Entergy 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9494

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

94

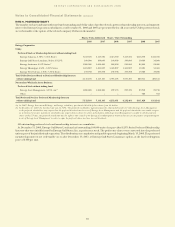

AC T U A R I A L AS S U M P T I O N S

The assumed health care cost trend rate used in measuring the

APBO of Entergy was 8.5% for 2009, gradually decreasing each

successive year until it reaches 4.75% in 2015 and beyond. The

assumed health care cost trend rate used in measuring the Net

Other Postretirement Benefit Cost of Entergy was 9.0% for 2008,

gradually decreasing each successive year until it reaches 4.75% in

2013 and beyond. A one percentage point change in the assumed

health care cost trend rate for 2008 would have the following

effects (in thousands):

1 Percentage Point Increase 1 Percentage Point Decrease

Impact on the Impact on the

sum of service sum of service

Impact on costs and Impact on costs and

2008 the APBO interest cost the APBO interest cost

Entergy

Corporation and

its subsidiaries $118,645 $16,862 $(105,248) $(14,382)

The significant actuarial assumptions used in determining the

pension PBO and the SFAS 106 APBO as of December 31, 2008,

and 2007 were as follows:

2008 2007

Weighted-average discount rate:

Pension 6.75% 6.50%

Other postretirement 6.70% 6.50%

Weighted-average rate of increase

in future compensation levels 4.23% 4.23%

The significant actuarial assumptions used in determining the

net periodic pension and other postretirement benefit costs for

2008, 2007, and 2006 were as follows:

2008 2007 2006

Weighted-average discount rate:

Pension 6.50% 6.00% 5.90%

Other postretirement 6.50% 6.00% 5.90%

Weighted-average rate of increase

in future compensation levels 4.23% 3.25% 3.25%

Expected long-term rate of

return on plan assets:

Taxable assets 5.50% 5.50% 5.50%

Non-taxable assets 8.50% 8.50% 8.50%

Entergy’s SFAS 106 transition obligations are being amortized

over 20 years ending in 2012.

AC C O U N T I N G ME C H A N I S M S

Entergy calculates the expected return on pension and other

postretirement benefit plan assets by multiplying the long-term

expected rate of return on assets by the market-related value (MRV)

of plan assets. Entergy determines the MRV of pension plan assets by

calculating a value that uses a 20-quarter phase-in of the difference

between actual and expected returns. For other postretirement

benefit plan assets Entergy uses fair value when determining MRV.

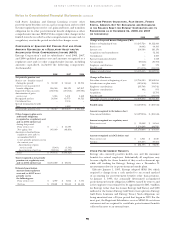

ME D I C A R E PR E S C R I P T I O N DR U G , IM P R O V E M E N T A N D

MO D E R N I Z A T I O N AC T O F 2003

In December 2003, the President signed the Medicare Prescription

Drug, Improvement and Modernization Act of 2003 into law. The

Act introduces a prescription drug benefit cost under Medicare

(Part D), which started in 2006, as well as a federal subsidy to

employers who provide a retiree prescription drug benefit that is at

least actuarially equivalent to Medicare Part D.

The actuarially estimated effect of future Medicare subsidies

reduced the December 31, 2008 and 2007 Accumulated

Postretirement Benefit Obligation by $187 million and $182

million, respectively, and reduced the 2008, 2007, and 2006 other

postretirement benefit cost by $24.7 million, $26.5 million, and

$29.3 million, respectively. In 2008, Entergy received $5.7 million

in Medicare subsidies for prescription drug claims through

September 2008.

NO N -QU A L I F I E D PE N S I O N PL A N S

Entergy also sponsors non-qualified, non-contributory defined

benefit pension plans that provide benefits to certain key employees.

Entergy recognized net periodic pension cost related to these plans

of $17.2 million in 2008, $20.6 million in 2007, and $21 million

in 2006. The projected benefit obligation was $138.4 million and

$134.5 million as of December 31, 2008 and 2007, respectively. There

were $0.2 million in plan assets for a pre-merger Entergy Gulf States

Louisiana plan at December 31, 2008. The accumulated benefit

obligation was $125.5 million and $118 million as of December 31,

2008 and 2007, respectively.

After the application of SFAS 158, Entergy’s non-qualified,

non-current pension liability at December 31, 2008 and 2007 was

$121.5 million and $128.4 million, respectively; and its current

liability was $16.7 million and $5.9 million, respectively. The

unamortized transition asset, prior service cost and net loss are

recognized in regulatory assets ($44.1 million at December 31, 2008

and $43.9 million at December 31, 2007) and accumulated other

comprehensive income before taxes ($18.2 million at December 31,

2008 and $17.4 million at December 31, 2007.)

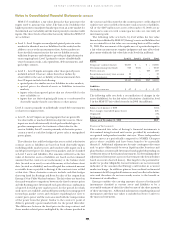

DE F I N E D CO N T R I B U T I O N PL A N S

Entergy sponsors the Savings Plan of Entergy Corporation and

Subsidiaries (System Savings Plan). The System Savings Plan

is a defined contribution plan covering eligible employees of

Entergy and its subsidiaries. The employing Entergy subsidiary

makes matching contributions for all non-bargaining and certain

bargaining employees to the System Savings Plan in an amount equal

to 70% of the participants’ basic contributions, up to 6% of their

eligible earnings per pay period. The 70% match is allocated to

investments as directed by the employee.