Entergy 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9090

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

90

market value or to renew the leases for either fair market value or,

under certain conditions, a fixed rate.

Entergy Louisiana issued $208.2 million of non-interest bearing

first mortgage bonds as collateral for the equity portion of certain

amounts payable under the leases.

Upon the occurrence of certain events, Entergy Louisiana may

be obligated to assume the outstanding bonds used to finance

the purchase of the interests in the unit and to pay an amount

sufficient to withdraw from the lease transaction. Such events

include lease events of default, events of loss, deemed loss events,

or certain adverse “Financial Events.” “Financial Events” include,

among other things, failure by Entergy Louisiana, following the

expiration of any applicable grace or cure period, to maintain (i)

total equity capital (including preferred membership interests)

at least equal to 30% of adjusted capitalization, or (ii) a fixed

charge coverage ratio of at least 1.50 computed on a rolling 12

month basis. As of December 31, 2008, Entergy Louisiana was in

compliance with these provisions.

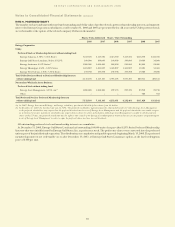

As of December 31, 2008, Entergy Louisiana had future minimum

lease payments (reflecting an overall implicit rate of 7.45%) in

connection with the Waterford 3 sale and leaseback transactions,

which are recorded as long-term debt, as follows (in thousands):

2009 $ 32,452

2010 35,138

2011 50,421

2012 39,067

2013 26,301

Years thereafter 137,858

Total 321,237

Less: Amount representing interest 73,512

Present value of net minimum lease payments $247,725

Grand Gulf Lease Obligations

In December 1988, in two separate but substantially identical

transactions, System Energy sold and leased back undivided

ownership interests in Grand Gulf for the aggregate sum of $500

million. The interests represent approximately 11.5% of Grand Gulf.

The leases expire in 2015. Under certain circumstances, System

Entergy may repurchase the leased interests prior to the end of the

term of the leases. At the end of the lease terms, System Energy has

the option to repurchase the leased interests in Grand Gulf at fair

market value or to renew the leases for either fair market value or,

under certain conditions, a fixed rate.

In May 2004, System Energy caused the Grand Gulf lessors to

refinance the outstanding bonds that they had issued to finance the

purchase of their undivided interest in Grand Gulf. The refinancing

is at a lower interest rate, and System Energy’s lease payments have

been reduced to reflect the lower interest costs.

System Energy is required to report the sale-leaseback as a

financing transaction in its financial statements. For financial

reporting purposes, System Energy expenses the interest portion of

the lease obligation and the plant depreciation. However, operating

revenues include the recovery of the lease payments because the

transactions are accounted for as a sale and leaseback for ratemaking

purposes. Consistent with a recommendation contained in a FERC

audit report, System Energy initially recorded as a net regulatory

asset the difference between the recovery of the lease payments and

the amounts expensed for interest and depreciation and continues

to record this difference as a regulatory asset or liability on an

ongoing basis, resulting in a zero net balance for the regulatory

asset at the end of the lease term. The amount of this net regulatory

asset was $19.2 million and $36.6 million as of December 31, 2008

and 2007, respectively.

As of December 31, 2008, System Energy had future minimum

lease payments (reflecting an implicit rate of 5.13%), which are

recorded as long-term debt as follows (in thousands):

2009 $ 47,760

2010 48,569

2011 49,437

2012 49,959

2013 50,546

Years thereafter 103,890

Total 350,161

Less: Amount representing interest 54,857

Present value of net minimum lease payments $295,304

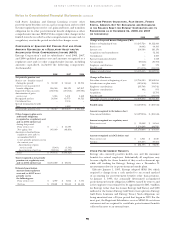

NOTE 11. RETIREMENT, OTHER POSTRETIREMENT

BENEFITS, AND DEFINED CONTRIBUTION PLANS

QU A L I F I E D PE N S I O N PL A N S

Entergy has seven qualified pension plans covering substantially

all of its employees: “Entergy Corporation Retirement Plan for

Non-Bargaining Employees,” “Entergy Corporation Retirement

Plan for Bargaining Employees,” “Entergy Corporation

Retirement Plan II for Non-Bargaining Employees,” “Entergy

Corporation Retirement Plan II for Bargaining Employees,”

“Entergy Corporation Retirement Plan III,” “Entergy Corporation

Retirement Plan IV for Non-Bargaining Employees,” and “Entergy

Corporation Retirement Plan IV for Bargaining Employees.” The

Registrant Subsidiaries participate in two of these plans: “Entergy

Corporation Retirement Plan for Non-Bargaining Employees” and

“Entergy Corporation Retirement Plan for Bargaining Employees.”

Except for the Entergy Corporation Retirement Plan III, the

pension plans are noncontributory and provide pension benefits

that are based on employees’ credited service and compensation

during the final years before retirement. The Entergy Corporation

Retirement Plan III includes a mandatory employee contribution

of 3% of earnings during the first 10 years of plan participation,

and allows voluntary contributions from 1% to 10% of earnings for

a limited group of employees.

Entergy Corporation and its subsidiaries fund pension costs

in accordance with contribution guidelines established by the

Employee Retirement Income Security Act of 1974, as amended,

and the Internal Revenue Code of 1986, as amended. The assets

of the plans include common and preferred stocks, fixed-income

securities, interest in a money market fund, and insurance

contracts. The Registrant Subsidiaries’ pension costs are recovered

from customers as a component of cost of service in each of their

jurisdictions. Entergy uses a December 31 measurement date for

its pension plans.

In September 2006, FASB issued SFAS 158, “Employer’s

Accounting for Defined Benefit Pension and Other Postretirement

Plans, an amendment of FASB Statements Nos. 87, 88, 106 and

132(R),” to be effective December 31, 2006. SFAS 158 requires

an employer to recognize in its balance sheet the funded status

of its benefit plans. This is measured as the difference between

plan assets at fair value and the benefit obligation. Employers are

to record previously unrecognized gains and losses, prior service

costs, and the remaining transition asset or obligation as a result

of adopting SFAS 87 and SFAS 106 as comprehensive income

and/or as a regulatory asset reflective of the recovery mechanism

for pension and OPEB costs in the Utility’s jurisdictions. For the

portion of Entergy Gulf States Louisiana that is not regulated, the

unrecognized prior service cost, gains and losses, and transition

asset/obligation for its pension and other postretirement benefit

obligations are recorded as other comprehensive income. Entergy