Foot Locker 2010 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This report contains forward-looking statements within the meaning of the federal securities laws. All statements, other than statements of historical facts, that

address activities, events or developments that the Company expects or anticipates will or may occur in the future, including, but not limited to, such things

as future capital expenditures, expansion, strategic plans, financial objectives, dividend payments, stock repurchases, growth of the Company’s business and

operations, including future cash flows, revenues and earnings, and other such matters are forward-looking statements. These forward-looking statements are

based on many assumptions and factors detailed in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form

10-K for the 2010 fiscal year. Any changes in such assumptions or factors could produce significantly different results. The Company undertakes no obligation to

update forward-looking statements, whether as a result of new information, future events, or otherwise.

Financial Highlights, Store Summary ....................... 1

About the Company ................................................ 2

Letter to Shareholders ............................................. 3

Our Vision ................................................................. 5

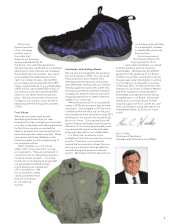

Power Merchandiser ................................................ 7

Compelling Apparel ................................................. 8

Exciting Places to Shop ........................................... 9

Growth Opportunities ............................................. 10

Increased Productivity ............................................. 11

Retail Leaders ........................................................... 12

Community Outreach ............................................... 13

Board of Directors, Corporate Management,

Division Management, Corporate Information ....... 14

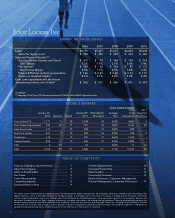

STORE SUMMARY

Gross Square Footage

2010 2011

January 30, January 29, Remodeled/ Average Total Targeted

2010 Opened Closed 2011 Relocated Size (thousands) Openings

Foot Locker U.S. 1,171 5 32 1,144 54 4,000 4,600 5

Foot Locker International 740 22 11 751 50 2,900 2,167 40

Lady Foot Locker 415 - 37 378 15 2,200 838 -

Kids Foot Locker 301 5 12 294 16 2,400 706 5

Footaction 319 - 12 307 15 4,600 1,413 -

Champs Sports 552 1 13 540 21 5,300 2,880 -

CCS 2 10 - 12 - 2,600 31 10

Total 3,500 43 117 3,426 171 3,700 12,635 60

TABLE OF CONTENTS

FINANCIAL HIGHLIGHTS

2006 2007 2008 2009 2010

Sales* $ 5,750 $ 5,437 $ 5,237 $ 4,854 $ 5,049

Sales Per Square Foot $ 372 $ 352 $ 350 $ 333 $ 360

Adjusted Financial Results:**

Earnings Before Interest and Taxes* $ 412 $ 79 $ 164 $ 138 $ 274

EBIT Margin 7.2% 1.5% 3.1% 2.8% 5.4%

Net Income* $ 259 $ 62 $ 106 $ 85 $ 173

Net Income Margin 4.5% 1.1% 2.0% 1.8% 3.4%

Diluted EPS from continuing operations $ 1.66 $ 0.40 $ 0.68 $ 0.54 $ 1.10

Return on Invested Capital 9.1% 4.1% 5.4% 5.3% 8.3%

Cash, cash equivalents and short-term

investment position, net of debt* $ 236 $ 272 $ 266 $ 451 $ 559

* In Millions

** See page 15 of Form 10-K for reconciliation of GAAP to non-GAAP adjusted results

1