Foot Locker 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign Currency Translation

The functional currency of the Company’s international operations is the applicable local currency. The

translation of the applicable foreign currency into U.S. dollars is performed for balance sheet accounts using

current exchange rates in effect at the balance sheet date and for revenue and expense accounts using the

weighted-average rates of exchange prevailing during the year. The unearned gains and losses resulting from

such translation are included as a separate component of accumulated other comprehensive loss within

shareholders’ equity.

Recent Accounting Pronouncements

Recently issued accounting pronouncements did not, or are not believed by management to, have a material

effect on the Company’s present or future consolidated financial statements.

2. Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of January 29, 2011, the Company has two reportable segments, Athletic Stores and

Direct-to-Customers. The Company acquired CCS during the fourth quarter of 2008, and its operations are

presented within the Direct-to-Customers segment.

The accounting policies of both segments are the same as those described in the Summary of Significant

Accounting Policies note. The Company evaluates performance based on several factors, of which the primary

financial measure is division results. Division profit (loss) reflects income (loss) from continuing operations

before income taxes, corporate expense, non-operating income, and net interest expense.

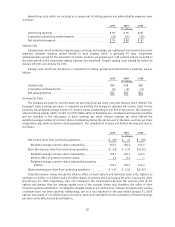

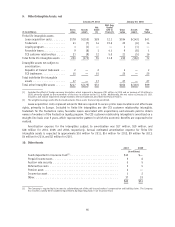

2010 2009 2008

(in millions)

Sales

Athletic Stores ......................................... $4,617 $4,448 $4,847

Direct-to-Customers...................................... 432 406 390

Total sales .......................................... $5,049 $4,854 $5,237

Operating Results

Athletic Stores

(1)

........................................ $ 329 $ 114 $ (59)

Direct-to-Customers

(2)

.................................... 30 32 43

359 146 (16)

Restructuring income

(3)

................................... — 1 —

Division profit (loss) ..................................... 359 147 (16)

Less: Corporate expense

(4)

................................. 97 67 87

Operating profit (loss) .................................... 262 80 (103)

Other income

(5)

......................................... 4 3 8

Interest expense, net ..................................... 9 10 5

Income (loss) from continuing operations before income taxes ......... $ 257 $ 73 $(100)

(1) The year ended January 30, 2010 includes non-cash impairment charges totaling $32 million, which were recorded to write-down

long-lived assets such as store fixtures and leasehold improvements at the Company’s Lady Foot Locker, Kids Foot Locker, Footaction,

and Champs Sports divisions. The year ended January 31, 2009 includes a $241 million charge representing long-lived store asset

impairment, goodwill and other intangibles impairment, and store closing costs related to the Company’s U.S. operations.

(2) Included in the results for the year ended January 29, 2011 is a non-cash impairment charge of $10 million to write down the CCS

tradename intangible asset. Included in the results for the year ended January 30, 2010 is a non-cash impairment charge of $4 million

to write off software development costs.

(3) During the year ended January 30, 2010, the Company adjusted its 1999 restructuring reserves to reflect a favorable lease termination.

(4) During the fourth quarter of 2009, the Company restructured its organization by consolidating the Lady Foot Locker, Foot Locker U.S.,

Kids Foot Locker, and Footaction businesses in addition to reducing corporate staff, resulting in a $5 million charge. Included in

corporate expense for the year ended January 31, 2009 is a $3 million other-than-temporary impairment charge related to the

investment in the Reserve International Liquidity Fund. Additionally, for the year ended January 31, 2009 the Company recorded a

$15 million impairment charge on the Northern Group note receivable.

(5) Other income includes non-operating items, such as gains from insurance recoveries, gains on the repurchase and retirement of bonds,

royalty income, the changes in fair value, premiums paid and realized gains associated with foreign currency option contracts. Included

in the year ended January 29, 2011 is a $2 million gain to reflect the Company’s settlement of its investment in the Reserve

International Liquidity Fund.

42