Foot Locker 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

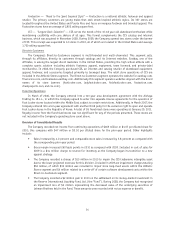

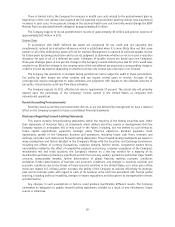

Segment Information

The Company’s two reportable segments, Athletic Stores and Direct-to-Customers, are based on its method of

internal reporting. The Company evaluates performance based on several factors, the primary financial measure of

which is division results. Division profit (loss) reflects income (loss) from continuing operations before income

taxes, corporate expense, non-operating income, and net interest expense. Sales and division results for the

Company’s reportable segments for the years ended January 29, 2011, January 30, 2010, and January 31, 2009 are

presented below.

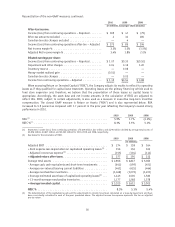

Athletic Stores

2010 2009 2008

(in millions)

Sales .............................................. $4,617 $4,448 $4,847

Division profit (loss) ................................... $ 329 $ 114 $ (59)

Division profit (loss) margin .............................. 7.1% 2.6% (1.2)%

Number of stores at year end .............................. 3,426 3,500 3,641

Selling square footage (in millions) .......................... 7.54 7.74 8.09

Gross square footage (in millions) ........................... 12.64 12.96 13.50

Sales per average gross square foot .......................... $ 360 $ 333 $ 350

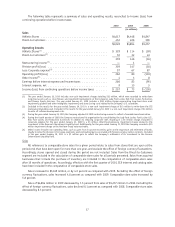

2010 compared with 2009

Athletic Stores sales of $4,617 million increased 3.8 percent in 2010, as compared with $4,448 million in

2009. Excluding the effect of foreign currency fluctuations, primarily related to the euro, sales from the Athletic

Stores segment increased by 4.4 percent in 2010. Comparable-store sales for the Athletic Stores segment

increased 5.7 percent as compared with the prior year. The Company’s U.S. operations sales increased 3.9 percent

reflecting meaningful increases in all formats, except for Lady Foot Locker. Lady Foot Locker was negatively

affected by the lower demand for certain styles, in particular toning. Excluding the effect of foreign currency

fluctuations, international sales increased 5.5 percent in 2010 as compared with 2009. Foot Locker Europe’s sales

reflected strong increases in men’s footwear and apparel.

Athletic Stores reported a division profit of $329 million in 2010 as compared with $114 million in 2009. The

2009 results included impairment charges totaling $32 million, which were recorded to write down long-lived

assets such as store fixtures and leasehold improvements at the Company’s Lady Foot Locker, Kids Foot Locker,

Footaction, and Champs Sports divisions for 787 stores. Additionally, in 2009 the Company recorded a $14 million

inventory reserve on certain aged apparel. Excluding these charges, division profit increased by $169 million as

compared with the corresponding prior-year period. This increase reflects division profit gains in both the

Company’s domestic and international operations. Foreign currency fluctuations negatively affected division

profit by approximately $4 million as compared with the corresponding prior-year period.

2009 compared with 2008

Athletic Stores sales of $4,448 million decreased 8.2 percent in 2009, as compared with $4,847 million in

2008. Excluding the effect of foreign currency fluctuations, primarily related to the euro, sales from the Athletic

Stores segment decreased by 7.0 percent in 2009. Comparable-store sales for the Athletic Stores segment

declined 6.2 percent as compared with 2008. The decline in sales for the year ended January 30, 2010 was

primarily related to the domestic operations as the result of a decline in mall traffic and consumer spending in

general. Excluding the effect of foreign currency fluctuations, sales in Europe increased low single digits in 2009

as compared with 2008.

20