Foot Locker 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

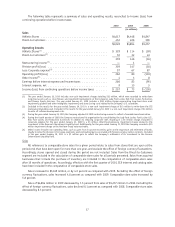

Gross Margin

Gross margin as a percentage of sales was 30.0 percent in 2010 increasing 260 basis points as compared with

2009. In 2009, the Company recorded a $14 million inventory reserve on certain aged apparel as part of its new

apparel strategy. Excluding this charge, gross margin would have increased by 230 basis points as compared with

2009. This increase reflected an increase of 150 basis points in the merchandise margin rate reflecting lower

markdowns as the Company was less promotional during the year as compared with the prior year. Lower vendor

allowances during the current year, reflecting the overall lower promotional activity, negatively affected gross

margin by 10 basis points. The increase in the gross margin also reflected a decrease of 80 basis points in the

occupancy and buyers salary expense rate reflecting improved leverage and expense reductions.

Gross margin as a percentage of sales was 27.4 percent in 2009 decreasing 50 basis points as compared with

2008. The decrease in the gross margin reflected an increase of 30 basis points in the merchandise margin rate

due to lower markdowns, offset by an 80 basis point increase in the occupancy rate due to lower sales. Vendor

allowances were essentially the same as compared with 2008 and did not significantly affect the gross margin

rate. Excluding the $14 million inventory reserve recorded in 2009, gross margin would have declined by 20 basis

points as compared with 2008.

Selling, General and Administrative Expenses

Selling, general and administrative (‘‘SG&A’’) expenses increased by $39 million to $1,138 million in 2010, or

by 3.5 percent, as compared with 2009. SG&A as a percentage of sales decreased to 22.5 percent as compared

with 22.6 percent in 2009, due to expense management and the increase in sales. Excluding the effect of foreign

currency fluctuations in 2010, SG&A increased by $47 million. This increase primarily reflects higher incentive

compensation costs totaling $45 million, partially offset by expense management efforts.

SG&A expenses decreased by $75 million to $1,099 million in 2009, or by 6.4 percent, as compared with

2008. SG&A as a percentage of sales increased to 22.6 percent as compared with 22.4 percent in 2008, due to the

decline in sales. Excluding the effect of foreign currency fluctuations in 2009, SG&A decreased by $64 million.

This decrease reflects lower divisional expenses primarily due to operating fewer stores and compensation

expense, offset, in part, by increased pension expense of $13 million.

Corporate Expense

Corporate expense consists of unallocated general and administrative expenses as well as depreciation and

amortization related to the Company’s corporate headquarters, centrally managed departments, unallocated

insurance and benefit programs, certain foreign exchange transaction gains and losses, and other items.

Corporate expense increased by $30 million to $97 million in 2010 as compared with 2009. Depreciation and

amortization included in corporate expense was $12 million in 2010 and $13 million in 2009. Incentive

compensation costs included within corporate expense represent an increase of $29 million as a result of the

Company’s outperformance as compared with plan. Additionally, 2009 included a $5 million charge related to the

reorganization of its operations and corporate staff reductions.

Corporate expense decreased by $20 million to $67 million in 2009 as compared with 2008. Depreciation and

amortization included in corporate expense was $13 million in both 2009 and 2008. Included in 2008 corporate

expense were charges that totaled $18 million, which represented a $3 million other-than-temporary impairment

charge related to a short-term investment and a $15 million impairment charge related to the Northern Group

note receivable. The balance of the change represents lower incentive compensation costs as well as income of

$3 million related to the final settlement of the Visa/MasterCard litigation. These reductions in corporate

expense were offset, in part, by higher pension expense.

Depreciation and Amortization

Depreciation and amortization of $106 million decreased by 5.4 percent in 2010 from $112 million in 2009.

This decrease primarily reflects reduced depreciation and amortization resulting from store long-lived asset

impairment charges recorded in 2009. Additionally, foreign currency fluctuations reduced depreciation and

amortization expense by $1 million.

18