Foot Locker 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

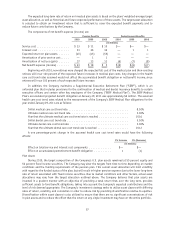

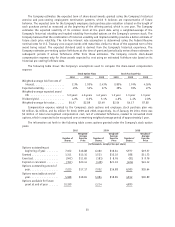

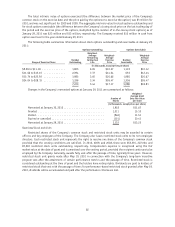

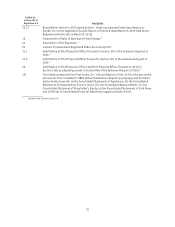

The Company recorded compensation expense related to restricted shares, net of estimated forfeitures, of

$8 million, $8 million, and $5 million for 2010, 2009, and 2008, respectively. At January 29, 2011, there was

$9 million of total unrecognized compensation cost net of estimated forfeitures, related to nonvested restricted

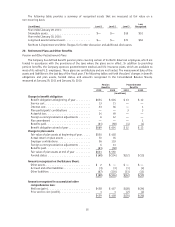

stock awards. Restricted share and unit activity is summarized as follows:

Number of Shares and Units

2010 2009 2008

(in thousands)

Outstanding at beginning of year ............. 1,680 844 810

Granted .............................. 189 1,115 243

Vested ............................... (492) (279) (109)

Cancelled or forfeited ..................... (80) — (100)

Outstanding at end of year.................. 1,297 1,680 844

Aggregate value (in millions) ................ $ 20 $ 23 $ 17

Weighted-average remaining contractual life ..... 1.44 years 1.50 years 1.28 years

The weighted-average grant-date fair value per share was $13.75, $9.90, and $11.79 for 2010, 2009, and

2008, respectively. The total fair value of awards for which restrictions lapsed was $10 million, $5 million, and

$3 million for 2010, 2009, and 2008 respectively.

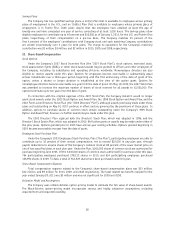

22. Legal Proceedings

Legal proceedings pending against the Company or its consolidated subsidiaries consist of ordinary, routine

litigation, including administrative proceedings, incidental to the business of the Company or businesses that

have been sold or disposed of by the Company in past years. These legal proceedings include commercial,

intellectual property, customer, and labor-and-employment-related claims.

Certain of the Company’s subsidiaries are defendants in a number of lawsuits filed in state and federal courts

containing various class action allegations under federal or state wage and hour laws, including allegations

concerning unpaid overtime, meal and rest breaks, and uniforms.

The Company is a defendant in one such case in which plaintiff alleges that the Company permitted unpaid

off-the-clock hours in violation of the Fair Labor Standards Act (‘‘FLSA’’) and state labor laws. The case, Pereira v.

Foot Locker, was filed in the U.S. District Court for the Eastern District of Pennsylvania in 2007. In his complaint,

in addition to unpaid wage and overtime allegations, plaintiff seeks compensatory and punitive damages,

injunctive relief, and attorneys’ fees and costs. In September 2009, the Court conditionally certified a nationwide

collective action. During the course of 2010, notices were sent to approximately 81,888 current and former

employees of the Company offering them the opportunity to participate in the class action, and approximately

5,027 have opted in.

The Company was a defendant in an additional seven purported wage and hour class actions that assert

claims similar to those asserted in Pereira and seek similar remedies. With the exception of one case in state

court in Illinois, all of these actions were either commenced in federal district court or the Company has

subsequently removed them to federal district court. Subsequent to year-end, one of these cases was settled for

an amount that was not material to the Company; three of them are in the discovery stage; and the remaining

three are in preliminary stages of proceedings. The Company anticipates that, during the course of 2011, it will

engage in mediation with plaintiff in Pereira and his counsel in an attempt to determine whether it will be

possible to resolve these cases. Meanwhile, the Company is vigorously defending them. The Company is currently

unable to make an estimate of loss or range of loss for these cases.

Management does not believe that the outcome of any such legal proceedings pending against the Company

or its consolidated subsidiaries, including Pereira and related cases, as described above, would have a material

adverse effect on the Company’s consolidated financial position, liquidity, or results of operations, taken as a

whole.

63