Entergy 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Management’s Financial Discussion and Analysis continued

52

Assumptions

Key actuarial assumptions utilized in determining these costs

include:

nDiscount rates used in determining the future benefit

obligations;

nProjected health care cost trend rates;

nExpected long-term rate of return on plan assets; and

nRate of increase in future compensation levels.

Entergy reviews these assumptions on an annual basis and adjusts

them as necessary. The falling interest rate environment and

worse-than-expected performance of the financial equity markets

in previous years have impacted Entergy’s funding and reported

costs for these benefits. In addition, these trends have caused

Entergy to make a number of adjustments to its assumptions.

In selecting an assumed discount rate to calculate benefit

obligations, Entergy reviews market yields on high-quality

corporate debt and matches these rates with Entergy’s projected

stream of benefit payments. Based on recent market trends,

Entergy increased its discount rate used to calculate benefit

obligations from 6.5% in 2007 to 6.75% for pension and 6.7% for

other postretirement benefits in 2008. Entergy’s assumed discount

rate used to calculate the 2006 benefit obligations was 6.00%.

Entergy reviews actual recent cost trends and projected future

trends in establishing health care cost trend rates. Based on this

review, Entergy’s health care cost trend rate assumption used in

calculating the December 31, 2008 accumulated postretirement

benefit obligation was an 8.5% increase in health care costs in

2009 gradually decreasing each successive year, until it reaches a

4.75% annual increase in health care costs in 2015 and beyond.

In determining its expected long-term rate of return on

plan assets, Entergy reviews past long-term performance, asset

allocations, and long-term inflation assumptions. Entergy targets

an asset allocation for its pension plan assets of roughly 65% equity

securities and 35% fixed-income securities. The target allocation

for Entergy’s other postretirement benefit assets is 51% equity

securities and 49% fixed-income securities. Entergy’s expected

long-term rate of return on pension plan and non-taxable other

postretirement assets used were 8.5% in 2008, 2007 and 2006.

Entergy’s expected long-term rate of return on taxable other

postretirement assets were 5.5% in 2008 and 2007 and 2006. The

assumed rate of increase in future compensation levels used to

calculate benefit obligations was 4.23% in 2008 and 2007 and

3.25% in 2006.

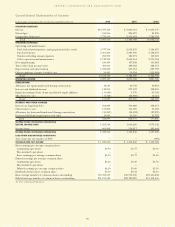

Cost Sensitivity

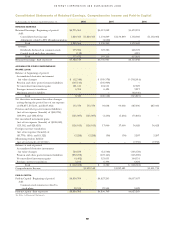

The following chart reflects the sensitivity of qualified pension

cost to changes in certain actuarial assumptions (dollars in

thousands):

Impact on

Qualified

Impact on 2008 Projected

Change in Qualified Benefit

Actuarial Assumption Assumption Pension Cost Obligation

Increase/(Decrease)

Discount rate (0.25%) $10,797 $111,953

Rate of return on plan assets (0.25%) $ 6,781 –

Rate of increase in compensation 0.25% $ 5,593 $ 29,424

The following chart reflects the sensitivity of postretirement

benefit cost to changes in certain actuarial assumptions (dollars

in thousands):

Impact on

Accumulated

Impact on 2008 Postretirement

Change in Postretirement Benefit

Actuarial Assumption Assumption Benefit Cost Obligation

Increase/(Decrease)

Health care cost trend 0.25% $6,151 $29,047

Discount rate (0.25%) $4,018 $33,496

Each fluctuation above assumes that the other components of the

calculation are held constant.

Accounting Mechanisms

In September 2006, Financial Accounting Standards Board (FASB)

issued SFAS 158, “Employer’s Accounting for Defined Benefit

Pension and Other Postretirement Plans, an amendment of FASB

Statements Nos. 87, 88, 106 and 132(R),” to be effective December

31, 2006. SFAS 158 requires an employer to recognize in its balance

sheet the funded status of its benefit plans. Refer to Note 11 to

the financial statements for a further discussion of SFAS 158 and

Entergy’s funded status.

In accordance with SFAS No. 87, “Employers’ Accounting for

Pensions,” Entergy utilizes a number of accounting mechanisms that

reduce the volatility of reported pension costs. Differences between

actuarial assumptions and actual plan results are deferred and are

amortized into expense only when the accumulated differences

exceed 10% of the greater of the projected benefit obligation or the

market-related value of plan assets. If necessary, the excess is amortized

over the average remaining service period of active employees.

Entergy calculates the expected return on pension and other

postretirement benefit plan assets by multiplying the long-term

expected rate of return on assets by the market-related value

(MRV) of plan assets. Entergy determines the MRV of pension

plan assets by calculating a value that uses a 20-quarter phase-in

of the difference between actual and expected returns. For other

postretirement benefit plan assets Entergy uses fair value when

determining MRV.

Costs and Funding

In 2008, Entergy’s total qualified pension cost was $98 million.

Entergy anticipates 2009 qualified pension cost to be $86

million. Pension funding was $287.8 million for 2008. Entergy’s

contributions to the pension trust are currently estimated to be

$140 million in 2009, although market conditions occurring in

2008 could have impacts to that expected amount, as further

described below. Guidance pursuant to the Pension Protection

Act of 2006 (Pension Protection Act) rules, effective for the 2008

plan year and beyond, continues to evolve, be interpreted through

technical corrections bills, and discussed within the industry and

congressional lawmakers. Any changes to the Pension Protection

Act as a result of these discussions and efforts may affect the level

of Entergy’s pension contributions in the future.

The Pension Protection Act of 2006 was signed by the President

on August 17, 2006. The intent of the legislation is to require

companies to fund 100% of their pension liability; and then for

companies to fund, on a going-forward basis, an amount generally

estimated to be the amount that the pension liability increases

each year due to an additional year of service by the employees

eligible for pension benefits.

The recent decline in stock market prices will affect Entergy’s

planned levels of contributions in the future. Minimum required

funding calculations as determined under Pension Protection Act

guidance are performed annually as of January 1 of each year and

are based on measurements of the market-related values of assets

and funding liabilities as measured at that date. An excess of the