Entergy 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5757

ENTERGY CORPORATION AND SUBSIDIARIES 2008

5757

ENTERGY CORPORATION AND SUBSIDIARIES 2008

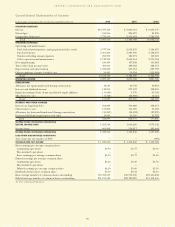

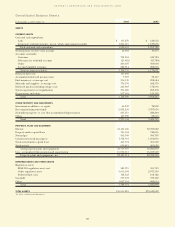

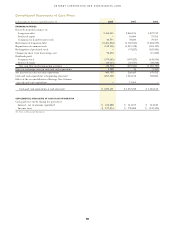

Consolidated Statements of Retained Earnings, Comprehensive Income and Paid-In Capital

In thousands, for the years ended December 31, 2008 2007 2006

RETAINED EARNINGS

Retained Earnings - Beginning of period $6,735,965 $6,113,042 $5,433,931

Add:

Consolidated net income 1,220,566 $1,220,566 1,134,849 $1,134,849 1,132,602 $1,132,602

Adjustment related to FIN 48 implementation – (4,600) –

Total 1,220,566 1,130,249 1,132,602

Deduct:

Dividends declared on common stock 573,924 507,326 448,572

Capital stock and other expenses (112) – 4,919

Total 573,812 507,326 453,491

Retained Earnings - End of period $7,382,719 $6,735,965 $6,113,042

ACCUMULATED OTHER COMPREHENSIVE

INCOME (LOSS)

Balance at beginning of period:

Accumulated derivative instrument

fair value changes $ (12,540) $ (105,578) $ (392,614)

Pension and other postretirement liabilities (107,145) (105,909) –

Net unrealized investment gains 121,611 104,551 67,923

Foreign currency translation 6,394 6,424 3,217

Minimum pension liability – – (22,345)

Total 8,320 (100,512) (343,819)

Net derivative instrument fair value changes

arising during the period (net of tax expense

of $78,837, $57,185, and $187,462) 133,370 133,370 93,038 93,038 287,036 287,036

Pension and other postretirement liabilities

(net of tax expense (benefit) of ($68,076),

$29,994, and ($92,419)) (125,087) (125,087) (1,236) (1,236) (75,805) –

Net unrealized investment gains

(net of tax expense (benefit) of ($108,049),

$23,562, and $28,428) (126,013) (126,013) 17,060 17,060 36,628 36,628

Foreign currency translation

(net of tax expense (benefit) of

($1,770), ($16), and $1,122) (3,288) (3,288) (30) (30) 3,207 3,207

Minimum pension liability

(net of tax benefit of ($5,911)) – – – – (7,759) (7,759)

Balance at end of period:

Accumulated derivative instrument

fair value changes 120,830 (12,540) (105,578)

Pension and other postretirement liabilities (232,232) (107,145) (105,909)

Net unrealized investment gains (4,402) 121,611 104,551

Foreign currency translation 3,106 6,394 6,424

Total $ (112,698) $ 8,320 $ (100,512)

Comprehensive Income $1,099,548 $1,243,681 $1,451,714

PAID-IN CAPITAL

Paid-in Capital - Beginning of period $4,850,769 $4,827,265 $4,817,637

Add:

Common stock issuances related to

stock plans 18,534 23,504 9,628

Paid-in Capital - End of period $4,869,303 $4,850,769 $4,827,265

See Notes to Financial Statements.