Foot Locker 2010 Annual Report Download - page 42

Download and view the complete annual report

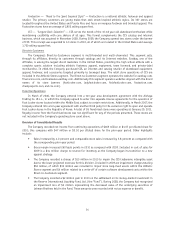

Please find page 42 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating activities from continuing operations provided cash of $346 million in 2009 as compared with

$383 million in 2008. These amounts reflect income from continuing operations adjusted for non-cash items and

working capital changes. During 2009, the Company recorded non-cash impairment and other charges of

$36 million primarily related to impairment of store-level assets in the domestic operations. Merchandise

inventories represented a $111 million source of cash in 2009 as inventory purchases were reduced to keep

inventory levels in line with sales as well as reflecting the effect of the store closings. During 2009, the Company

contributed $100 million to its U.S. and Canadian qualified pension plans as compared with $6 million

contributed in 2008. Additionally, during 2009 the Company terminated its interest rate swaps for a gain of

$19 million. The other changes primarily reflect the timing of February 2010 rent payments, which totaled

$34 million and were due and paid in 2010 as compared with the February 2009 rent payments that were due and

paid in 2008, as well as income tax refunds of $32 million.

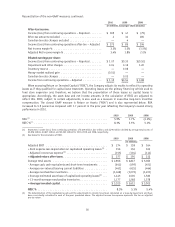

Net cash used in investing activities of the Company’s continuing operations was $87 million in 2010 as

compared with $72 million used in investing activities in 2009. During 2010, the Company received $9 million

from the Reserve International Liquidity Fund representing further redemptions. Capital expenditures were

$97 million primarily related to store remodeling and to the development of information systems and other

support facilities, representing an increase of $8 million as compared with the prior year.

Net cash used in investing activities of the Company’s continuing operations was $72 million in 2009 as

compared with $272 million used in investing activities in 2008. During 2009, the Company received $16 million

from the Reserve International Liquidity Fund representing further redemptions. Capital expenditures were

$89 million, primarily related to store remodeling and to the development of information systems and other

support facilities, representing a decrease of $57 million as compared with the prior year. The Company made a

strategic decision to conserve cash in 2009 and, therefore, reduced capital spending, focusing on projects that

improved the customer experience. The net cash used in investing activities in 2008 reflected the acquisition of

CCS for $106 million.

Net cash used in financing activities of continuing operations was $127 million in 2010 as compared with

$94 million in 2009. During 2010, the Company repurchased 3,215,000 shares of its common stock under its

common share repurchase program for $50 million. Additionally, the Company declared and paid dividends

totaling $93 million and $94 million in 2010 and 2009, respectively, representing a quarterly rate of $0.15 per

share in both 2010 and 2009. On February 15, 2011, the Company’s Board of Directors declared a quarterly cash

dividend on the Company’s common stock of $0.165 per share, which represents an increase of 10 percent. During

2010 and 2009, the Company received proceeds from the issuance of common stock and treasury stock in

connection with the employee stock programs of $10 million and $3 million, respectively. During 2010, in

connection with stock option exercises, the Company recorded excess tax benefits related to share-based

compensation of $3 million as a financing activity.

Net cash used in financing activities of continuing operations was $94 million in 2009 as compared with

$185 million in 2008. During 2009 and 2008, the Company purchased and retired $3 million and $6 million,

respectively, of its 8.50 percent debentures. During 2008, the Company reduced its long-term debt by repaying

the balance of its term loan of $88 million. Additionally, the Company declared and paid dividends totaling

$94 million and $93 million in 2009 and 2008, respectively, representing a quarterly rate of $0.15 per share in

both 2009 and 2008. During 2009 and 2008, the Company received proceeds from the issuance of common stock

and treasury stock in connection with the employee stock programs of $3 million and $2 million, respectively.

23