Foot Locker 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

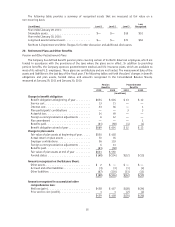

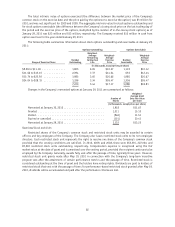

23. Commitments

In connection with the sale of various businesses and assets, the Company may be obligated for certain lease

commitments transferred to third parties and pursuant to certain normal representations, warranties, or

indemnifications entered into with the purchasers of such businesses or assets. Although the maximum potential

amounts for such obligations cannot be readily determined, management believes that the resolution of such

contingencies will not have a material effect on the Company’s consolidated financial position, liquidity, or

results of operations. The Company is also operating certain stores and making rental payments for which lease

agreements are in the process of being negotiated with landlords. Although there is no contractual commitment

to make these payments, it is likely that a lease will be executed.

The Company does not have any off-balance sheet financing, other than operating leases entered into in the

normal course of business and disclosed above, or unconsolidated special purpose entities. The Company does

not participate in transactions that generate relationships with unconsolidated entities or financial partnerships,

including variable interest entities.

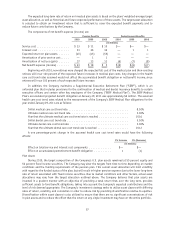

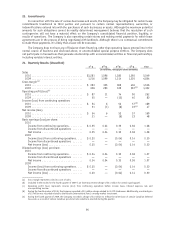

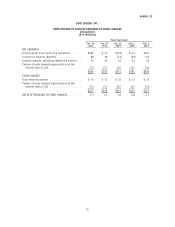

24. Quarterly Results (Unaudited)

1

st

Q2

nd

Q3

rd

Q4

th

Q Year

(in millions, except per share amounts)

Sales

2010.............................. $1,281 1,096 1,280 1,392 5,049

2009.............................. 1,216 1,099 1,214 1,325 4,854

Gross margin

(a)

2010.............................. $ 393 305 388 430 1,516

2009.............................. 356 280 329 367

(b)

1,332

Operating profit (loss)

(c)

2010.............................. $ 87 11 74 90 262

2009.............................. 50 — (10) 40 80

Income (loss) from continuing operations

2010.............................. $ 54 6 52 57

(d)

169

2009.............................. 31 (1) (6) 23

(e)

47

Net income (loss)

2010.............................. $ 54 6 52 57 169

2009.............................. 31 — (6) 23 48

Basic earnings (loss) per share:

2010

Income from continuing operations ........ $0.35 0.04 0.33 0.36 1.08

Income from discontinued operations ...... — — — — —

Net income ........................ 0.35 0.04 0.33 0.36 1.08

2009

Income (loss) from continuing operations.... $0.20 — (0.04) 0.14 0.30

Income from discontinued operations ...... — — — — —

Net income (loss) .................... 0.20 — (0.04) 0.14 0.30

Diluted earnings (loss) per share:

2010

Income from continuing operations ........ $0.34 0.04 0.33 0.36 1.07

Income from discontinued operations ...... — — — — —

Net income ........................ 0.34 0.04 0.33 0.36 1.07

2009

Income (loss) from continuing operations.... $0.20 — (0.04) 0.14 0.30

Income from discontinued operations ...... — — — — —

Net income (loss) .................... 0.20 — (0.04) 0.14 0.30

(a) Gross margin represents sales less cost of sales.

(b) Included in the results for the fourth quarter of 2009 is an inventory reserve charge of $14 million for certain aged apparel.

(c) Operating profit (loss) represents income (loss) from continuing operations before income taxes, interest expense, net, and

non-operating income.

(d) During the fourth quarter of 2010, the Company recorded a $10 million charge related to its CCS tradename. Additionally, a realized gain

of $2 million was recorded related to the Reserve International Fund, a money-market investment.

(e) During the fourth quarter of 2009, the Company recorded a charge of $4 million to reflect the write-down of certain Canadian deferred

tax assets as a result of certain Canadian provincial rate reductions enacted during the quarter.

64