Foot Locker 2010 Annual Report Download - page 60

Download and view the complete annual report

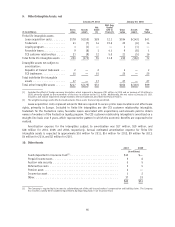

Please find page 60 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s financial assets recorded at fair value are categorized as follows:

Level 1 − Quoted prices for identical instruments in active markets.

Level 2 − Quoted prices for similar instruments in active markets; quoted prices for identical or similar

instruments in markets that are not active; and model-derived valuations in which all significant inputs or

significant value-drivers are observable in active markets.

Level 3 − Model-derived valuations in which one or more significant inputs or significant value-drivers are

unobservable.

Income Taxes

The Company determines its deferred tax provision under the liability method, whereby deferred tax assets

and liabilities are recognized for the expected tax consequences of temporary differences between the tax basis

of assets and liabilities and their reported amounts using presently enacted tax rates. Deferred tax assets are

recognized for tax credits and net operating loss carryforwards, reduced by a valuation allowance, which is

established when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income during the period

that includes the enactment date.

A taxing authority may challenge positions that the Company adopted in its income tax filings. Accordingly,

the Company may apply different tax treatments for transactions in filing its income tax returns than for income

tax financial reporting. The Company regularly assesses its tax positions for such transactions and records

reserves for those differences when considered necessary. Tax positions are recognized only when it is more likely

than not, based on technical merits, that the positions will be sustained upon examination. Tax positions that

meet the more-likely-than-not threshold are measured using a probability weighted approach as the largest

amount of tax benefit that is greater than fifty percent likely of being realized upon settlement. Whether the

more-likely-than-not recognition threshold is met for a tax position is a matter of judgment based on the

individual facts and circumstances of that position, evaluated in light of all available evidence. The Company

recognizes interest and penalties related to unrecognized tax benefits in income tax expense.

Provision for U.S. income taxes on undistributed earnings of foreign subsidiaries is made only on those

amounts in excess of the funds considered to be permanently reinvested.

Pension and Postretirement Obligations

The discount rate selected to measure the present value of the Company’s U.S. benefit obligations was

derived using a cash flow matching method whereby the Company matches the plans’ projected payment

obligations by year with the corresponding yield on the Citibank Pension Discount Curve. The cash flows are then

discounted to their present value and an overall discount rate is determined. The discount rate selected to

measure the present value of the Company’s Canadian benefit obligations was developed by using the plan’s bond

portfolio indices, which match the benefit obligations.

Insurance Liabilities

The Company is primarily self-insured for health care, workers’ compensation and general liability costs.

Accordingly, provisions are made for the Company’s actuarially determined estimates of discounted future claim

costs for such risks, for the aggregate of claims reported and claims incurred but not yet reported. Self-insured

liabilities totaled $15 million for both January 29, 2011 and January 30, 2010. The Company discounts its

workers’ compensation and general liability reserves using a risk-free interest rate. Imputed interest expense

related to these liabilities was not significant for 2010, 2009, and 2008.

Accounting for Leases

The Company recognizes rent expense for operating leases as of the possession date for store leases or the

commencement of the agreement for a non-store lease. Rental expense, inclusive of rent holidays, concessions

and tenant allowances are recognized over the lease term on a straight-line basis. Contingent payments based

upon sales and future increases determined by inflation related indices cannot be estimated at the inception of

the lease and accordingly, are charged to operations as incurred.

41