Foot Locker 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Savings Plans

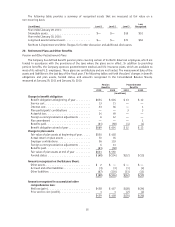

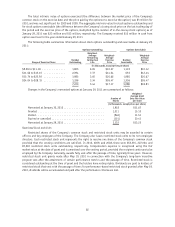

The Company has two qualified savings plans, a 401(k) Plan that is available to employees whose primary

place of employment is the U.S., and an 1165(e) Plan that is available to employees whose primary place of

employment is in Puerto Rico. Both plans require that the employees have attained at least the age of

twenty-one and have completed one year of service consisting of at least 1,000 hours. The savings plans allow

eligible employees to contribute up to 40 percent and $10,000 as of January 1, 2011, for the U.S. and Puerto Rico

plans, respectively, of their compensation on a pre-tax basis. The Company matches 25 percent of the

first 4 percent of the employees’ contributions with Company stock and such matching Company contributions

are vested incrementally over 5 years for both plans. The charge to operations for the Company’s matching

contribution was $2 million, $3 million, and $2 million in 2010, 2009, and 2008, respectively.

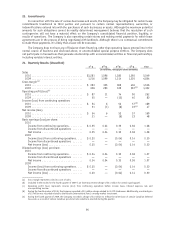

21. Share-Based Compensation

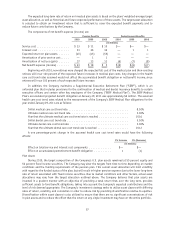

Stock Options

Under the Company’s 2007 Stock Incentive Plan (the ‘‘2007 Stock Plan’’), stock options, restricted stock,

stock appreciation rights (SARs), or other stock-based awards may be granted to officers and other employees of

the Company, including its subsidiaries and operating divisions worldwide. Nonemployee directors are also

eligible to receive awards under this plan. Options for employees become exercisable in substantially equal

annual installments over a three-year period, beginning with the first anniversary of the date of grant of the

option, unless a shorter or longer duration is established at the time of the option grant. Options for

nonemployee directors become exercisable one year from the date of grant. On May 19, 2010, the 2007 Stock Plan

was amended to increase the maximum number of shares of stock reserved for all awards to 12,000,000. The

options terminate up to ten years from the date of grant.

In connection with the original approval of the 2007 Stock Plan, the Company stated it would no longer

grant stock awards under the 2003 Stock Option and Award Plan, the 1998 Stock Option and Award Plan, and the

2002 Foot Locker Directors’ Stock Plan (the ‘‘2002 Directors’ Plan’’), although awards previously made under those

plans and outstanding on May 30, 2007 continue in effect and are governed by the provisions of those plans. In

addition, options to purchase shares of common stock remain outstanding under the Company’s 1995 Stock

Option and Award Plan; however, no further awards may be made under this plan.

The 2002 Directors’ Plan replaced both the Directors’ Stock Plan, which was adopted in 1996, and the

Directors’ Stock Option Plan, which was adopted in 2000. No further grants or awards may be made under either of

the prior plans. Options granted prior to 2003 have a three-year vesting schedule. Options granted beginning in

2003 became exercisable one year from the date of grant.

Employees Stock Purchase Plan

Under the Company’s 2003 Employees Stock Purchase Plan (‘‘the Plan’’), participating employees are able to

contribute up to 10 percent of their annual compensation, not to exceed $25,000 in any plan year, through

payroll deductions to acquire shares of the Company’s common stock at 85 percent of the lower market price on

one of two specified dates in each plan year. Under the Plan, 3,000,000 shares of common stock are authorized for

purchase beginning June 2005. Of the 3,000,000 shares of common stock authorized for purchase under this plan,

764 participating employees purchased 278,212 shares in 2010, and 604 participating employees purchased

125,992 shares in 2009. To date, a total of 941,929 shares have been purchased under this plan.

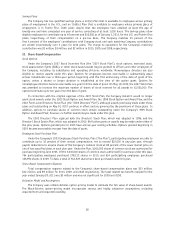

Share-Based Compensation Expense

Total compensation expense related to the Company’s share-based compensation plans was $13 million,

$12 million, and $9 million for 2010, 2009, and 2008 respectively. The total related tax benefit realized for the

year ended January 29, 2011 was $3 million and was not significant for 2009 and 2008.

Valuation Model and Assumptions

The Company uses a Black-Scholes option-pricing model to estimate the fair value of share-based awards.

The Black-Scholes option-pricing model incorporates various and highly subjective assumptions, including

expected term and expected volatility.

60