Foot Locker 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Footaction — ‘‘Head to Toe Sport Inspired Style’’ — Footaction is a national athletic footwear and apparel

retailer. The primary customers are young males that seek street-inspired athletic styles. Its 307 stores are

located throughout the United States and Puerto Rico and focus on marquee footwear and branded apparel. The

Footaction stores have an average of 2,900 selling square feet.

CCS — ‘‘Largest Deck Selection’’ — CCS serves the needs of the 10-18 year old skateboard enthusiast while

maintaining credibility with core skaters of all ages. This format complements the CCS catalog and internet

business, which was acquired in November 2008. During 2009, the Company opened two stores under the banner

of CCS. This concept was expanded to 12 stores in 2010, all of which are located in the United States and average

1,700 selling square feet.

Direct-to-Customers

The Company’s Direct-to-Customers segment is multi-branded and multi-channeled. This segment sells,

through its affiliates, directly to customers through catalogs and its Internet websites. Eastbay, one of the

affiliates, is among the largest direct marketers in the United States, providing the high school athlete with a

complete sports solution including athletic footwear, apparel, equipment, team licensed, and private-label

merchandise. In 2008, the Company purchased CCS, an Internet and catalog retailer of skateboard equipment,

apparel, footwear, and accessories targeted primarily to teenaged boys. The retail store operations of CCS are

included in the Athletic Stores segment. The Direct-to-Customers segment operates the website for eastbay.com,

final-score.com, and teamsales.eastbay.com. Additionally this segment operates websites aligned with the brand

names of its store banners (footlocker.com, ladyfootlocker.com, kidsfootlocker.com, footaction.com,

champssports.com, and ccs.com).

Franchise Operations

In March of 2006, the Company entered into a ten-year area development agreement with the Alshaya

Trading Co. W.L.L., in which the Company agreed to enter into separate license agreements for the operation of

Foot Locker stores located within the Middle East, subject to certain restrictions. Additionally, in March 2007, the

Company entered into a ten-year agreement with another third party for the exclusive right to open and operate

Foot Locker stores in the Republic of Korea. A total of 26 franchised stores were operating at January 29, 2011.

Royalty income from the franchised stores was not significant for any of the periods presented. These stores are

not included in the Company’s operating store count above.

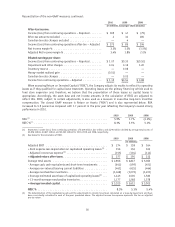

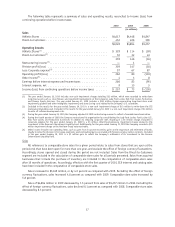

Overview of Consolidated Results

The Company recorded net income from continuing operations of $169 million or $1.07 per diluted share for

2010; this compares with $47 million or $0.30 per diluted share for the prior-year period. Other highlights

include:

• Sales increased by 4.0 percent and comparable-store sales increased by 5.8 percent as compared with

the corresponding prior-year period.

• Gross margin increased 260 basis points in 2010 as compared with 2009. Included in cost of sales for

2009 is a $14 million charge to reserve for inventory as the Company began its transition to a new

apparel strategy.

• The Company recorded a charge of $10 million in 2010 to impair the CCS tradename intangible asset

due to the lower projected revenues for this division. Included in 2009 are impairment charges totaling

$36 million, of which $32 million was recorded to impair store long-lived assets within the Athletic

Stores segment and $4 million related to a write-off of certain software development costs within the

Direct-to-Customers segment.

• The Company recorded a $2 million gain in 2010 on the settlement on its money-market investment in

the Reserve International Liquidity Fund, Ltd. (the ‘‘Fund’’). During 2008, the Company had recognized

an impairment loss of $3 million representing the decreased value of the underlying securities of

Lehman Brothers held in the Fund. These amounts were recorded with no tax expense or benefit.

14