Entergy 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2008

49

Management’s Financial Discussion and Analysis continued

issued an order accepting a tariff amendment establishing that the

WPP shall take effect at a date to be determined, after completion

of successful simulation trials and the ICT’s endorsement of the

WPP’s implementation. On January 16, 2009, the Utility operating

companies filed a compliance filing with the FERC that included

the ICT’s endorsement of the WPP implementation, subject to the

FERC’s acceptance of certain additional tariff amendments and

the completion of simulation testing and certain other items. The

Utility operating companies filed the tariff amendments supported

by the ICT on the same day. The amendments propose to further

amend the WPP to (a) limit supplier offers in the WPP to on-peak

periods and (b) eliminate the granting of certain transmission

service through the WPP. The Utility operating companies noted

that Entergy and the ICT believe that, if the FERC approves the

compliance and tariff filings by March 17, 2009, the WPP can be

implemented by the week of March 23, 2009.

In March 2004, the APSC initiated a proceeding to review

Entergy’s proposal and compare the benefits of such a proposal to

the alternative of Entergy joining the SPP RTO. The APSC sought

comments from all interested parties on this issue. Various parties,

including the APSC General Staff, filed comments opposing the

ICT proposal. A public hearing has not been scheduled by the

APSC at this time, although Entergy Arkansas has responded to

various APSC data requests. In May 2004, Entergy Mississippi filed

a petition for review with the MPSC requesting MPSC support

for the ICT proposal. A hearing in that proceeding was held in

August 2004, and the MPSC has taken no further action. Entergy

New Orleans appeared before the Utility Committee of the City

Council in June 2005 to provide information on the ICT proposal,

and the Council has taken no further action. Entergy Louisiana

and Entergy Gulf States Louisiana filed an application with the

LPSC requesting that the LPSC find that the ICT proposal is a

prudent and appropriate course of action. A hearing in the LPSC

proceeding on the ICT proposal was held in October 2005, and

the LPSC voted to approve the ICT proposal in July 2006.

Interconnection Orders

The Utility operating companies (except Entergy New Orleans)

have been parties to several proceedings before the FERC in which

independent generation entities (GenCos) seek refunds of monies

that the GenCos had previously paid to the Entergy companies for

facilities necessary to connect the GenCos’ generation facilities to

Entergy’s transmission system. To the extent the Utility operating

companies have been ordered to provide refunds, or may in the

future be ordered to provide additional refunds, the majority

of these costs will qualify for inclusion in the Utility operating

companies’ rates. The recovery of these costs is not automatic,

however, especially at the retail level, where the majority of the

cost recovery would occur. With respect to the facilities that

the GenCos have funded, the ICT recently completed a report

evaluating the classification of a portion of facilities that either are

receiving refunds or eligible for refunds. Following the issuance

of the report, the Utility operating companies filed proposed

modifications to the respective interconnection agreements

seeking to implement the ICT’s classifications and thereby reduce

the amount of refunds not yet credited against transmission

charges. The FERC has accepted the amended interconnection

agreements that have been filed. The ICT is continuing to review

additional facilities and will issue subsequent reports evaluating

the classification of such transmission upgrades.

MARKET AND CREDIT RISK SENSITIVE INSTRUMENTS

Market risk is the risk of changes in the value of commodity

and financial instruments, or in future operating results or cash

flows, in response to changing market conditions. Entergy holds

commodity and financial instruments that are exposed to the

following significant market risks:

nThe commodity price risk associated with the sale of electricity

by Entergy’s Non-Utility Nuclear business.

n The interest rate and equity price risk associated with Entergy’s

investments in pension and other postretirement benefit

trust funds. See Note 11 to the financial statements for details

regarding Entergy’s pension and other postretirement benefit

trust funds.

nThe interest rate and equity price risk associated with Entergy’s

investments in decommissioning trust funds, particularly in the

Non-Utility Nuclear business. See Note 17 to the financial

statements for details regarding Entergy’s decommissioning

trust funds.

nThe interest rate risk associated with changes in interest rates

as a result of Entergy’s issuances of debt. Entergy manages its

interest rate exposure by monitoring current interest rates and

its debt outstanding in relation to total capitalization. See Notes

4 and 5 to the financial statements for the details of Entergy’s

debt outstanding.

Entergy’s commodity and financial instruments are also exposed

to credit risk. Credit risk is the risk of loss from nonperformance

by suppliers, customers, or financial counterparties to a contract or

agreement. Credit risk also includes potential demand on liquidity due

to credit support requirements within supply or sales agreements.

CO M M O D I T Y PR I C E RI S K

Power Generation

As a wholesale generator, Entergy’s Non-Utility Nuclear business’

core business is selling energy, measured in MWh, to its customers.

Non-Utility Nuclear enters into forward contracts with its customers

and sells energy in the day ahead or spot markets. In addition to

selling the energy produced by its plants, Non-Utility Nuclear

sells unforced capacity to load-serving entities, which allows those

companies to meet specified reserve and related requirements

placed on them by the ISOs in their respective areas. Non-Utility

Nuclear’s forward fixed price power contracts consist of contracts

to sell energy only, contracts to sell capacity only, and bundled

contracts in which it sells both capacity and energy. While the

terminology and payment mechanics vary in these contracts, each

of these types of contracts requires Non-Utility Nuclear to deliver

MWh of energy to its counterparties, make capacity available to

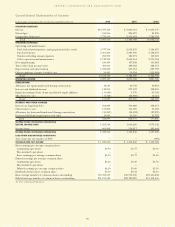

them, or both. The following is a summary as of December 31,

2008 of the amount of Non-Utility Nuclear’s nuclear power plants’

planned energy output that is sold forward under physical or

financial contracts:

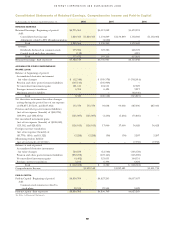

Non-Utility Nuclear 2009 2010 2011 2012 2013

Percent of planned generation

sold forward:

Unit-contingent 48% 31% 29% 18% 12%

Unit-contingent with

guarantee of availability(1) 38% 35% 17% 7% 6%

Total 86% 66% 46% 25% 18%

Planned generation (TWh) 41 40 41 41 40

Average contracted

price per MWh(2) $61 $60 $56 $54 $50

(1) A sale of power on a unit-contingent basis coupled with a guarantee of

availability provides for the payment to the power purchaser of contract damages,

if incurred, in the event the seller fails to deliver power as a result of the failure

of the specified generation unit to generate power at or above a specified

availability threshold. All of Entergy’s outstanding guarantees of availability

provide for dollar limits on Entergy’s maximum liability under such guarantees.

(2) The Vermont Yankee acquisition included a 10-year PPA under which the former owners

will buy most of the power produced by the plant, which is through the expiration in 2012

of the current operating license for the plant. The PPA includes an adjustment clause

under which the prices specified in the PPA will be adjusted downward monthly, beginning

in November 2005, if power market prices drop below PPA prices, which has not happened

thus far and is not expected in the foreseeable future.