Johnson Controls 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

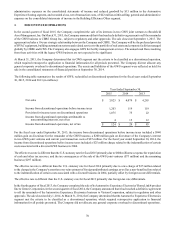

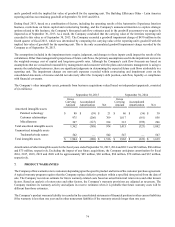

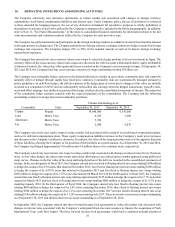

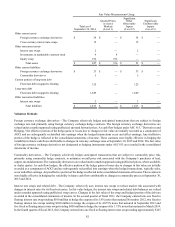

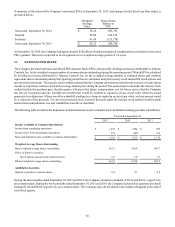

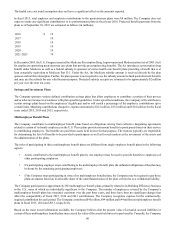

The following tables present the location and amount of the effective portion of gains and losses gross of tax on derivative

instruments and related hedge items reclassified from AOCI into the Company’s consolidated statements of income for the fiscal

years ended September 30, 2015 and 2014 and amounts recorded in AOCI net of tax in the consolidated statements of financial

position (in millions):

Location of Gain (Loss)

Reclassified from AOCI into Income

Amount of Gain (Loss) Reclassified from AOCI into Income

Derivatives in ASC 815 Cash Flow

Hedging Relationships

Year Ended September 30,

2015 2014

Foreign currency exchange derivatives Cost of sales $ 1 $ (2)

Commodity derivatives Cost of sales (11) 1

Forward treasury locks Net financing charges 1 1

Total $ (9) $ —

Derivatives in ASC 815 Cash Flow

Hedging Relationships

Amount of Gain (Loss) Recognized in AOCI on Derivative

September 30, 2015 September 30, 2014

Foreign currency exchange derivatives $ (5) $ —

Commodity derivatives (7) (2)

