Johnson Controls 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

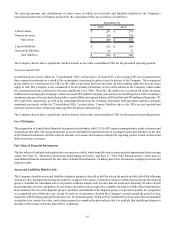

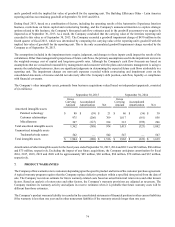

The fair values of all derivatives are recorded in the consolidated statements of financial position. The change in a derivative’s

fair value is recorded each period in current earnings or accumulated other comprehensive income (AOCI), depending on whether

the derivative is designated as part of a hedge transaction and if so, the type of hedge transaction. See Note 10, "Derivative

Instruments and Hedging Activities," and Note 11, "Fair Value Measurements," of the notes to consolidated financial statements

for disclosure of the Company’s derivative instruments and hedging activities.

Pension and Postretirement Benefits

The Company utilizes a mark-to-market approach for recognizing pension and postretirement benefit expenses, including

measuring the market related value of plan assets at fair value and recognizing actuarial gains and losses in the fourth quarter of

each fiscal year or at the date of a remeasurement event. Refer to Note 15, "Retirement Plans," of the notes to consolidated financial

statements for disclosure of the Company's pension and postretirement benefit plans.

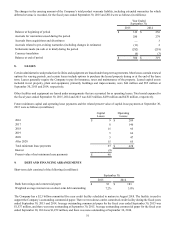

Retrospective Changes

Certain amounts as of September 30, 2015, 2014 and 2013, as described below, have been revised to conform to the current year’s

presentation.

At March 31, 2015, the Company determined that its Building Efficiency Global Workplace Solutions (GWS) segment met the

criteria to be classified as a discontinued operation, which required retrospective application to financial information for all periods

presented. Refer to Note 3, "Discontinued Operations," of the notes to consolidated financial statements for further information

regarding the Company's discontinued operations.

New Accounting Pronouncements

In September 2015, the FASB issued Accounting Standards Update (ASU) No. 2015-16, "Business Combinations (Topic 805):

Simplifying the Accounting for Measurement-Period Adjustments." ASU No. 2015-16 requires that the cumulative impact of a

measurement period adjustment (including the impact on prior periods) be recognized in the reporting period in which the adjustment

is identified. ASU No. 2015-16 was early adopted by the Company in the quarter ended September 30, 2015. The adoption of this

guidance did not have an impact on the Company's consolidated financial condition or results from operations.

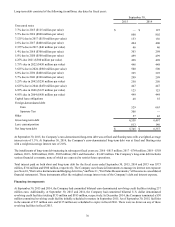

In July 2015, the FASB issued ASU No. 2015-11, "Simplifying the Measurement of Inventory." ASU No. 2015-11 requires inventory

that is recorded using the first-in, first-out method to be measured at the lower of cost or net realizable value. ASU No. 2015-11

will be effective retrospectively for the Company for the quarter ending December 31, 2017, with early adoption permitted. The

adoption of this guidance is not expected to have a significant impact on the Company's consolidated financial statements.

In May 2015, the FASB issued ASU No. 2015-07, "Disclosures for Investments in Certain Entities That Calculate Net Asset Value

per Share (or Its Equivalent)." ASU No. 2015-07 removes the requirement to categorize within the fair value hierarchy all

investments for which fair value is measured using the net asset value per share practical expedient. Such investments should be

disclosed separate from the fair value hierarchy. ASU No. 2015-07 will be effective retrospectively for the Company for the quarter

ending December 31, 2016, with early adoption permitted. The adoption of this guidance is not expected to have an impact on the

Company's consolidated financial statements but will impact pension asset disclosures.

In April 2015, the FASB issued ASU No. 2015-03, "Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation

of Debt Issuance Costs." ASU No. 2015-03 requires that debt issuance costs related to a recognized debt liability be presented in

the balance sheet as a direct deduction from the carrying amount of the debt liability. ASU No. 2015-03 will be effective

retrospectively for the Company for the quarter ending December 31, 2016, with early adoption permitted. The adoption of this

guidance is not expected to have a significant impact on the Company's consolidated financial statements.

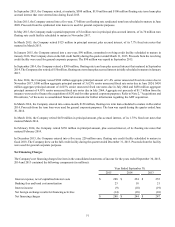

In February 2015, the FASB issued ASU No. 2015-02, "Consolidation (Topic 810): Amendments to the Consolidation Analysis."

ASU No. 2015-02 amends the analysis performed to determine whether a reporting entity should consolidate certain types of legal

entities. ASU No. 2015-02 will be effective retrospectively for the Company for the quarter ending December 31, 2016, with early

adoption permitted. The Company is currently assessing the impact adoption of this guidance will have on its consolidated financial

statements.

In May 2014, the FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers (Topic 606)." ASU No. 2014-09

clarifies the principles for recognizing revenue when an entity either enters into a contract with customers to transfer goods or

services or enters into a contract for the transfer of non-financial assets. The original standard was effective retrospectively for the

Company for the quarter ending December 31, 2017; however in August 2015, the FASB issued ASU No. 2015-14, "Revenue