Johnson Controls 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.89

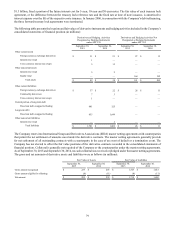

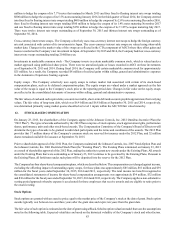

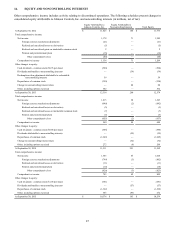

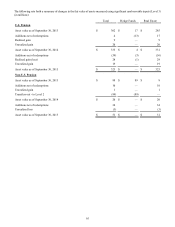

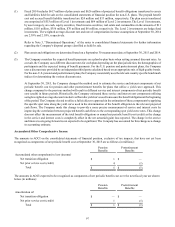

as part of the divestiture-related losses recognized within discontinued operations as a result of the divestiture of the Automotive

Experience Electronics business.

** Refer to Note 10, "Derivative Instruments and Hedging Activities," of the notes to consolidated financial statements for

disclosure of the line items on the consolidated statements of income affected by reclassifications from AOCI into income related

to derivatives.

*** Refer to Note 11, "Fair Value Measurements," of the notes to consolidated financial statements for disclosure of the line item

on the consolidated statements of income affected by reclassifications from AOCI into income related to marketable common

stock.

**** Refer to Note 15, "Retirement Plans," of the notes to consolidated financial statements for disclosure of the components of

the Company's net periodic benefit costs associated with its defined benefit pension and postretirement plans. For the year ended

September 30, 2015 the amounts reclassified from AOCI into income for pension and postretirement plans were primarily recorded

in selling, general and administrative expenses and income (loss) from discontinued operations, net of tax on the consolidated

statements of income. For the year ended September 30, 2014, the amounts reclassified from AOCI into income for pension and

postretirement plans were primarily recorded in cost of sales and income (loss) from discontinued operations, net of tax on the

consolidated statements of income. For the year ended September 30, 2013 the amounts reclassified from AOCI into income for

pension and postretirement plans were primarily recorded in selling, general and administrative expenses and income (loss) from

discontinued operations, net of tax on the consolidated statements of income.

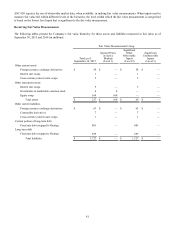

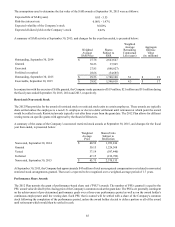

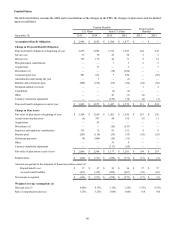

15. RETIREMENT PLANS

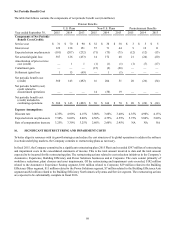

Pension Benefits

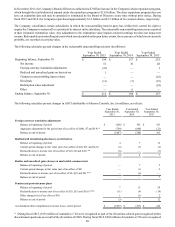

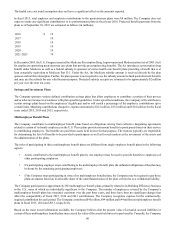

The Company has non-contributory defined benefit pension plans covering certain U.S. and non-U.S. employees. The benefits

provided are primarily based on years of service and average compensation or a monthly retirement benefit amount. Effective

January 1, 2006, certain of the Company’s U.S. pension plans were amended to prohibit new participants from entering the plans.

Effective September 30, 2009, active participants continued to accrue benefits under the amended plans until December 31, 2014.

Funding for U.S. pension plans equals or exceeds the minimum requirements of the Employee Retirement Income Security Act

of 1974. Funding for non-U.S. plans observes the local legal and regulatory limits. Also, the Company makes contributions to

union-trusteed pension funds for construction and service personnel.

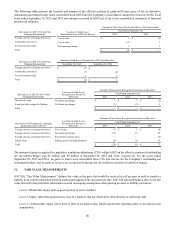

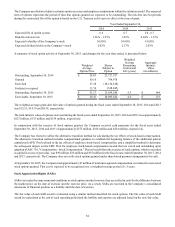

For pension plans with accumulated benefit obligations (ABO) that exceed plan assets, the projected benefit obligation (PBO),

ABO and fair value of plan assets of those plans were $2,465 million, $2,464 million and $2,065 million, respectively, as of

September 30, 2015 and $3,413 million, $3,363 million and $2,642 million, respectively, as of September 30, 2014.

In fiscal 2015, total employer contributions to the defined benefit pension plans were $407 million, of which $317 million were

voluntary contributions made by the Company. The Company expects to contribute approximately $113 million in cash to its

defined benefit pension plans in fiscal 2016. Projected benefit payments from the plans as of September 30, 2015 are estimated

as follows (in millions):

2016 $ 269

2017 228

2018 227

2019 236

2020 243

2021-2025 1,295

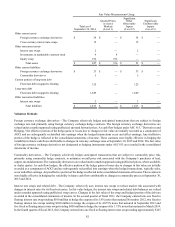

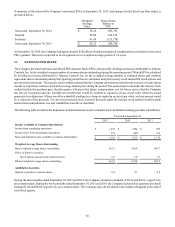

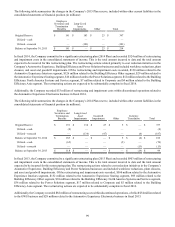

Postretirement Benefits

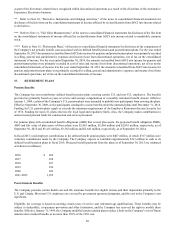

The Company provides certain health care and life insurance benefits for eligible retirees and their dependents primarily in the

U.S. and Canada. Most non-U.S. employees are covered by government sponsored programs, and the cost to the Company is not

significant.

Eligibility for coverage is based on meeting certain years of service and retirement age qualifications. These benefits may be

subject to deductibles, co-payment provisions and other limitations, and the Company has reserved the right to modify these

benefits. Effective January 31, 1994, the Company modified certain salaried plans to place a limit on the Company’s cost of future

annual retiree medical benefits at no more than 150% of the 1993 cost.