Forward treasury locks 5 6

Total $ (7) $ 4

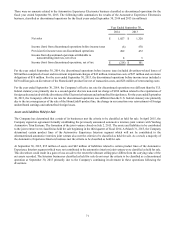

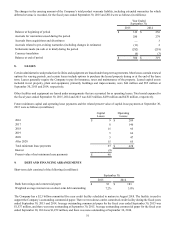

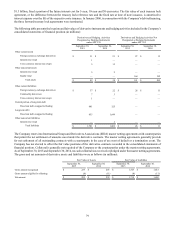

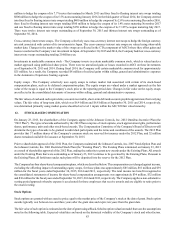

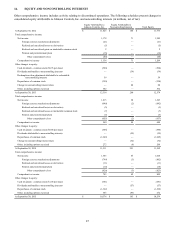

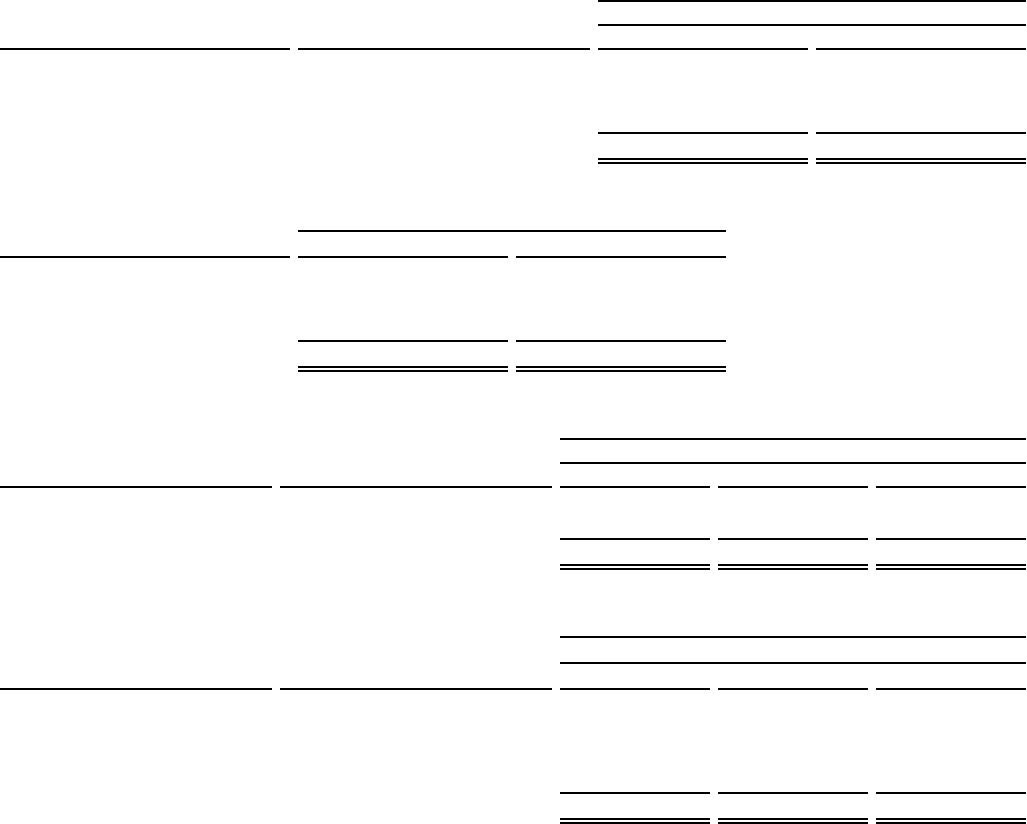

Location of Gain (Loss)

Recognized in Income on

Derivative

Amount of Gain (Loss) Recognized in Income on Derivative

Derivatives in ASC 815 Fair Value

Hedging Relationships

Year Ended September 30,

2015 2014 2013

Interest rate swap Net financing charges $ 7 $ 5 $ (2)

Fixed rate debt swapped to floating Net financing charges (7) (5) 2

Total $ — $ — $ —

Location of Gain (Loss)

Recognized in Income on

Derivative

Amount of Gain (Loss) Recognized in Income on Derivative

Derivatives Not Designated as Hedging

Instruments under ASC 815

Year Ended September 30,

2015 2014 2013

Foreign currency exchange derivatives Cost of sales $ (3) $ 1 $ (8)

Foreign currency exchange derivatives Net financing charges (12) 18 25

Foreign currency exchange derivatives Provision for income taxes — — (5)

Equity swap Selling, general and administrative (9) (1) 65

Total $ (24) $ 18 $ 77

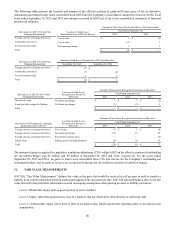

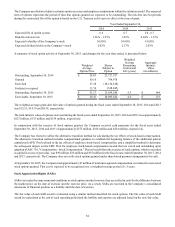

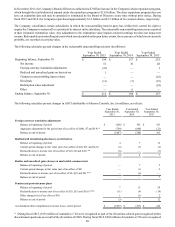

The amount of gains recognized in cumulative translation adjustment (CTA) within AOCI on the effective portion of outstanding

net investment hedges was $2 million and $9 million at September 30, 2015 and 2014, respectively. For the years ended

September 30, 2015 and 2014, no gains or losses were reclassified from CTA into income for the Company’s outstanding net

investment hedges, and no gains or losses were recognized in income for the ineffective portion of cash flow hedges.

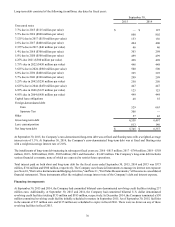

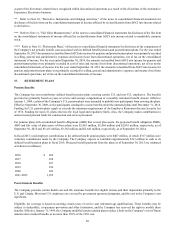

11. FAIR VALUE MEASUREMENTS

ASC 820, "Fair Value Measurement," defines fair value as the price that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a three-level fair

value hierarchy that prioritizes information used in developing assumptions when pricing an asset or liability as follows:

Level 1: Observable inputs such as quoted prices in active markets;

Level 2: Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

Level 3: Unobservable inputs where there is little or no market data, which requires the reporting entity to develop its own

assumptions.