Entergy 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9393

ENTERGY CORPORATION AND SUBSIDIARIES 2008

93

Notes to Consolidated Financial Statements continued

93

The trust asset investment strategy is to invest the assets in a

manner whereby long-term earnings (and cash contributions)

on the assets provide adequate funding for pension benefits

payments and certain postretirement benefit payments. Pursuant

to regulatory directives, Entergy Arkansas, Entergy Mississippi,

Entergy New Orleans, Entergy Texas, and System Energy

contribute postretirement benefit costs collected in rates into

trusts. System Energy is funding, on behalf of Entergy Operations,

postretirement benefits associated with Grand Gulf.

The mix of assets in the trusts is based on an optimization study

that identifies asset allocation targets in order to achieve the

maximum return for an acceptable level of risk, while minimizing

the expected contributions and pension and postretirement

expense. For certain regulatory jurisdictions, other postretirement

benefits are funded on a pay-as-you-go basis

In the optimization study, assumptions are formulated about

characteristics, such as expected asset class investment returns,

volatility (risk), and correlation coefficients among the various asset

classes. The future market assumptions used in the optimization

study are determined by examining historical market characteristics

of the various asset classes, and making adjustments to reflect future

conditions expected to prevail over the study period.

The optimization analysis utilized in the Plan Administrator’s

latest study produced the following approved asset class target

allocations.

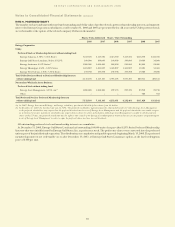

Pension Postretirement

Domestic Equity Securities 45% 37%

International Equity Securities 20% 14%

Fixed-Income Securities 35% 49%

These allocation percentages combined with each asset class’

expected investment return produced an aggregate return

expectation for the five years following the study of 7.6% for

pension assets, 5.4% for taxable postretirement assets, and 7.2%

for non-taxable postretirement assets.

The expected long term rate of return of 8.50% for the qualified

retirement plans assets is based on the expected long-term return

of each asset class, weighted by the target allocation for each class

as defined in the table above. The source for each asset class’

expected long-term rate of return is the geometric mean of the

respective asset class total return. The time period reflected in the

total returns is a long dated period spanning several decades.

The expected long term rate of return of 8.50% for the non-

taxable Voluntary Employee Beneficiary Association (VEBA) trust

assets is based on the expected long-term return of each asset class,

weighted by the target allocation for each class as defined in the

table above. The source for each asset class’ expected long-term

rate of return is the geometric mean of the respective asset class

total return. The time period reflected in the total returns is a long

dated period spanning several decades.

For the taxable VEBA trust assets the allocation has a high

percentage of tax-exempt fixed income securities. The tax-exempt

fixed income long-term total return was estimated using total

return data from the 2008 Economic Report of the President. The

time period reflected in the tax-exempt fixed income total return

is 1929 to 2007. After reflecting the tax-exempt fixed income

percentage and unrelated business income tax, the long-term rate

of return for taxable VEBA trust assets is expected to be 6.0% in

2009 and beyond.

Since precise allocation targets are inefficient to manage security

investments, the following ranges were established to produce an

acceptable economically efficient plan to manage to targets:

Pension Postretirement

Domestic Equity Securities 45% to 55% 32% to 42%

International Equity Securities 15% to 25% 9% to 19%

Fixed-Income Securities 25% to 35% 44% to 54%

Other 0% to 10% 0% to 5%

AC C U M U L A T E D PE N S I O N BE N E F I T OB L I G A T I O N

The accumulated benefit obligation for Entergy’s qualified pension

plans was $2.9 billion and $2.8 billion at December 31, 2008 and

2007, respectively.

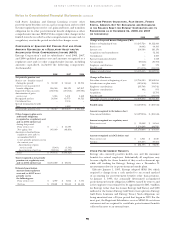

ES T I M A T E D FU T U R E BE N E F I T PA Y M E N T S

Based upon the assumptions used to measure Entergy’s qualified

pension and postretirement benefit obligation at December

31, 2008, and including pension and postretirement benefits

attributable to estimated future employee service, Entergy expects

that benefits to be paid and the Medicare Part D subsidies to be

received over the next ten years for Entergy Corporation and its

subsidiaries will be as follows (in thousands):

Estimated Future Benefits Payments

Postretirement Estimated Future

Qualified Non-Qualified (before Medicare Medicare Subsidy

Pension Pension Subsidy) Receipts

2009 $ 146,276 $16,695 $ 68,552 $ 5,175

2010 $ 151,060 $10,079 $ 73,153 $ 5,768

2011 $ 157,421 $ 9,695 $ 77,351 $ 6,433

2012 $ 167,107 $ 8,931 $ 81,247 $ 7,218

2013 $ 179,160 $15,419 $ 85,504 $ 8,054

2014–2018 $1,144,365 $77,569 $499,844 $53,895

CO N T R I B U T I O N S

Entergy Corporation and its subsidiaries expect to contribute $140

million (excluding about $1 million in employee contributions)

to the qualified pension plans and $76 million to its other

postretirement plans in 2009. Guidance pursuant to the Pension

Protection Act of 2006 rules, effective for the 2009 plan year and

beyond, may affect the level of Entergy’s pension contributions in

the future.