Johnson Controls 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

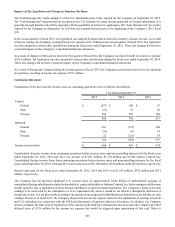

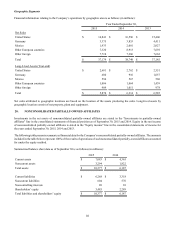

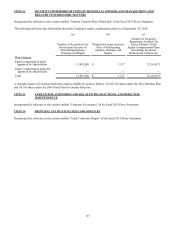

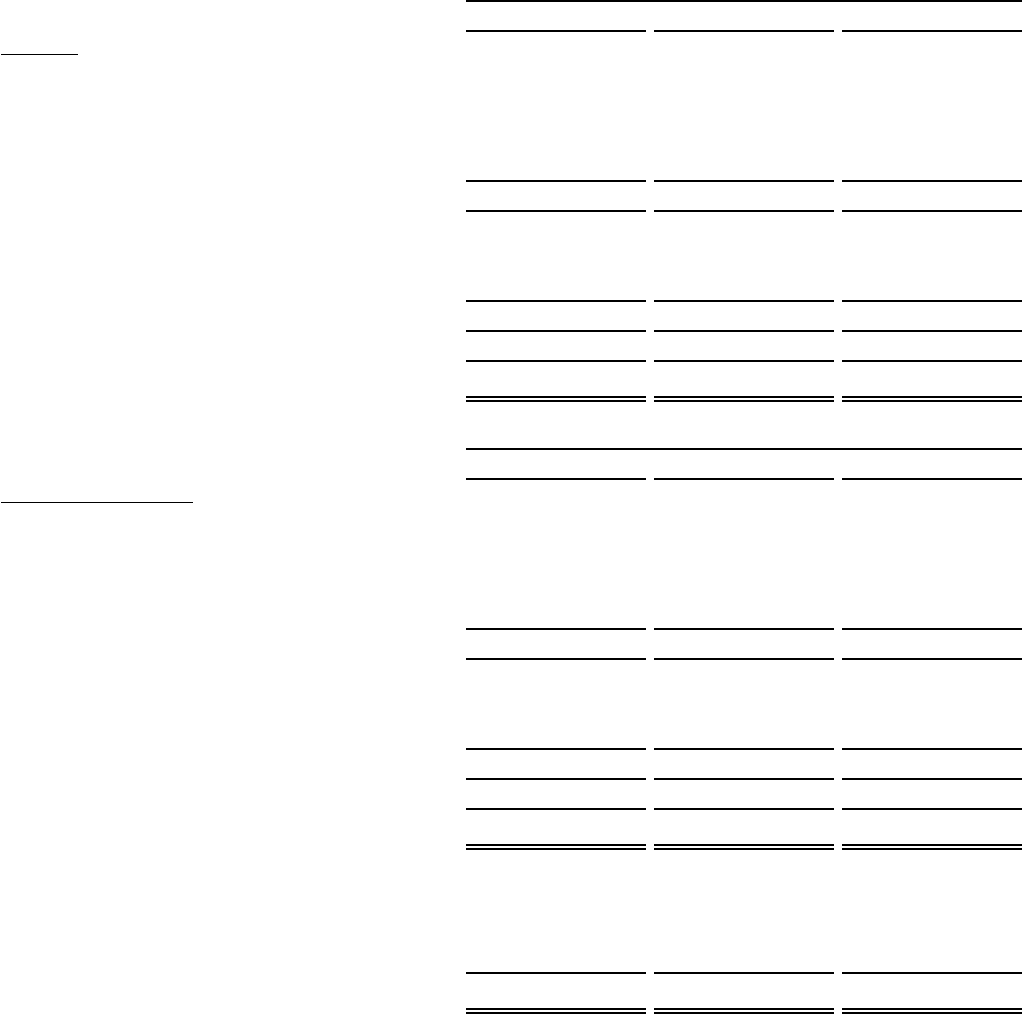

Management evaluates the performance of the segments based primarily on segment income, which represents income from

continuing operations before income taxes and noncontrolling interests excluding net financing charges, significant restructuring

and impairment costs, and net mark-to-market adjustments on pension and postretirement plans. General corporate and other

overhead expenses are allocated to business segments in determining segment income. As mentioned above, the previously reported

GWS segment met the criteria to be classified as a discontinued operation, and general corporate overhead was not allocated to

discontinued operations. The Company reported discontinued operations through retrospective application to all periods presented,

resulting in general corporate allocation changes between the segments in the prior periods. Financial information relating to the

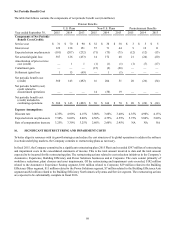

Company’s reportable segments is as follows (in millions):

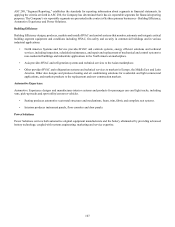

Year Ended September 30,

2015 2014 2013

Net Sales

Building Efficiency

North America Systems and Service $ 4,443 $ 4,336 $ 4,492

Asia 1,957 2,069 2,022

Other 4,110 3,680 3,812

10,510 10,085 10,326

Automotive Experience

Seating 16,539 17,531 16,285

Interiors 3,540 4,501 4,176

20,079 22,032 20,461

Power Solutions 6,590 6,632 6,358

Total net sales $ 37,179 $ 38,749 $ 37,145

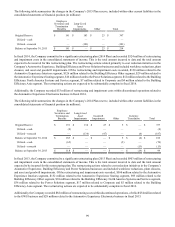

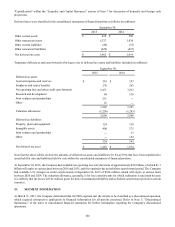

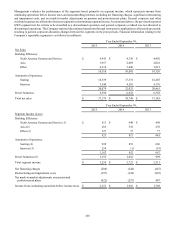

Year Ended September 30,

2015 2014 2013

Segment Income (Loss)

Building Efficiency

North America Systems and Service (1) $ 513 $ 448 $ 498

Asia (2) 283 332 270

Other (3) 127 37 77

923 817 845

Automotive Experience

Seating (4) 928 853 686

Interiors (5) 254 (1)(19)

1,182 852 667

Power Solutions (6) 1,153 1,052 999

Total segment income $ 3,258 $ 2,721 $ 2,511

Net financing charges (288)(244)(247)

Restructuring and impairment costs (397)(324)(903)

Net mark-to-market adjustments on pension and

postretirement plans (422)(237) 407

Income from continuing operations before income taxes $ 2,151 $ 1,916 $ 1,768