Foot Locker 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Property and Equipment

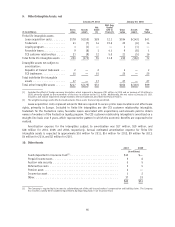

Property and equipment are recorded at cost, less accumulated depreciation and amortization. Significant

additions and improvements to property and equipment are capitalized. Maintenance and repairs are charged to

current operations as incurred. Major renewals or replacements that substantially extend the useful life of an

asset are capitalized and depreciated. Owned property and equipment are depreciated on a straight-line basis

over the estimated useful lives of the assets: maximum of 50 years for buildings and 3 to 10 years for furniture,

fixtures, and equipment. Property and equipment under capital leases and improvements to leased premises are

generally amortized on a straight-line basis over the shorter of the estimated useful life of the asset or the

remaining lease term. Capitalized software reflects certain costs related to software developed for internal use

that are capitalized and amortized. After substantial completion of a project, the costs are amortized on a

straight-line basis overa2to7year period. Capitalized software, net of accumulated amortization, is included as

a component of property and equipment and was $27 million and $24 million at January 29, 2011 and January 30,

2010, respectively.

Recoverability of Long-Lived Assets

The Company recognizes impairment losses whenever events or changes in circumstances indicate that the

carrying amounts of long-lived tangible and intangible assets with finite lives may not be recoverable.

Management’s policy in determining whether an impairment indicator exists, a triggering event, comprises

measurable operating performance criteria at the division level, as well as qualitative measures. The Company

considers historical performance and future estimated results, which are predominately identified from the

Company’s three-year strategic plans, in its evaluation of potential store-level impairment and then compares the

carrying amount of the asset with the estimated future cash flows expected to result from the use of the asset. If

the carrying amount of the asset exceeds the estimated expected undiscounted future cash flows, the Company

measures the amount of the impairment by comparing the carrying amount of the asset with its estimated fair

value. The estimation of fair value is measured by discounting expected future cash flows at the Company’s

weighted-average cost of capital. The Company estimates fair value based on the best information available

using estimates, judgments, and projections as considered necessary.

Goodwill and Other Intangible Assets

The Company reviews goodwill and intangible assets with indefinite lives for impairment annually during the

first quarter of its fiscal year or more frequently if impairment indicators arise. The fair value of each reporting

unit is determined using a combination of market and discounted cash flow approaches.

Derivative Financial Instruments

All derivative financial instruments are recorded in the Company’s Consolidated Balance Sheets at their fair

values. For derivatives designated as a hedge, and effective as part of a hedge transaction, the effective portion

of the gain or loss on the hedging derivative instrument is reported as a component of other comprehensive

income/loss or as a basis adjustment to the underlying hedged item and reclassified to earnings in the period in

which the hedged item affects earnings. The effective portion of the gain or loss on hedges of foreign net

investments is generally not reclassified to earnings unless the net investment is disposed of.

To the extent derivatives do not qualify or are not designated as hedges, or are ineffective, their changes in

fair value are recorded in earnings immediately, which may subject the Company to increased earnings volatility.

Fair Value

The Company categorizes its financial instruments into a three-level fair value hierarchy that prioritizes the

inputs to valuation techniques used to measure fair value into three broad levels. The fair value hierarchy gives

the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest

priority to unobservable inputs (Level 3). If the inputs used to measure fair value fall within different levels of

the hierarchy, the category level is based on the lowest priority level input that is significant to the fair value

measurement of the instrument. Fair value is determined based upon the exit price that would be received to sell

an asset or paid to transfer a liability in an orderly transaction between market participants exclusive of any

transaction costs.

40