Entergy 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7979

ENTERGY CORPORATION AND SUBSIDIARIES 2008

79

Notes to Consolidated Financial Statements continued

79

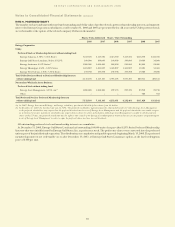

Significant components of net deferred and noncurrent accrued

tax liabilities for Entergy Corporation and subsidiaries as of

December 31, 2008 and 2007 are as follows (in thousands):

2008 2007

Deferred and noncurrent accrued tax liabilities:

Net regulatory assets/liabilities $ (1,026,203) $ (838,507)

Plant-related basis differences (4,898,373) (4,838,216)

Power purchase agreements (762,576) (935,876)

Nuclear decommissioning trusts (1,297,585) (1,451,676)

Other (311,558) (336,809)

Total (8,296,295) (8,401,084)

Deferred tax assets:

Accumulated deferred investment

tax credit 123,810 130,609

Capital losses 131,690 161,793

Net operating loss carryforwards 387,405 405,640

Sale and leaseback 252,479 248,660

Unbilled/deferred revenues 27,841 24,567

Pension-related items 391,702 378,103

Reserve for regulatory adjustments 106,302 76,252

Customer deposits 76,559 76,317

Nuclear decommissioning liabilities 239,814 240,590

Other 75,732 391,603

Valuation allowance (75,502) (74,612)

Total 1,737,832 2,059,522

- Net deferred and noncurrent accrued

tax liability $(6,558,463) $(6,341,562)

At December 31, 2008, Entergy had federal capital loss carryovers

which, if utilized, would result in tax benefits of $131.7 million

after adjustments for FASB Interpretation No. 48. If the capital loss

carryovers are not utilized, they will expire. The tax benefits on the

capital loss carryovers by year of expiration are as follows: $16.1

million in 2009, $32.6 million in 2011, and $83 million in 2013.

At December 31, 2008, Entergy had an estimated federal net

operating loss carryover of $837.5 million. If the federal net operating

loss carryover is not utilized, it will expire in the year 2025.

At December 31, 2008, Entergy had estimated state net

operating loss carryovers of $1.5 billion. If the state net operating

loss carryovers are not utilized, they will expire in the years 2009

through 2023.

For 2008 and 2007, valuation allowances are provided against

certain federal capital loss and state net operating loss carryovers.

FASB IN T E R P R E T A T I O N NO. 48

FASB Interpretation No. 48, “Accounting for Uncertainty in

Income Taxes” (FIN 48) was issued in July 2006. FIN 48 establishes

a “more-likely-than-not” recognition threshold that must be met

before a tax benefit can be recognized in the financial statements.

If a tax deduction is taken on a tax return, but does not meet the

more-likely-than-not recognition threshold, an increase in income

tax liability, above what is payable on the tax return, is required

to be recorded. Entergy and the Registrant Subsidiaries adopted

the provisions of FIN 48, on January 1, 2007. As a result of the

implementation of FIN 48, Entergy recognized an increase in

the liability for unrecognized tax benefits of approximately $5

million, which was accounted for as a reduction to the January

1, 2007 balance of retained earnings. The reconciliation of

unrecognized tax benefits for Entergy for 2008 presents

amounts before consideration of deposits on account with the

IRS. The reconciliation of uncertain tax benefits for 2007 has

been revised to conform to this presentation. The “Amount

to reflect uncertain tax benefits gross of deposits” provides

for comparative presentation. A reconciliation of Entergy’s

beginning and ending amount of unrecognized tax benefits is as

follows (in thousands):

2008 2007

Balance at January 1, as previously disclosed

in the 2007 Form 10-K $1,977,001

Amount to reflect uncertain tax benefits

gross of deposits 288,256

Balance at January 1, adjusted for deposits $ 2,523,794 $2,265,257

Additions based on tax positions related

to the current year 378,189 142,827

Additions for tax positions of prior years 259,434 670,385

Reductions for tax positions of prior years (166,651) (450,252)

Settlements (1,169,319) (102,485)

Lapse of statute of limitations – (1,938)

Balance at December 31 $ 1,825,447 $2,523,794

The balances of unrecognized tax benefits include $543 million and

$242 million as of December 31, 2008 and 2007, respectively, which,

if recognized, would lower the effective income tax rates. Because

of the effect of deferred tax accounting, the remaining balances of

unrecognized tax benefits of $734 million and $1.88 billion as of

December 31, 2008 and 2007, respectively, if disallowed, would not

affect the annual effective income tax rate but would accelerate the

payment of cash to the taxing authority to an earlier period. Entergy

accrues interest and penalties expenses related to unrecognized tax

benefits in income tax expense. Entergy’s December 31, 2008 and

2007 balance of unrecognized tax benefits includes approximately

$55 million and $50 million, respectively, accrued for the possible

payment of interest and penalties.

Entergy and the Registrant Subsidiaries do not expect that total

unrecognized tax benefits will significantly change within the next

twelve months; however, the results of pending litigations and audit

issues, discussed below, could result in significant changes.

IN C O M E TA X LI T I G A T I O N

For tax years 1997 and 1998, a U.S. Tax Court trial was held in April

2008. The issues before the Court are as follows:

nThe ability to credit the U.K. Windfall Tax against U.S. tax as a

foreign tax credit. The U.K. Windfall Tax relates to Entergy’s

former investment in London Electricity.

nThe validity of Entergy’s change in method of tax accounting

for street lighting assets and the related increase in

depreciation deductions.

A decision is anticipated by the second or third quarter of 2009.

On February 21, 2008, the IRS issued a Statutory Notice of

Deficiency for the year 2000. A Tax Court Petition was filed in

the second quarter of 2008. This petition challenges the IRS

assessment on the same two issues described above as well as the

following issue:

nThe allowance of depreciation deductions that resulted from

Entergy’s purchase price allocations on its acquisitions of its

Non-Utility Nuclear plants.

With respect to the U.K. Windfall Tax issue, the total tax included

in IRS Notices of Deficiency is $82 million. The total tax and interest

associated with this issue is $230 million for all years.

With respect to the street lighting issue, the total tax included in IRS

Notices of Deficiency is $22 million. The federal and state tax and interest

associated with this issue total $53 million for all open tax years.

With respect to the depreciation deducted on Non-Utility Nuclear

plant acquisitions, the total tax included in IRS Notices of Deficiency

is $7 million. The federal and state tax and interest associated with

this issue total $45 million for all open tax years.

IN C O M E TA X AU D I T S

Entergy or one of its subsidiaries files U.S. federal and various state and

foreign income tax returns. Other than the matters discussed in the

Income Tax Litigation section above, the IRS’ and substantially all state

taxing authorities’ examinations are completed for years before 2004.