Johnson Controls 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

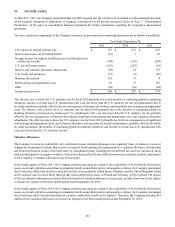

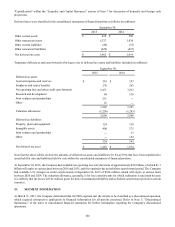

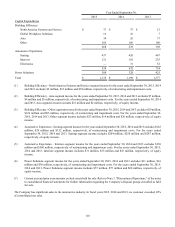

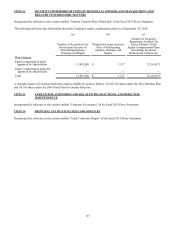

Summarized income statement data for the years ended September 30 is as follows (in millions):

2015 2014 2013

Net sales $ 12,922 $ 10,820 $ 9,973

Gross profit 1,911 1,638 1,483

Net income 890 790 644

Income attributable to noncontrolling interests 10 3 5

Net income attributable to the entity 880 787 639

21. COMMITMENTS AND CONTINGENCIES

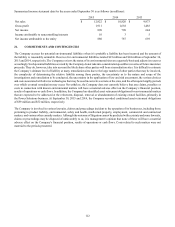

The Company accrues for potential environmental liabilities when it is probable a liability has been incurred and the amount of

the liability is reasonably estimable. Reserves for environmental liabilities totaled $23 million and $24 million at September 30,

2015 and 2014, respectively. The Company reviews the status of its environmental sites on a quarterly basis and adjusts its reserves

accordingly. Such potential liabilities accrued by the Company do not take into consideration possible recoveries of future insurance

proceeds. They do, however, take into account the likely share other parties will bear at remediation sites. It is difficult to estimate

the Company’s ultimate level of liability at many remediation sites due to the large number of other parties that may be involved,

the complexity of determining the relative liability among those parties, the uncertainty as to the nature and scope of the

investigations and remediation to be conducted, the uncertainty in the application of law and risk assessment, the various choices

and costs associated with diverse technologies that may be used in corrective actions at the sites, and the often quite lengthy periods

over which eventual remediation may occur. Nevertheless, the Company does not currently believe that any claims, penalties or

costs in connection with known environmental matters will have a material adverse effect on the Company’s financial position,

results of operations or cash flows. In addition, the Company has identified asset retirement obligations for environmental matters

that are expected to be addressed at the retirement, disposal, removal or abandonment of existing owned facilities, primarily in

the Power Solutions business. At September 30, 2015 and 2014, the Company recorded conditional asset retirement obligations

of $59 million and $52 million, respectively.

The Company is involved in various lawsuits, claims and proceedings incident to the operation of its businesses, including those

pertaining to product liability, environmental, safety and health, intellectual property, employment, commercial and contractual

matters, and various other casualty matters. Although the outcome of litigation cannot be predicted with certainty and some lawsuits,

claims or proceedings may be disposed of unfavorably to us, it is management’s opinion that none of these will have a material

adverse effect on the Company’s financial position, results of operations or cash flows. Costs related to such matters were not

material to the periods presented.