Johnson Controls 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

a favorable impact on SG&A of $189 million. Refer to the segment analysis below within Item 7 for a discussion of segment

income by segment.

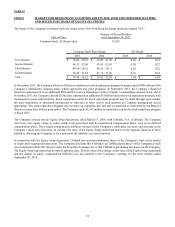

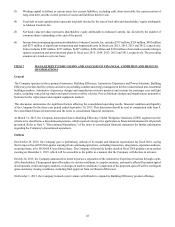

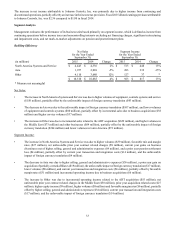

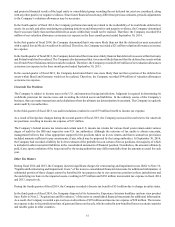

Restructuring and Impairment Costs

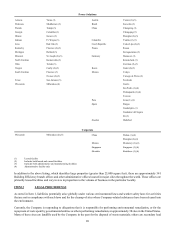

Year Ended

September 30,

(in millions) 2015 2014 Change

Restructuring and impairment costs $ 397 $ 324 23%

Refer to Note 16, "Significant Restructuring and Impairment Costs," of the notes to consolidated financial statements for further

disclosure related to the Company's restructuring plans.

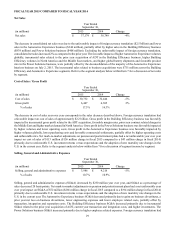

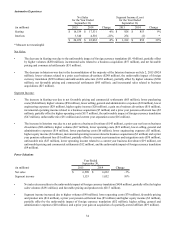

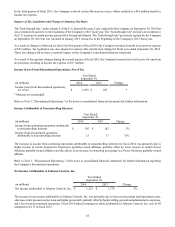

Net Financing Charges

Year Ended

September 30,

(in millions) 2015 2014 Change

Net financing charges $ 288 $ 244 18%

Net financing charges increased in fiscal 2015 as compared to fiscal 2014 primarily due to higher average borrowing levels related

to the acquisition of ADT and the share repurchase program.

Equity Income

Year Ended

September 30,

(in millions) 2015 2014 Change

Equity income $ 375 $ 395 -5%

The decrease in equity income was primarily due to prior year gains on acquisitions of partially-owned affiliates in the Power

Solutions business ($19 million) and Building Efficiency business ($19 million), partially offset by higher current year income at

certain Automotive Experience partially-owned affiliates. Refer to the segment analysis below within Item 7 for a discussion of

segment income by segment.

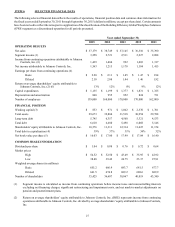

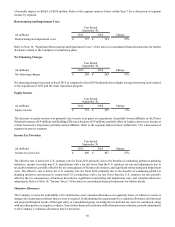

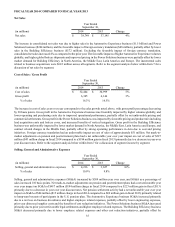

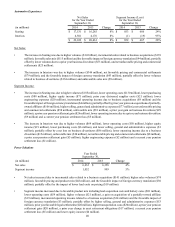

Income Tax Provision

Year Ended

September 30,

(in millions) 2015 2014 Change

Income tax provision $ 600 $ 407 47%

The effective rate is below the U.S. statutory rate for fiscal 2015 primarily due to the benefits of continuing global tax planning

initiatives, income in certain non-U.S. jurisdictions with a tax rate lower than the U.S. statutory tax rate and adjustments due to

tax audit resolutions, partially offset by the tax consequences of business divestitures, and significant restructuring and impairment

costs. The effective rate is below the U.S. statutory rate for fiscal 2014 primarily due to the benefits of continuing global tax

planning initiatives and income in certain non-U.S. jurisdictions with a tax rate lower than the U.S. statutory tax rate partially

offset by the tax consequences of business divestitures, significant restructuring and impairment costs, and valuation allowance

adjustments. Refer to Note 18, "Income Taxes," of the notes to consolidated financial statements for further details.

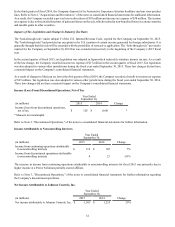

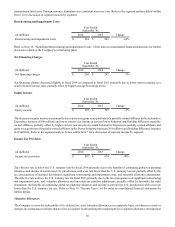

Valuation Allowances

The Company reviews the realizability of its deferred tax asset valuation allowances on a quarterly basis, or whenever events or

changes in circumstances indicate that a review is required. In determining the requirement for a valuation allowance, the historical

and projected financial results of the legal entity or consolidated group recording the net deferred tax asset are considered, along

with any other positive or negative evidence. Since future financial results may differ from previous estimates, periodic adjustments

to the Company’s valuation allowances may be necessary.