Johnson Controls 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

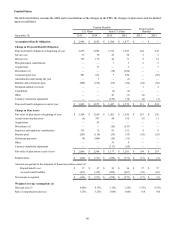

18. INCOME TAXES

At March 31, 2015, the Company determined that its GWS segment met the criteria to be classified as a discontinued operation,

which required retrospective application to financial information for all periods presented. Refer to Note 3, "Discontinued

Operations," of the notes to consolidated financial statements for further information regarding the Company's discontinued

operations.

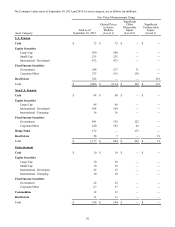

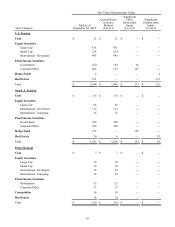

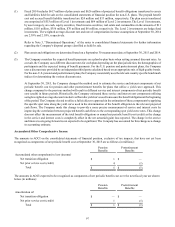

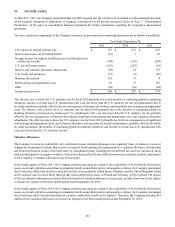

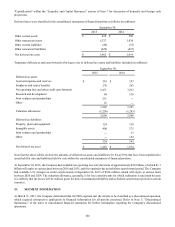

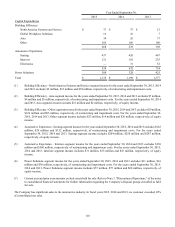

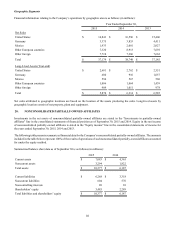

The more significant components of the Company’s income tax provision from continuing operations are as follows (in millions):

Year Ended September 30,

2015 2014 2013

Tax expense at federal statutory rate $ 753 $ 671 $ 619

State income taxes, net of federal benefit (23) 7 39

Foreign income tax expense at different rates and foreign losses

without tax benefits (198)(196)(299)

U.S. tax on foreign income (203)(222)(56)

Reserve and valuation allowance adjustments (99) 34 197

U.S. credits and incentives (12)(9)(28)

Business divestitures 354 71 8

Restructuring and impairment costs 52 75 238

Other (24)(24)(44)

Income tax provision $ 600 $ 407 $ 674

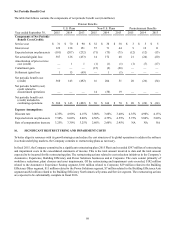

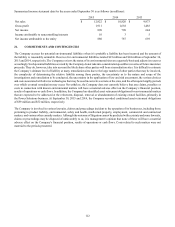

The effective rate is below the U.S. statutory rate for fiscal 2015 primarily due to the benefits of continuing global tax planning

initiatives, income in certain non-U.S. jurisdictions with a tax rate lower than the U.S. statutory tax rate and adjustments due to

tax audit resolutions, partially offset by the tax consequences of business divestitures, and significant restructuring and impairment

costs. The effective rate is below the U.S. statutory rate for fiscal 2014 primarily due to the benefits of continuing global tax

planning initiatives and income in certain non-U.S. jurisdictions with a tax rate lower than the U.S. statutory tax rate partially

offset by the tax consequences of business divestitures, significant restructuring and impairment costs, and valuation allowance

adjustments. The effective rate is above the U.S. statutory rate for fiscal 2013 primarily due to the tax consequences of significant

restructuring and impairment costs, and valuation allowance and uncertain tax position adjustments, partially offset by favorable

tax audit resolutions, the benefits of continuing global tax planning initiatives and income in certain non-U.S. jurisdictions with

a tax rate lower than the U.S. statutory tax rate.

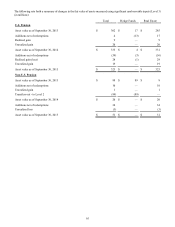

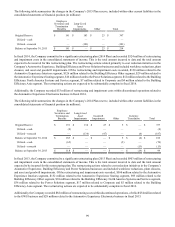

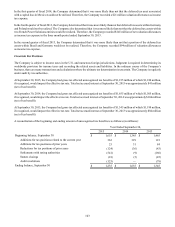

Valuation Allowances

The Company reviews the realizability of its deferred tax asset valuation allowances on a quarterly basis, or whenever events or

changes in circumstances indicate that a review is required. In determining the requirement for a valuation allowance, the historical

and projected financial results of the legal entity or consolidated group recording the net deferred tax asset are considered, along

with any other positive or negative evidence. Since future financial results may differ from previous estimates, periodic adjustments

to the Company’s valuation allowances may be necessary.

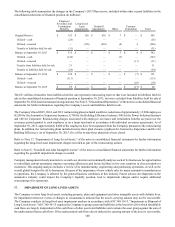

In the fourth quarter of fiscal 2015, the Company performed an analysis related to the realizability of its worldwide deferred tax

assets. As a result, and after considering tax planning initiatives and other positive and negative evidence, the Company determined

that it was more likely than not that certain deferred tax assets primarily within Spain, Germany, and the United Kingdom would

not be realized, and it is more likely than not that certain deferred tax assets of Poland and Germany will be realized. The impact

of the net valuation allowance provision offset the benefit of valuation allowance releases and, as such, there was no net impact

to income tax expense in the three month period ended September 30, 2015.

In the fourth quarter of fiscal 2014, the Company performed an analysis related to the realizability of its worldwide deferred tax

assets. As a result, and after considering tax planning initiatives and other positive and negative evidence, the Company determined

that it was more likely than not that deferred tax assets within Italy would not be realized. Therefore, the Company recorded $34

million of net valuation allowances as income tax expense in the three month period ended September 30, 2014.