The Interiors businesses classified as held for sale do not meet the criteria to be classified as a discontinued

operation at September 30, 2015 primarily due to the Company's continuing involvement in these operations following the

divestiture.