Estee Lauder 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Estee Lauder annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120

|

|

10

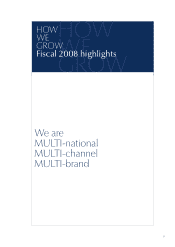

MULTI-NATIONAL

59% International

41% U.S.

46% International

54% U.S.

2003 2008

$5.0 Billion

$7.9 Billion

Fast-growing emerging

markets contributed

the sharpest gains.

MULTI-BRAND

20081968

Our brands are

among our most

important assets.

NUMBER OF BRANDS

NET SALES

2008

MULTI-CHANNEL

2003

We pursue channels

that create

retail excitement,

enhance our image

and drive our growth.

DISTRIBUTION MIX

44% North American

Department Stores

19% International

Department Stores

15% Perfumeries

6% Travel Retail

7% Retail Stores

4% Salons/Spas

5% Other (incl. distributors)

9% Retail Stores

5% Salons/Spas

7% Other (incl. distributors)

30% North American

Department Stores

26% International

Department Stores

15% Perfumeries

8% Travel Retail

0

5

10

15

2

0

2

5

3

0