Johnson Controls 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

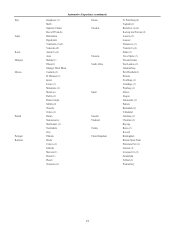

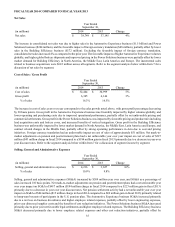

FISCAL YEAR 2015 COMPARED TO FISCAL YEAR 2014

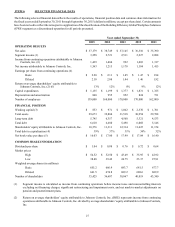

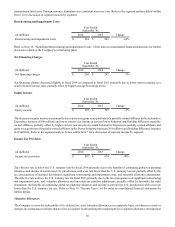

Net Sales

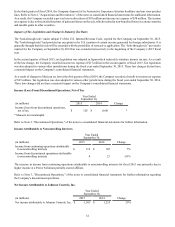

Year Ended

September 30,

(in millions) 2015 2014 Change

Net sales $ 37,179 $ 38,749 -4%

The decrease in consolidated net sales was due to the unfavorable impact of foreign currency translation ($2.5 billion) and lower

sales in the Automotive Experience business ($344 million), partially offset by higher sales in the Building Efficiency business

($839 million) and Power Solutions business ($408 million). Excluding the unfavorable impact of foreign currency translation,

consolidated net sales increased 2% as compared to the prior year. The favorable impacts of higher Automotive Experience volumes

globally, incremental sales related to the prior year acquisition of ADT in the Building Efficiency business, higher Building

Efficiency volumes in North America and the Middle East markets, and higher global battery shipments and favorable product

mix in the Power Solutions business, were partially offset by the deconsolidation of the majority of the Automotive Experience

Interiors business on July 2, 2015. The incremental sales related to business acquisitions were $751 million across the Building

Efficiency and Automotive Experience segments. Refer to the segment analysis below within Item 7 for a discussion of net sales

by segment.

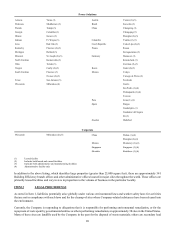

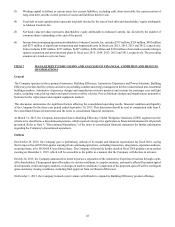

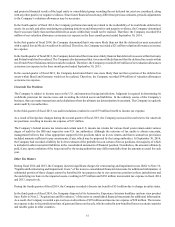

Cost of Sales / Gross Profit

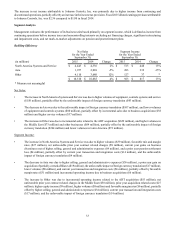

Year Ended

September 30,

(in millions) 2015 2014 Change

Cost of sales $ 30,732 $ 32,444 -5%

Gross profit 6,447 6,305 2%

% of sales 17.3% 16.3%

The decrease in cost of sales year over year corresponds to the sales decrease described above. Foreign currency translation had

a favorable impact on cost of sales of approximately $2.2 billion. Gross profit in the Building Efficiency business was favorably

impacted by incremental gross profit related to the ADT acquisition, favorable margin rates, prior year contract related charges in

the Middle East and higher market demand in North America. Gross profit in the Power Solutions business was favorably impacted

by higher volumes and lower operating costs. Gross profit in the Automotive Experience business was favorably impacted by

higher volumes globally, lower purchasing costs and favorable commercial settlements, partially offset by higher operating costs

and unfavorable mix. Net mark-to-market adjustments on pension and postretirement plans had a net unfavorable year over year

impact on cost of sales of $113 million ($156 million charge in fiscal 2015 compared to a $43 million charge in fiscal 2014)

primarily due to unfavorable U.S. investment returns versus expectations and the adoption of new mortality rate changes in the

U.S. in the current year. Refer to the segment analysis below within Item 7 for a discussion of segment income by segment.

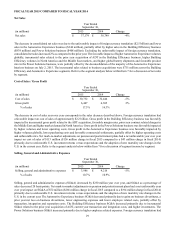

Selling, General and Administrative Expenses

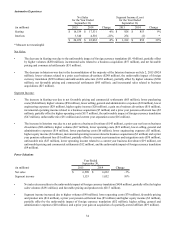

Year Ended

September 30,

(in millions) 2015 2014 Change

Selling, general and administrative expenses $ 3,986 $ 4,216 -5%

% of sales 10.7% 10.9%

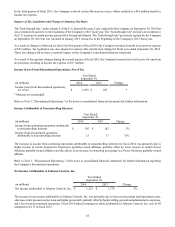

Selling, general and administrative expenses (SG&A) decreased by $230 million year over year, and SG&A as a percentage of

sales decreased 20 basis points. Net mark-to-market adjustments on pension and postretirement plans had a net unfavorable year

over year impact on SG&A of $72 million ($266 million charge in fiscal 2015 compared to a $194 million charge in fiscal 2014)

primarily due to unfavorable U.S. investment returns versus expectations and the adoption of new mortality rate changes in the

U.S. in the current year. The Automotive Experience business SG&A decreased primarily due to gains on business divestitures, a

prior year net loss on business divestitures, lower engineering expenses and lower employee related costs, partially offset by

transaction, integration and separation costs. The Building Efficiency business SG&A increased primarily due to incremental

SG&A related to the prior year acquisition of ADT, current year transaction and integration costs, and higher investments. The

Power Solutions business SG&A increased primarily due to higher employee related expenses. Foreign currency translation had