Entergy 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

ENTERGY CORPORATION AND SUBSIDIARIES 2008

31

Management’s Financial Discussion and Analysis continued

31

With confirmation of the plan of reorganization, Entergy

reconsolidated Entergy New Orleans in the second quarter 2007,

retroactive to January 1, 2007. Because Entergy owns all of the

common stock of Entergy New Orleans, reconsolidation does not

affect the amount of net income that Entergy recorded from Entergy

New Orleans’ operations for the current or prior periods, but does

result in Entergy New Orleans’ financial results being included in

each individual income statement line item in 2007, rather than

only its net income being presented as “Equity in earnings of

unconsolidated equity affiliates,” as remains the case for 2006.

RESULTS OF OPERATIONS

2008 CO M P A R E D T O 2007

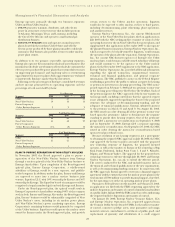

Following are income statement variances for Utility, Non-

Utility Nuclear, Parent & Other business segments, and Entergy

comparing 2008 to 2007 showing how much the line item increased

or (decreased) in comparison to the prior period (in thousands):

Non-Utility Parent &

Utility Nuclear Other Entergy

2007 Consolidated

Net Income (Loss) $682,707 $539,200 $ (87,058) $1,134,849

Net revenue (operating

revenue less fuel expense,

purchased power, and

other regulatory

charges/credits) (29,234) 495,199 (8,717) 457,248

Other operation and

maintenance expenses 10,877 13,289 68,942 93,108

Taxes other than

income taxes 1,544 9,137 (2,787) 7,894

Depreciation and

amortization 38,898 27,351 899 67,148

Other income (2,871) (40,896) (42,001) (85,768)

Interest charges (1,544) 19,188 (50,911) (33,267)

Other (including

discontinued operations) 23,734 38,558 7 62,299

Income taxes (10,744) 88,700 10,625 88,581

2008 Consolidated

Net Income (Loss) $587,837 $797,280 $(164,551) $1,220,566

Refer To “Selected Financial Data - Five-Year Comparison Of

Entergy Corporation And Subsidiaries” which accompanies

Entergy Corporation’s financial statements in this report for

further information with respect to operating statistics.

Earnings were negatively affected in the fourth quarter 2007

by expenses of $52 million ($32 million net-of-tax) recorded in

connection with a nuclear operations fleet alignment. This process

was undertaken with the goals of eliminating redundancies,

capturing economies of scale, and clearly establishing

organizational governance. Most of the expenses related to the

voluntary severance program offered to employees. Approximately

200 employees from the Non-Utility Nuclear business and 150

employees in the Utility business accepted the voluntary severance

program offers.

Net Revenue

Utility

Following is an analysis of the change in net revenue, comparing

2008 to 2007 (in millions):

2007 Net Revenue $4,618

Purchased power capacity (25)

Volume/weather (14)

Retail electric price 9

Other 1

2008 Net Revenue $4,589

The purchased power capacity variance is primarily due to

higher capacity charges. A portion of the variance is due to the

amortization of deferred capacity costs and is offset in base revenues

due to base rate increases implemented to recover incremental

deferred and ongoing purchased power capacity charges.

The volume/weather variance is primarily due to the effect of

less favorable weather compared to the same period in 2007 and

decreased electricity usage primarily during the unbilled sales

period. Hurricane Gustav and Hurricane Ike, which hit the Utility’s

service territories in September 2008, contributed an estimated

$46 million to the decrease in electricity usage. Industrial sales

were also depressed by the continuing effects of the hurricanes

and, especially in the latter part of the year, because of the overall

decline of the economy, in the latter part of the year leading to

lower usage affecting both the large customer industrial segment

as well as small and mid-sized industrial customers. The decreases

in electricity usage were partially offset by an increase in residential

and commercial customer electricity usage that occurred during

the periods of the year not affected by the hurricanes.

The retail electric price variance is primarily due to:

n an increase in the Attala power plant costs recovered through

the power management rider by Entergy Mississippi. The

net income effect of this recovery is limited to a portion

representing an allowed return on equity with the remainder

offset by Attala power plant costs in other operation and

maintenance expenses, depreciation expenses, and taxes other

than income taxes;

n a storm damage rider that became effective in October 2007 at

Entergy Mississippi; and

n an Energy Efficiency rider that became effective in November

2007 at Entergy Arkansas.

The establishment of the storm damage rider and the Energy

Efficiency rider results in an increase in rider revenue and a

corresponding increase in other operation and maintenance

expense with no impact on net income. The retail electric price

variance was partially offset by:

n the absence of interim storm recoveries through the formula

rate plans at Entergy Louisiana and Entergy Gulf States

Louisiana which ceased upon the Act 55 financing of storm

costs in the third quarter 2008; and

n a credit passed on to customers as a result of the Act 55 storm

cost financings.

Refer to “Liquidity and Capital Resources - Hurricane Katrina and

Hurricane Rita” below and Note 2 to the financial statements for

a discussion of the interim recovery of storm costs and the Act 55

storm cost financings.

Non-Utility Nuclear

Following is an analysis of the change in net revenue comparing

2008 to 2007 (in millions):

2007 Net Revenue $1,839

Realized price changes 309

Palisades acquisition 98

Volume variance (other than Palisades) 73

Fuel expenses (other than Palisades) (19)

Other 34

2008 Net Revenue $2,334