Entergy 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9292

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

92

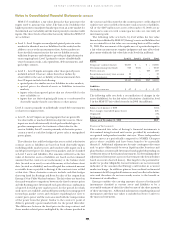

Entergy Arkansas, Entergy Mississippi, Entergy New Orleans,

and Entergy Texas have received regulatory approval to recover

SFAS 106 costs through rates. Entergy Arkansas began recovery

in 1998, pursuant to an APSC order. This order also allowed

Entergy Arkansas to amortize a regulatory asset (representing

the difference between SFAS 106 costs and cash expenditures

for other postretirement benefits incurred for a five-year period

that began January 1, 1993) over a 15-year period that began in

January 1998.

The LPSC ordered Entergy Gulf States Louisiana and Entergy

Louisiana to continue the use of the pay-as-you-go method for

ratemaking purposes for postretirement benefits other than

pensions. However, the LPSC retains the flexibility to examine

individual companies’ accounting for postretirement benefits to

determine if special exceptions to this order are warranted.

Pursuant to regulatory directives, Entergy Arkansas, Entergy

Mississippi, Entergy New Orleans, Entergy Texas, and System

Energy contribute the postretirement benefit costs collected in

rates to trusts. System Energy is funding, on behalf of Entergy

Operations, postretirement benefits associated with Grand Gulf.

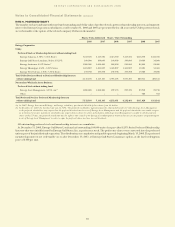

CO M P O N E N T S O F NE T OT H E R PO S T R E T I R E M E N T BE N E F I T CO S T

A N D OT H E R AM O U N T S RE C O G N I Z E D A S A RE G U L A T O R Y AS S E T

A N D/O R AOCI

Entergy Corporation’s and its subsidiaries’ total 2008, 2007, and

2006 other postretirement benefit costs, including amounts

capitalized and amounts recognized as a regulatory asset and/

or other comprehensive income, including amounts capitalized,

included the following components (in thousands):

2008 2007 2006

Other postretirement costs:

Service cost - benefits earned

during the period $ 47,198 $ 44,137 $ 41,480

Interest cost on APBO 71,295 63,231 57,263

Expected return on assets (28,109) (25,298) (19,024)

Amortization of transition obligation 3,827 3,831 2,169

Amortization of prior service cost (16,417) (15,836) (14,751)

Recognized net loss 15,565 18,972 22,789

Special termination benefits – 603 –

Net other postretirement benefit cost $ 93,359 $ 89,640 $ 89,926

Other changes in plan assets and benefit

obligations recognized as a regulatory

asset and/or AOCI (before tax)

Arising this period:

Prior service credit for period $ (5,422) $ (3,520)

Net (gain)/loss 59,291 (15,013)

Amounts reclassified from regulatory

asset and/or AOCI to net periodic

benefit cost in the current year:

Amortization of transition obligation (3,827) (3,831)

Amortization of prior service cost 16,417 15,836

Amortization of net loss (15,565) (18,972)

Total $ 50,894 $(25,500)

Total recognized as net periodic

benefit cost, regulatory asset,

and/or AOCI (before tax) $144,253 $ 64,140

Estimated amortization amounts from

regulatory asset and/or AOCI to net

periodic benefit cost in the following year

Transition obligation $ 3,729 $ 3,831 $ 3,831

Prior service cost $(17,519) $(16,417) $(15,837)

Net loss $ 19,018 $ 15,676 $ 18,974

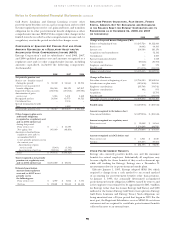

OT H E R PO S T R E T I R E M E N T BE N E F I T OB L I G A T I O N S ,

PL A N AS S E T S , FU N D E D ST A T U S , A N D AM O U N T S NO T YE T

RE C O G N I Z E D A N D RE C O G N I Z E D IN T H E BA L A N C E SH E E T

O F EN T E R G Y CO R P O R A T I O N A N D I T S SU B S I D I A R I E S A S O F

DE C E M B E R 31, 2008 A N D 2007

(IN T H O U S A N D S):

2008 2007

Change in APBO

Balance at beginning of year $1,129,631 $1,074,559

Service cost 47,198 44,137

Interest cost 71,295 63,231

Acquisition – 11,336

Plan amendments (5,422) (3,520)

Special termination benefits – 603

Plan participant contributions 8,618 11,384

Actuarial (gain)/loss (33,168) (19,997)

Benefits paid (68,799) (56,719)

Medicare Part D subsidy received 5,719 4,617

Balance at end of year $1,155,072 $1,129,631

Change in Plan Assets

Fair value of assets at beginning of year $ 350,719 $ 314,326

Actual return on plan assets (64,350) 20,314

Employer contributions 69,720 56,300

Plan participant contributions 8,618 11,384

Acquisition – 5,114

Benefits paid (68,799) (56,719)

Fair value of assets at end of year $ 295,908 $ 350,719

Funded status $ (859,164) $ (778,912)

Amounts recognized in the balance sheet

Current liabilities $ (29,594) $ (28,859)

Non-current liabilities (829,570) (750,053)

Total funded status $ (859,164) $ (778,912)

Amounts recognized as a regulatory asset

(before tax)

Transition obligation $ 12,436 $ 12,435

Prior service cost (966) (30,833)

Net loss 266,086 224,532

$ 277,556 $ 206,134

Amounts recognized as AOCI (before tax)

Transition obligation $ 2,483 $ 6,709

Prior service cost (35,108) (16,634)

Net loss 114,864 112,692

$ 82,239 $ 102,767

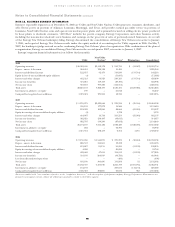

Qualified Pension and Other Postretirement Plans’ Assets

Entergy’s qualified pension and postretirement plans’ weighted-

average asset allocations by asset category at December 31, 2008

and 2007 are as follows:

Qualified Pension Postretirement

2008 2007 2008 2007

Domestic Equity Securities 43% 44% 37% 37%

International Equity Securities 19% 20% 13% 14%

Fixed-Income Securities 36% 34% 50% 49%

Other 2% 2% –% –%